Bitcoin modified hands spherical $115,685 on Sunday afternoon, and derivatives desks had been the leisure but sleepy as futures and choices process stacked up across venues. Space markets don’t even want drama; positioning is doing the total talking for now.

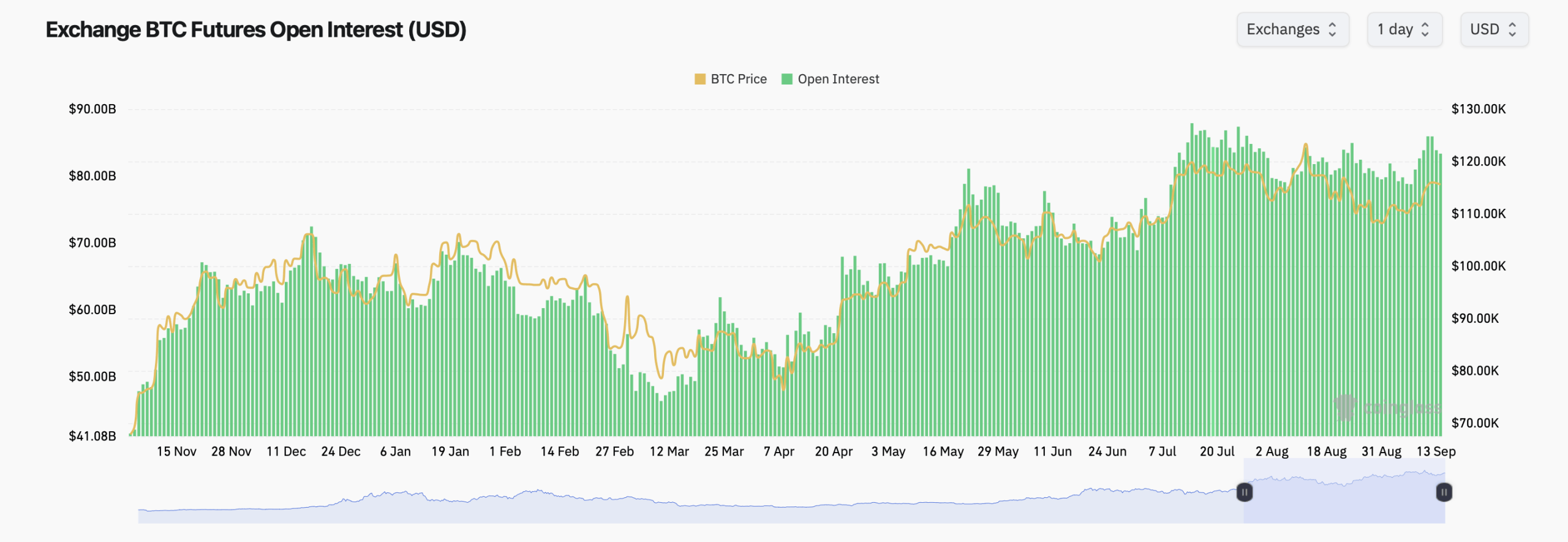

Bitcoin Birth Interest Nears Cycle Highs

Futures first: total bitcoin ( BTC) birth hobby (OI), in conserving with coinglass.com stats, hovers near the mid-$80 billion zone, pacing near cycle highs. Among the 21 venues, CME wears the crown with $16.73 billion in birth hobby, equal to 144.81K BTC and a 20.08% portion.

Binance follows with $14.70 billion (127.07K BTC; 17.63%), whereas Bybit holds $10.15 billion (87.82K BTC; 12.18%). Gate sits at $8.69 billion (10.42%), with OKX at $4.Fifty three billion (5.43%) and HTX at $4.56 billion (5.47%). The nice 5 firmly steer the board, but depth is gargantuan, spreading across mid-tier venues love WhiteBIT, MEXC, and Coinbase.

Intraday dynamics are mixed. Kucoin’s 24-hour alternate shows a comfortable +0.91%, Bitunix is +2.52%, and plenty of alternative others are rather flat, whereas Bingx prints a fascinating −30.42%. Smaller books consist of BitMEX at $393.67 million and Kraken at $383.18 million, with DYDX carrying a modest $55.23 million. On the opposite hand you prick it, the futures advanced stays thick, and the notional tally has crept greater in conserving with role.

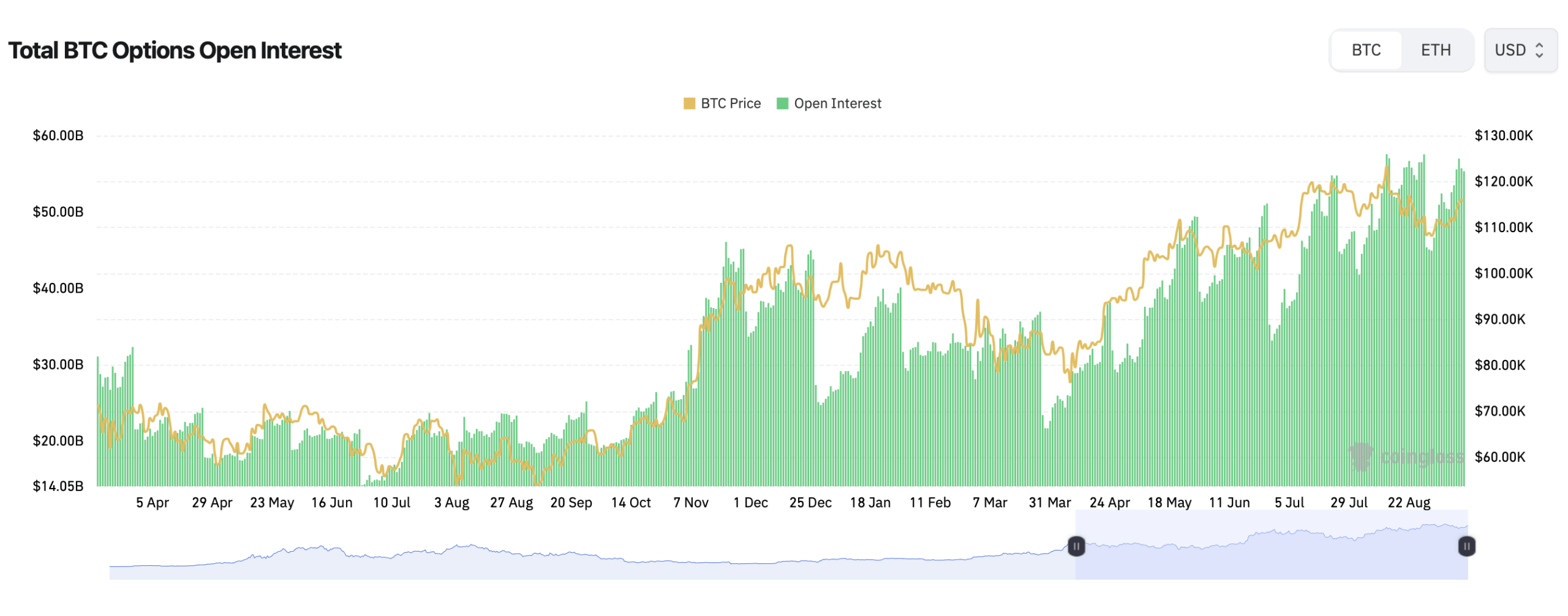

Max Anguish Keeps Place in the Center

Choices figures repeat an equally engaging chronicle, dominated by Deribit. Complete bitcoin choices birth hobby sits across the low-$50 billions and leans long: calls originate up 59.97% of OI (253,574.9 BTC) versus 40.03% in puts (169,270.6 BTC). The previous 24 hours, although, skewed a microscopic defensive, with puts at 52.76% of volume (4,070.3 BTC) and calls at 47.24% (3,644.41 BTC). Merchants appear long gamma into energy, but they are paying for design back insurance.

The board’s heaviest traces cluster spherical acquainted battlegrounds. The tip OI contracts consist of the Sept. 26 $95,000 set (10,113.6 BTC), the Dec. 26 $140,000 call (10,022.5 BTC), and the Sept. 26 $140,000 call (9,985.6 BTC), alongside beefy September set hobby at $108,000 and $110,000 and make contact with question near $115,000 to $116,000. That mix currently screams differ with ambition.

Max nervousness ranges line up with that read too. Attain-dated expiries hover spherical $115,000, the quarterly Sept. 26 sits nearer to $110,000, and the year-dwell cluster trends in the direction of $100,000. In uncomplicated English: the path of most discomfort keeps magnetizing role to the $110K–$115K pocket except and except a novel catalyst knocks it loose.

Any other scoreboard imprint: the value-to-role dance peaceable rhymes. As role has marched greater since unhurried summer season, both of bitcoin‘s futures and choices OI maintain climbed in tandem, a pairing that most continuously amplifies whips when momentum flips. It most continuously system more leveraged positions are stacked in the identical direction, so when sentiment flips, liquidations and hedging flows hit concurrently and could perhaps perhaps exaggerate tag moves a gargantuan deal.

Base line: the derivatives enviornment is entirely loaded, CME and Binance are neck-and-neck on heft, and choices merchants are leaning bullish, but they are also effectively-hedged. If role keeps flirting with six digits, inquire of of fireworks into the Sep. 26 drumroll, the set max nervousness says raise it succor to the heart.