Bitcoin Dominance (BTC.D) reached 64.98% within the first week of May additionally, marking a novel excessive for 2025 and the very best stage since 2021. Bitcoin Dominance measures BTC’s market cap as a percentage of the total crypto market cap.

Some skilled analysts interrogate this to recount off a restoration in altcoins, nevertheless others live skeptical.

Analysts Divided as Bitcoin Dominance Hits Nearly 65%

Analysts be pleased long monitored BTC.D as a key indicator for predicting altcoin season. The 65% stage also represents a basic historical resistance, a threshold many analysts be pleased been staring at carefully.

Analyst Darky believes that 65% would possibly very successfully be the high for BTC.D and expects a appealing descend from this point. If that occurs, it would possibly per chance per chance counsel that altcoins are about to rally. An altcoin season infrequently begins when capital rotates from Bitcoin into altcoins, within the break riding BTC.D the total device down to the improve zone around 39%.

“The BTC dominance is set to descend so sharp. Dangle your bags with altcoins,” Darky predicted.

Past the technical signal that 65% is a valorous resistance, some analysts also showcase a rising wedge sample forming in BTC.D. This classical chart sample on the total indicators a bearish reversal, supporting the scenario of a valorous pullback in Bitcoin dominance.

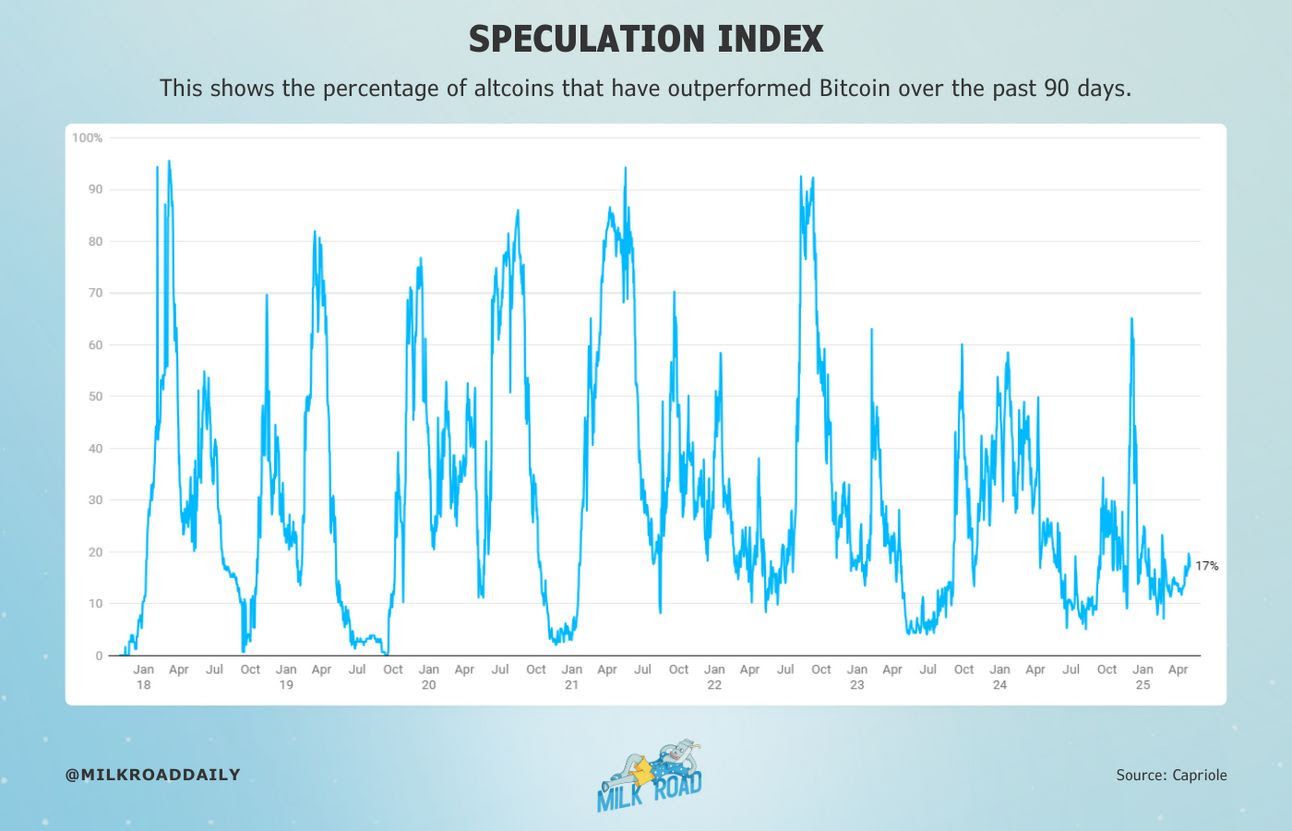

Other analysts also improve the postulate of an upcoming altcoin season nevertheless take a more cautious stance. Milk Freeway, for instance, argues that altcoins are restful underperforming and suggests BTC.D would possibly want to upward thrust above 70% sooner than an true rotation into altcoins begins.

“Good 17% of altcoins be pleased outperformed BTC over the final 90 days. That’s now not rotation. That’s BTC dominance holding the wheel. Till this quantity pushes past 70%, altseason isn’t on the table. No longer but,” Milk Freeway said.

BTC.D rose from 64.4% to 65% within the first week of May additionally, whereas the total market cap dropped from $3 trillion to $2.87 trillion. This suggests capital is exiting the market more from altcoins than from Bitcoin, which would now not but improve the case for a correct altcoin season.

Predicting Altcoin Season Requires More Than Steady Watching Bitcoin Dominance

Over the past three years, BTC.D has regularly climbed from 39% to 65%. At some stage in this time, most predictions of an altcoin season be pleased was out to be mistaken and disappointing. As a consequence, many traders be pleased suffered deeper losses of their altcoin portfolios.

This extended upward thrust in BTC.D has sparked rising skepticism. And most of those doubts come with reputable arguments. Thomas Fahrer, co-founding father of Apollo, believes the involvement of institutional traders has primarily modified the cycle.

“BTC Dominance fair made a novel cycle ATH. This cycle is assorted because when BlackRock & Saylor purchase Bitcoin they fair preserve it. They don’t swap them for altcoins,” Thomas Fahrer said.

Nic, co-founding father of Coinbase, equipped deeper insights. He argued that predicting altcoin season involves greater than simply tracking BTC.D. Other macro and on-chain components have to align.

He pointed out that historically, altcoin seasons have a tendency to delivery around 320 days after a Bitcoin bottom, which would possibly well blueprint them around now (May additionally 2025). On the opposite hand, circumstances equivalent to quantitative easing, retail investor curiosity in altcoins, and blockchain developer activity be pleased now not but been met.

“What desires to happen sooner than the true altseason begins: BTC dominance falls below 54%. The Fed formally ends QT and indicators rate cuts. Bitcoin holds a novel ATH whereas capital flows into alts — now not some distance flung from them. Till then? I’m thinking every pump is barely noise,” Nic predicted.

At the time of writing, the total market cap of altcoins rather then stablecoins (TOTAL3) is $807 billion, down 28% from the starting of the twelve months.