In a tumultuous flip of occasions, the cryptocurrency market has been rattled by a pointy decline in Bitcoin costs. After a sustained length of outstanding gains and document highs, Bitcoin has plunged to a weekly low of $65,000, marking a large setback for investors.

At the time of writing, Bitcoin numbers had been all painted in pink, and trading at $65,710, dropping value in the 24-hour and weekly timeframes by 5.6% and 4.5%, respectively, basically based completely on data from Coingecko.

A pair of days after its old low of $68,000, Bitcoin plummeted to its most stylish stage, a pick no longer viewed in a week, as bears persevered of their downward strain.

Altcoins Additionally Hold A Beating

While Bitcoin bears the brunt of the downturn, altcoins are no longer spared from the fallout. Ethereum (ETH) and Binance Coin (BNB) possess additionally witnessed large losses, shedding 10% of their value or more.

Dogecoin and Shiba Inu, two standard meme coins, possess skilled even steeper declines, plunging by 20% and nearly 30%, respectively. The broader altcoin market mirrors Bitcoin’s downward trajectory, amplifying the sense of unease among investors.

BTC market cap currently at $1.29 trillion. Chart: TradingView.com

Bitcoin: Affect On Market Dynamics

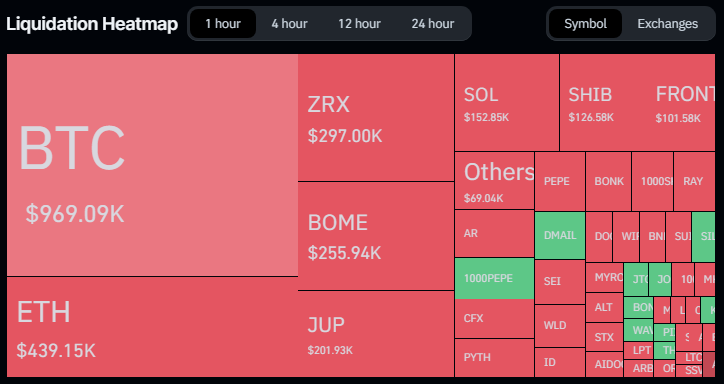

One of the stylish imprint correction in Bitcoin has reverberated across the cryptocurrency landscape, reshaping market dynamics and investor sentiment. The surge in liquidations, with over 151,000 merchants going thru margin calls in the past 24 hours, underscores the magnitude of the market upheaval. Bitcoin’s dominance available in the market is evident because it accounts for the lion’s half of the entire liquidations, highlighting its pivotal role in shaping overall market trends.

As a results of the decline in value, the entire market liquidations possess reached $426 million, with Bitcoin taking the worst hit.

Liquidation Spree

The amount that the imprint of Bitcoin has liquidated over the final 24 hours has exceeded $104 million, with long merchants dropping the most money—they misplaced $86 million when put next with $18 million for rapid sellers. Ethereum saw a $Forty eight million overall liquidation, with $33 million going to long merchants and $15 million going to rapid merchants, as a results of the dropping speed.

Analyst Sounds Apprehension Siren

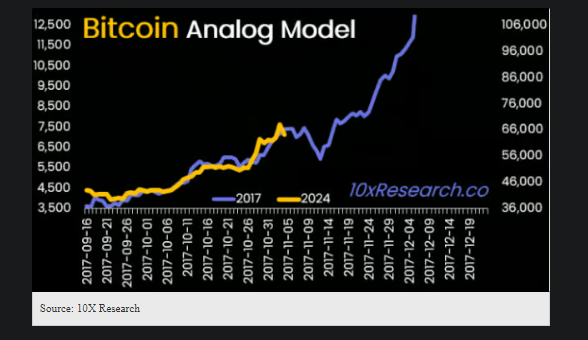

In the meantime, market analysts equivalent to Markus Thielen, CEO of 10x Study, possess sounded the terror bells, warning of further downside dangers for Bitcoin. Thielen’s prediction of a doable fall to $63,000 sends a sobering message to investors, urging caution and prudence in navigating the most stylish market atmosphere.

His insights shed light on underlying concerns about Bitcoin’s market building, including low trading volumes and liquidity, which exacerbate the chance of engaging imprint corrections.

Amidst the market turbulence, investors are grappling with the implications of Thielen’s diagnosis and adjusting their programs accordingly. The period of meme coin mania looks to be to be waning, prompting investors to reassess their positions and ranking earnings while they unexcited can.

Featured listing from Kinesis Money, chart from TradingView