Bitcoin’s ticket strikes to the upside saw some resistance at the $86,000 level, and the asset has slipped south by around a huge.

Most altcoins have additionally taken a breather after the weekend good points, except for for SOL, which continues its gradual ascent.

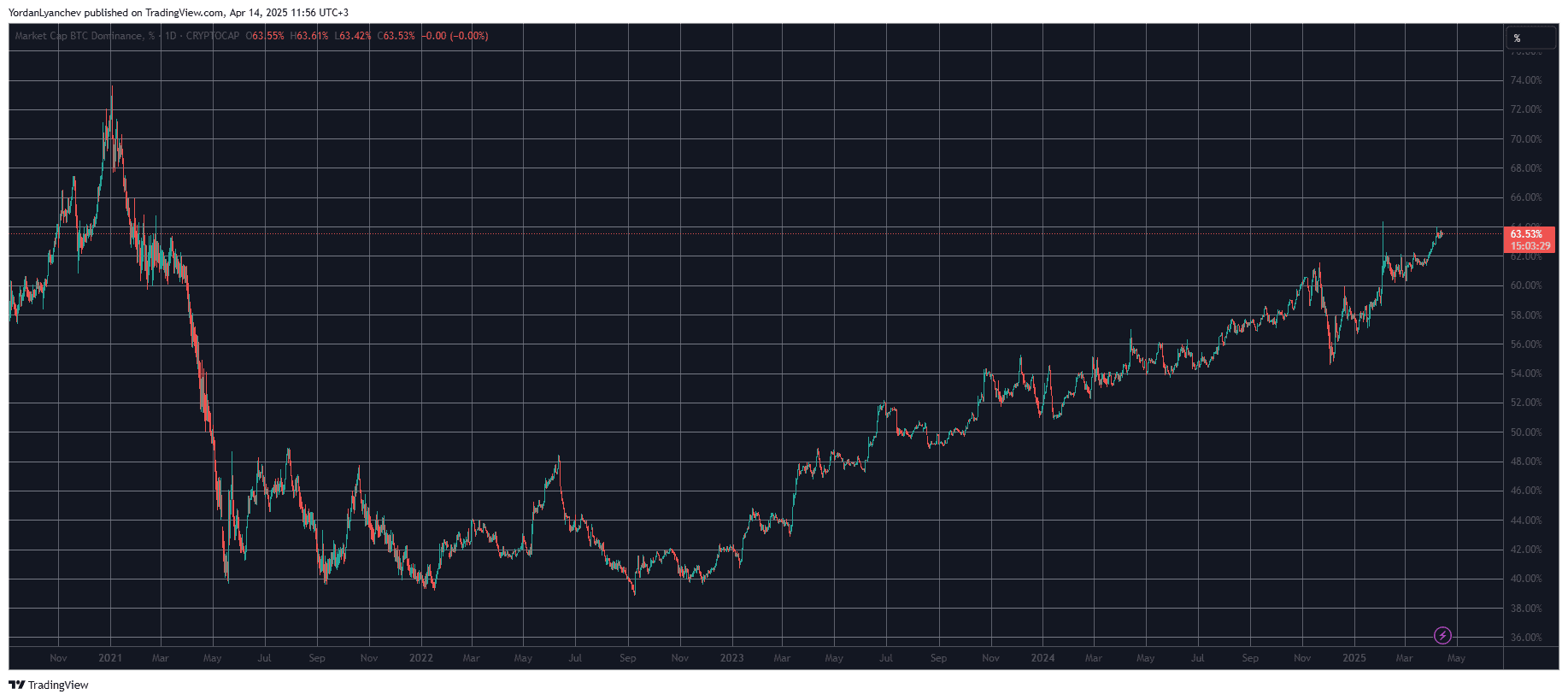

BTC Dominance Above 60%

The fundamental cryptocurrency started the earlier procuring and selling week on the spoiled foot, with its ticket dumping twice to a five-month low of factual over $74,000. This came after the rising political stress between the US and in fact the relaxation of the area.

After Trump eased off the tariffs against every other nation except for for China on Wednesday, BTC went on the flee and skyrocketed previous $83,000. This rally used to be additionally supported by favorable US CPI recordsdata.

The asset confronted some more volatility by the discontinue of the procuring and selling week, attributable to novel strikes on the China-US Alternate Battle entrance, but managed to get better the losses by the weekend and entered it at $83,000. It in fact climbed on Saturday and Sunday morning to an 11-day peak of $86,000 the put apart it confronted a rejection.

As of now, BTC trades at factual below $85,000, which marks a 12.7% weekly surge. Its market cap has risen above $1.680 trillion on CG, while its dominance over the alts is at 60.5% there and 63.4% on TradingView. Such high phases were closing viewed abet in 2021.

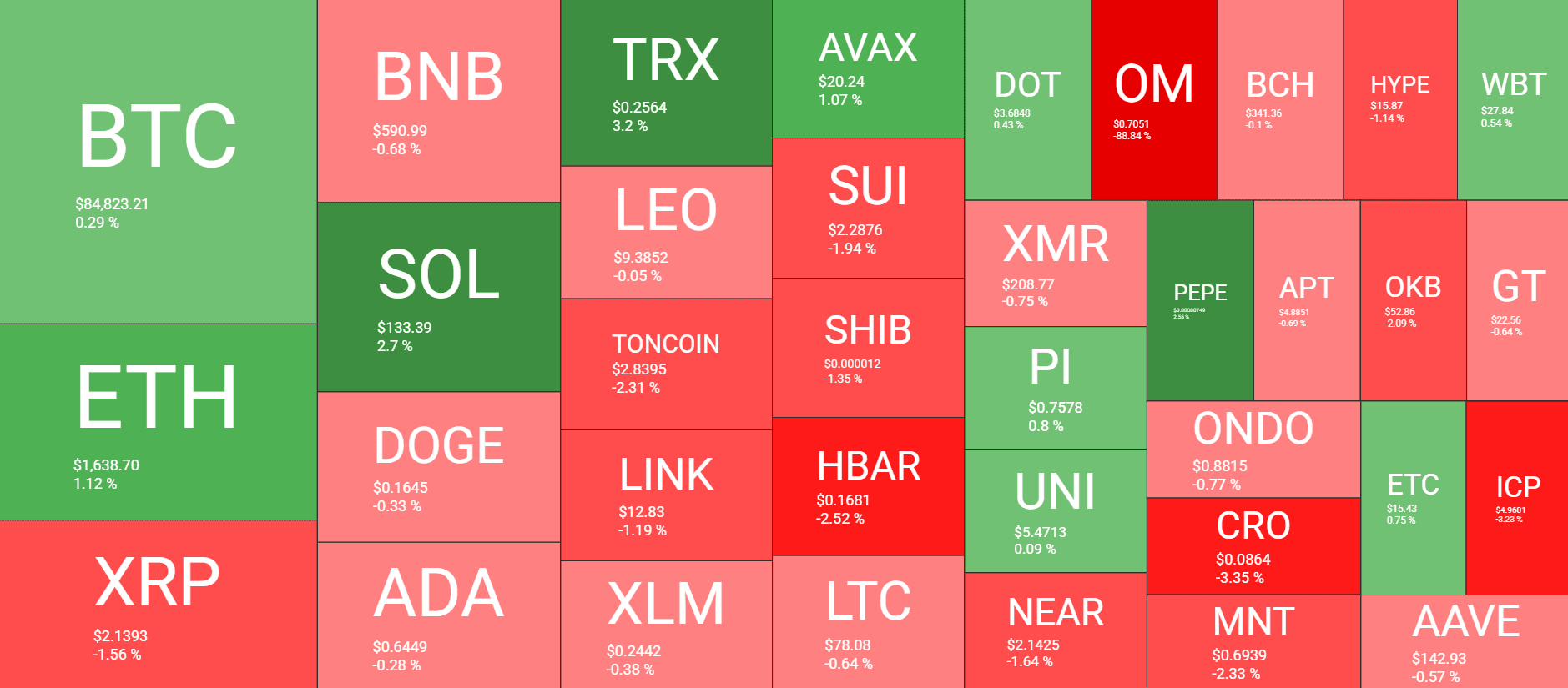

OM Crashes

The big recordsdata from the altcoin plot right this moment came from Mantra, because the project’s native token crashed by over 90% at one level. The CEO defined that the painful market strikes ‘were caused by reckless compelled closures initiated by centralized exchanges on OM yarn holders.’

Most bigger-cap alts are additionally a minute bit in the red, but nothing end to the OM decline. XRP, BNB, DOGE, ADA, TON, and LINK have marked minor losses, while TRX and SOL are up by around 3% each. This potential that, TRX trades above $0.25, while SOL is end to $135.

ETH has gained factual over 1% over the final 24 hours, and stands above $1,600.

The overall crypto market cap has failed to overcome the $2.9 trillion impediment and is down by $20 billion for the rationale that day prior to this.