The Fed’s cash-printing shift would possibly well perhaps neutral gasoline Bitcoin’s tag surge.

BitMEX co-founder Arthur Hayes predicts that Bitcoin will blow past $110,000 previous to pulling support to $76,500 as the central financial institution switches from tightening to easing—which can perhaps perhaps inject liquidity into the market and power up the digital asset’s tag.

“I bet $BTC hits $110k previous to it retests $76.5k. Y? The Fed goes from QT to QE for treasuries,” Hayes wrote on X on Sunday.

Hayes dismisses the aptitude unfavourable impact of tariffs on Bitcoin’s tag. He believes that inflation is ‘transitory’.

Markus Thielen, 10X Study founder, moreover projects attainable Bitcoin rebounds. The analyst wrote in a March 23 document that Bitcoin’s tag would possibly well perhaps neutral dangle reached its lowest point within the contemporary downturn and is poised for a restoration.

Per him, the Fed’s dovish stance on inflation and Trump’s flexibility on tariffs are two catalysts that would alleviate market considerations and potentially enhance investor self perception.

“The Fed signaled it can perhaps perhaps gape past non eternal inflationary pressures, laying the groundwork for attainable future easing,” he said.

Thielen reported that the relaxed political climate and favorable economic forecasts dangle modified into Bitcoin’s indicators bullish.

The analyst moreover neatly-known supporting factors delight in Bitcoin holders’ habits and ETF performance. Thielen believes Bitcoin won’t enter a deep endure market because natty Bitcoin holders are seemingly prolonged-duration of time investors.

In other areas, the return of inflows to US-primarily primarily based mostly residing Bitcoin ETFs is seen as a definite signal, indicating reduced promoting stress from arbitrage-centered investors.

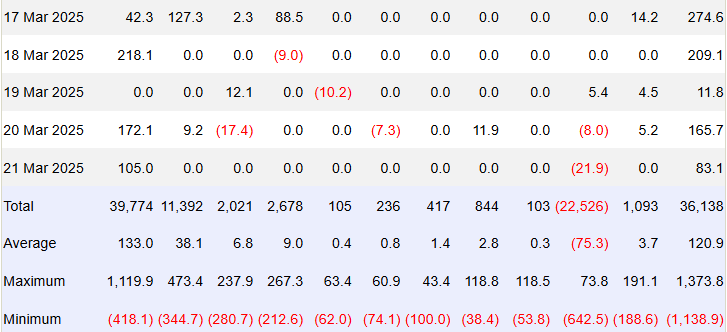

Files from Farside Investors shows that US-listed residing Bitcoin ETFs collectively took in spherical $744 million in bag inflows final week. BlackRock alone attracted roughly $537 million in sleek investments.

Whereas bullish, Thielen acknowledges the dearth of a “definite catalyst” for a right this moment parabolic rally.

Bitcoin was as soon as procuring and selling at roughly $87,000 at press time, up 3.5% within the final 24 hours, per CoinGecko. The whole crypto market cap surged moderately to $2.9 trillion.