Public firms that aquire and withhold Bitcoin and Ether maintain largely stopped amassing since the market tumbled earlier in October, a circulation signaling a fresh lapse in confidence.

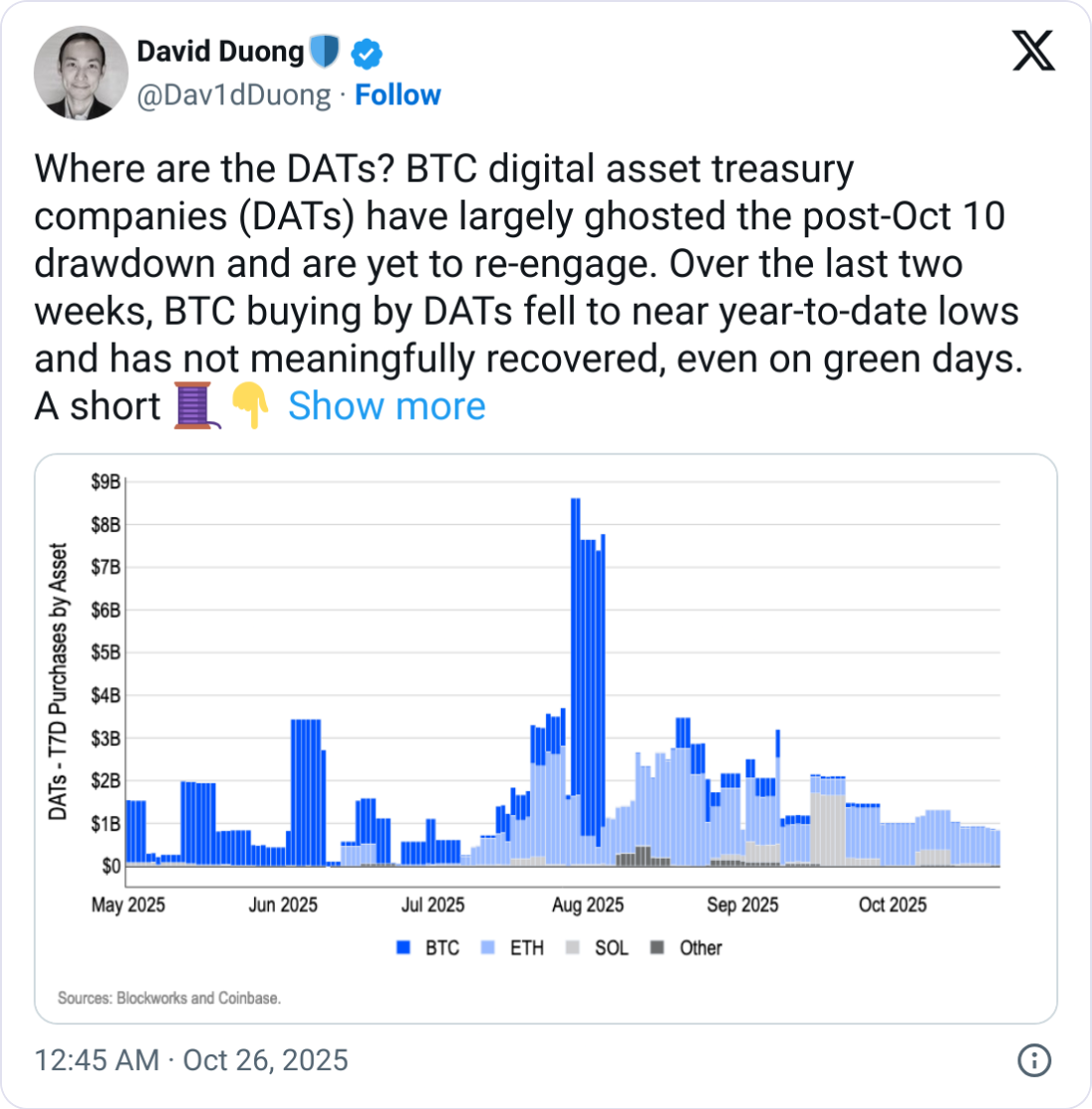

Digital asset treasury (DAT) firms that aquire Bitcoin (BTC) “maintain largely ghosted the put up-Oct 10 drawdown and are yet to re-engage,” Coinbase Institutional global head of investment analysis David Duong acknowledged on Sunday.

“Over the closing two weeks, BTC procuring for by DATs fell to shut to one year-to-date lows and has not meaningfully recovered, even on green days,” he added.

The crypto procuring for slowdown signals the sector is cautious, as the values of many crypto treasury firms were sliding toward the price of their asset holdings, whereas their stock costs maintain cooled from their big rallies.

Bitcoin fell 9% within the Oct. 10 to Oct. 11 length, shedding from spherical $121,500 to lows under $110,500. It has fallen to lows of under $105,000 this month but has since recovered to $114,250, trading flat over the previous 24 hours.

BitMine is aloof procuring for

Duong acknowledged the procuring for lull from Bitcoin procuring for firms is fundamental as they are “customarily heavy hitters with deep pockets,” but their pullback since Oct. 10 “signals exiguous confidence on their phase.”

The procuring for slowdown “highlights some caution from big avid gamers put up leverage washout, even at original ‘toughen’ phases,” he added.

Duong acknowledged that the Ether (ETH) treasury company BitMine Immersion Applied sciences has been the “easiest consistent buyer” since the market dropped, with knowledge exhibiting it spent over $1.9 billion since Oct. 10 to aquire on the topic of 483,000 ETH.

Ether fell alongside Bitcoin earlier this month, shedding over 15% to a low of $3,686 between Oct. 10 and 11, but has since somewhat recovered to $4,130.

BitMine’s procuring for, alongside “smaller contributions from other funds,” has buoyed the entire seven-day purchases by ETH treasury firms into the sure, Duong acknowledged.

Nonetheless, he added that if the company “slows or pauses, we terror that the hideous company uncover would possibly perchance well well proceed.”

“We deem this warrants more cautious positioning within the short timeframe,” Duong acknowledged. “The market seems to be more fragile when the finest discretionary balance sheets are sidelined.”