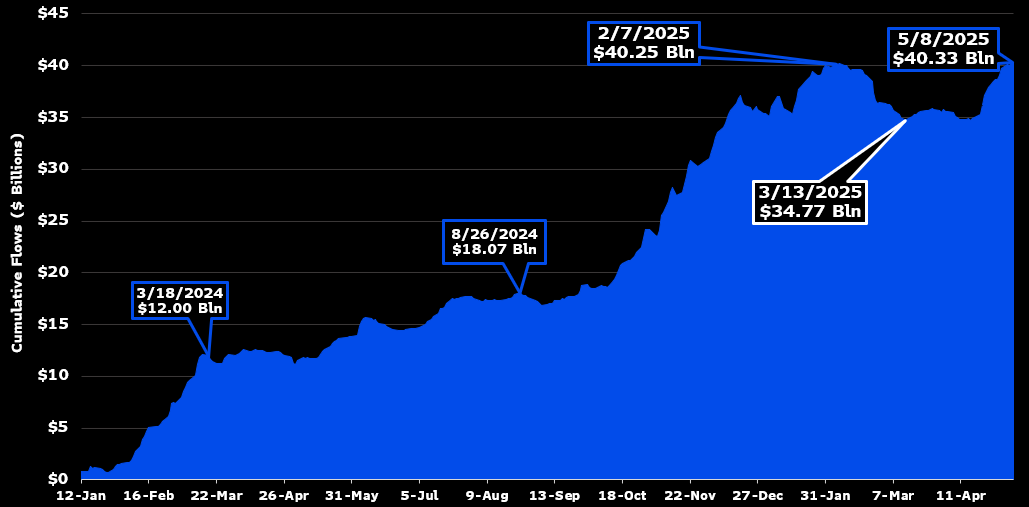

Most modern records claims that Bitcoin Predicament ETFs surpassed their outdated inflows file. Inflows currently sit at $40.33 billion, in spite of over $5 billion in outflows for the length of the final two months.

Despite the climate of Rude Grief within the crypto markets, Bitcoin ETFs seen comparatively restricted losses for the length of this era. By reclaiming this file so rapid, the market demonstrated a well-known resilience.

Bitcoin ETFs Ruin Influx Records Again

For the reason that Bitcoin ETFs first launched in 2024, they’ve entirely transformed the crypto trade. Analysts called BlackRock’s IBIT “the finest begin in ETF historical previous,” reflecting their outsized market allure.

At the moment, the records reflects one other encouraging victory for Bitcoin ETFs, as their inflows surpassed an all-time file attach in February:

Quickly after Bitcoin Predicament ETFs surpassed $40 billion in inflows, the market seen a enormous reversal. Over $5 billion in outflows devoured the total gains in 2025, inflicting issuers to partly offload their BTC reserves.

These corporations collectively had a ravenous query for Bitcoin, so their collective market dumping raised concerns of broader distress.

These losses had been clearly brought on by fears of a recession and the threat of Trump’s tariffs. Alternatively, a restoration began in leisurely April.

Even as Bitcoin ETFs started their rebound, inflows fell to a 2025 low. This dynamic is phase of why ETF analyst Eric Balchunas finds this metric so precious in market prognosis: it’s very hard to unsuitable.

“Lifetime rating flows is basically the main metric to peek in my realizing: very no longer easy to grow, pure truth, no BS. [It’s] impressive [that] they had been in a situation to invent it to recent high water designate so soon after the enviornment became presupposed to cease. Byproduct of barely someone leaving, left simplest a minute hole to dig out of,” Balchunas claimed over social media.

In a bunch of words, the crypto community’s “diamond hands” mentality would possibly per chance unbiased agree with defined this engrossing turnaround. On the high of the tariff panic, markets had been in Rude Grief, the lowest diploma of investor self assurance since the FTX crumple.

In this light, these products performed extraordinarily nicely. Two months later, the Bitcoin ETFs are taking part in consistent inflows over again.

Needless to claim, this influx file doesn’t guarantee that every little thing will live sunny for BTC ETFs. Bitcoin no longer too prolonged ago reclaimed $100,000, sparking a surge in inflows for this market, but about a bearish indicators linger in solutions procuring and selling.

For now, on the opposite hand, this accomplishment is terribly noteworthy. The ETFs’ successes were explosive, and Bitcoin has considered rising TradFi liquidity in recent weeks.