Build Bitcoin alternate-traded funds in the U.S. recorded outflows of over $300 million this week as world macroeconomic events sparked uncertainty over quick-term direction.

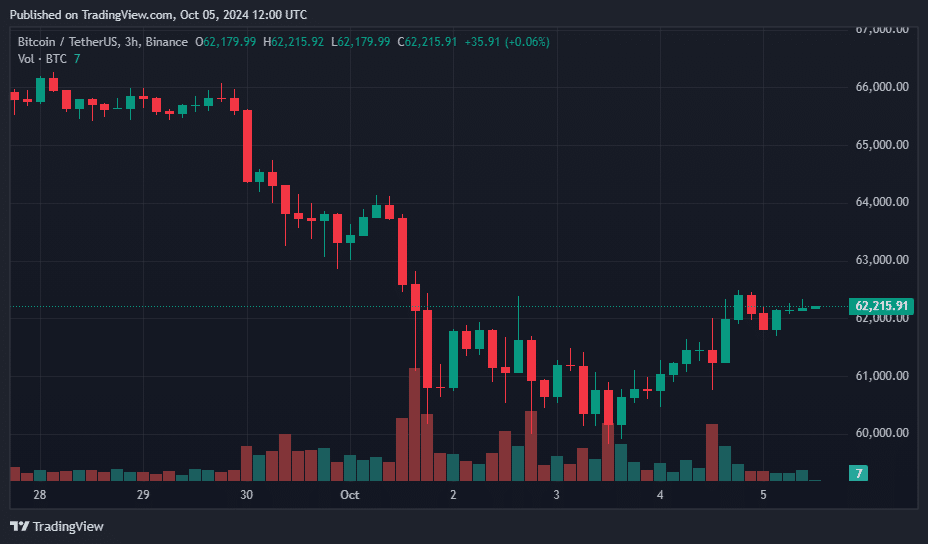

After closing the historically bearish September with over $1.1 billion in inflows, roughly $388.4 million moved out of the 12-instruct Bitcoin ETF funds between Oct. 1 and Oct. 3 coinciding with the escalating Iran-Israel war, which pushed Bitcoin’s mark to a weekly low of $60,047.

On Oct. 4, better-than-anticipated U.S. payroll knowledge introduced some reduction to the market, allowing Bitcoin to reclaim the $62,000 stage, whereas ETF products saw $25.59 million in inflows.

Nonetheless, this recovery wasn’t ample to fully offset the impression of the three-day outflow traipse.

Since Sept. 13, three consecutive weeks of inflows introduced in about $1.91 billion into instruct Bitcoin ETFs, but this week’s outflows triggered these funds to pause basically the most foremost week of October in damaging territory, with $301.54 million flowing out, in line with SoSoValue knowledge.

Underlining the final trading day’s process, Bitwise’s BITB saw basically the most inflows, whereas seven out of the twelve Bitcoin ETF products, alongside side BlackRock’s IBIT, saw no motion.

- Bitwise’s BITB led with inflows of $15.29 million.

- Fidelity’s FBTC, $13.63 million.

- ARK and 21Shares’ ARKB saw its first inflow this week, bringing in $5.29 million.

- VanEck’s BTCW, $5.29 million.

- Grayscale’s GBTC recorded outflows of $13.91.

Analysts cowl key levels

Besides the ETF market, some promoting stress moreover came from Bitcoin miners, who, in line with crypto analyst Ali, maintain offloaded roughly $143 million price of Bitcoin (BTC) since Sept. 29. Detect beneath:

#Bitcoin miners maintain bought 2,364 $BTC previously six days, price around $143 million! pic.twitter.com/1ZPo9sJPt7

— Ali (@ali_charts) October 4, 2024

The selling process could per chance well well intensify, in line with Ali, who identified in a subsequent X post that Bitcoin had been trading beneath the quick-term holders’ realized mark, which currently stands at $63,000.

This mark represents the original price at which quick-term investors obtained their Bitcoin, and when the market dips beneath it, these holders are more inclined to sell in an are attempting and lower losses—risking a “cascading sell-off” that will per chance well well exert additional promoting stress.

As such, Ali rapid investors to glance the $63,000 rate because the next key stage that BTC needs to conquer to take care of away from additional losses.

On the assorted hand, Crypto analyst Immortal pointed to a quite better quick-term plot of $64,000, alongside side that if the flagship cryptocurrency manages to interrupt above this key resistance stage, it can per chance well well signal the origin of a solid bullish pass.

Nonetheless, on an extended timeframe, consultants remain optimistic, citing Bitcoin’s ancient Q4 efficiency and expectations of U.S. rate cuts, which can per chance well well pressure costs toward the $72,000 differ regardless of quick-term volatility.

On the time of writing, Bitcoin used to be hovering steady above $62,200, marking a drop of over 5% previously week.

Meanwhile, market sentiment looks to be selecting up, with the Fear and Greed Index nudging help to a neutral 49, up from a more cautious 41 the day before this day, per knowledge from Exchange.