Bitcoin has retraced its most contemporary restoration above $104,000 as knowledge shows the Coinbase Top class Gap has persisted to be detrimental.

Bitcoin’s Coinbase Top class Gap Has Been Purple Not too long in the past

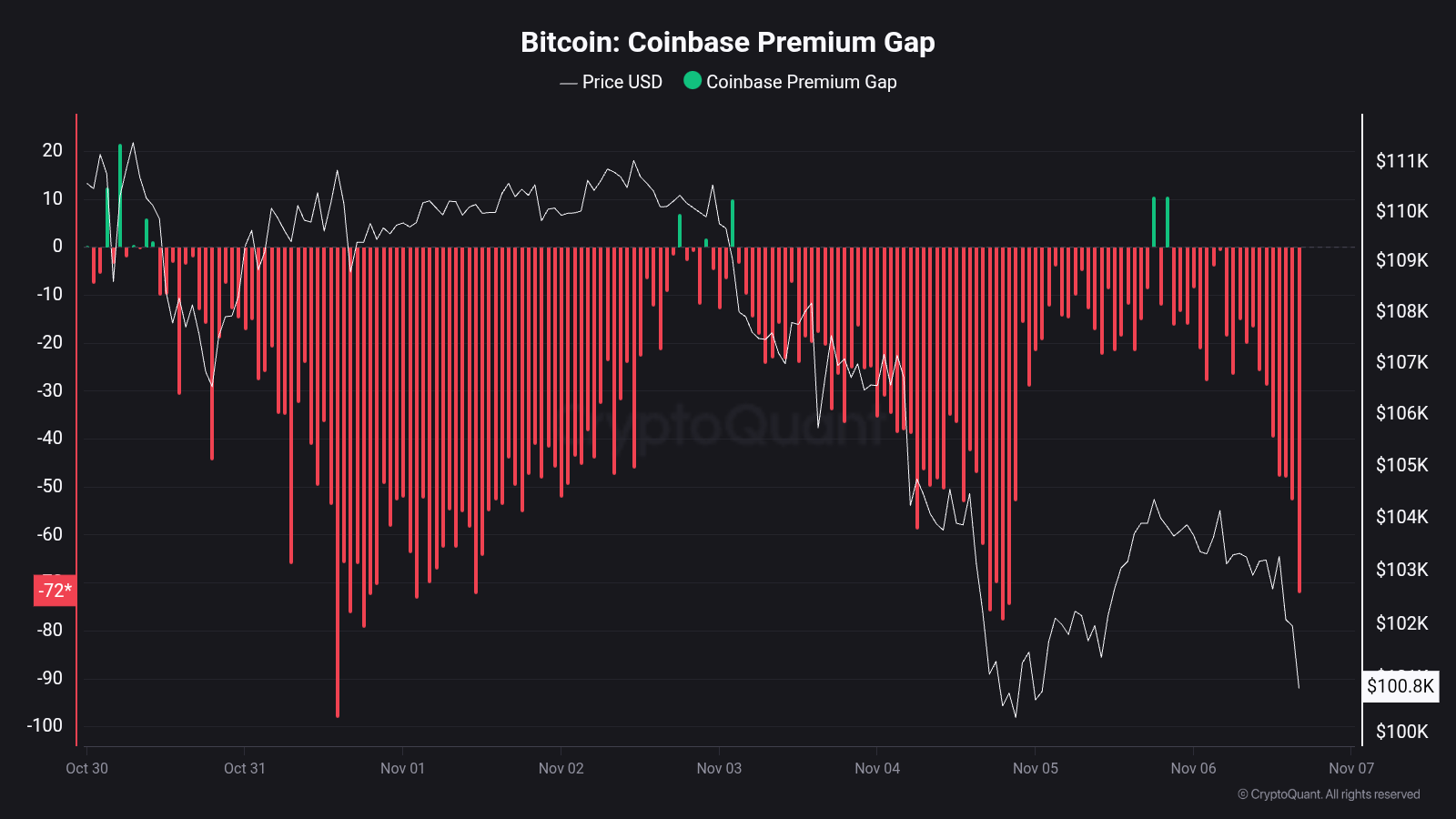

As pointed out by CryptoQuant community analyst Maartunn in a fresh put up on X, investors on Coinbase preserve promoting Bitcoin. The indicator of relevance right here is the “Coinbase Top class Gap,” which measures the difference between the BTC designate listed on Coinbase (USD pair) and that on Binance (USDT pair).

When the designate of this metric is clear, it procedure the asset is procuring and selling at a greater rate on Coinbase than Binance. The kind of pattern suggests the customers of the usual are making use of a greater searching to rating stress (or lower promoting stress) than these of the latter. On the opposite hand, the indicator being under the zero build implies Binance customers are the ones collaborating in a greater quantity of accumulation as they’ve pushed the asset to a greater designate on the platform.

Now, right here is the chart shared by Maartunn that shows how the Coinbase Top class Gap has fluctuated over the past week:

As displayed in the above graph, the Bitcoin Coinbase Top class Gap has stayed mostly in the detrimental zone for the period of the past week, implying customers on Coinbase were collaborating in promoting. The metric temporarily grew to turn out to be fair-green because the cryptocurrency witnessed a surge aid above $104,000, however since then, the indicator’s designate has again plummeted, and with it, the BTC designate has erased its restoration.

Since the begin of 2024, Bitcoin has customarily reacted to movements in the Coinbase Top class Gap in a an analogous intention, showcasing how Coinbase customers were a driver on the market. The alternate is mainly aged by American investors, particularly mammoth institutional entities love the world alternate-traded funds (ETFs), so the Coinbase Top class Gap truly shows how the US-essentially based whales fluctuate in behavior from Binance’s global traffic.

Since the indicator has been red not too long in the past, it would seem that the American institutions were distributing the cryptocurrency. Pondering the pattern over the closing couple of years, it’s that you could well additionally consider of that BTC’s restoration may per chance well well rely on whether a bullish sentiment can return amongst this cohort.

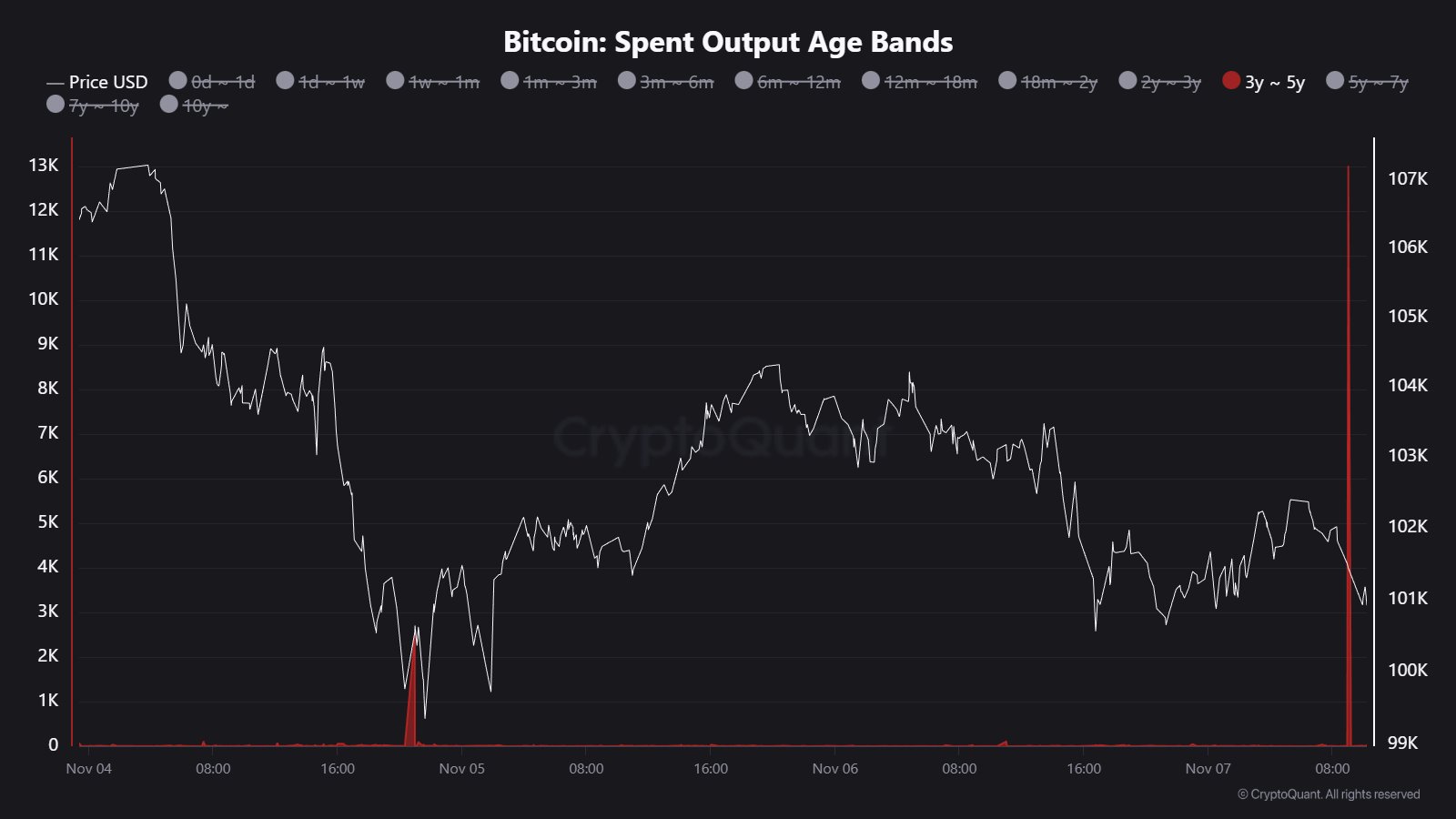

In every other news, a movement of aged tokens has factual been spotted on the Bitcoin blockchain, as Maartunn has highlighted in a single other X put up.

From the chart, it’s viewed that a stack of over 13,000 BTC that has been dormant for between 3 and 5 years has turn out to be obsessed with a transaction, a doable trace that a HODLer may per chance well presumably be gearing up for promoting.

BTC Designate

On the time of writing, Bitcoin is procuring and selling spherical $100,200, down nearly 9% over the closing week.