The weeks-long climb in Bitcoin’s effect, sparked largely by the approval of Bitcoin ETFs in January, pushed Bitcoin past its all-time high location in November 2021. Crypto Twitter changed into in a notify of euphoria—earlier than the worth of Bitcoin went into freefall.

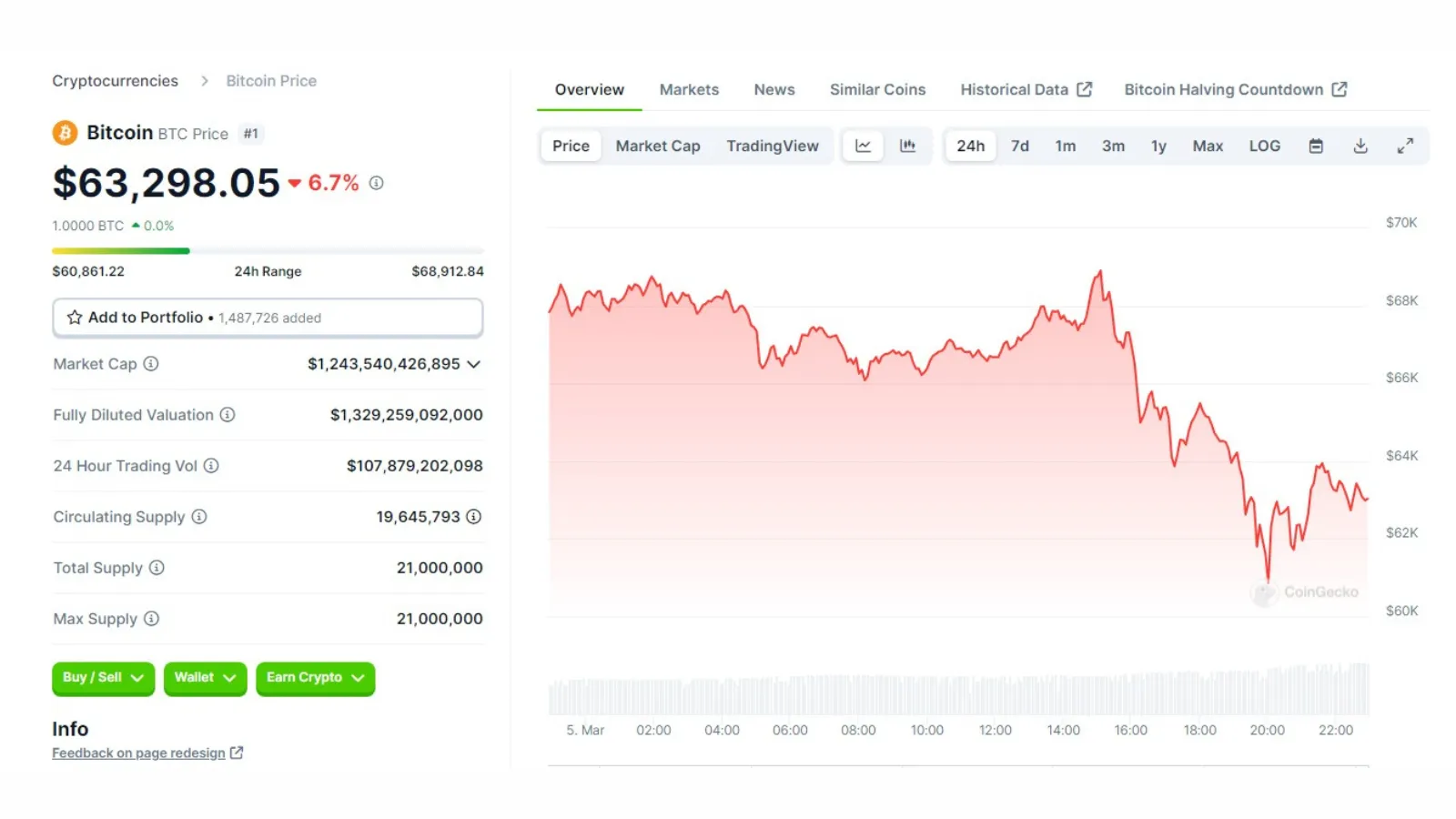

In step with CoinGecko, Bitcoin plummeted 12% to factual above $60,000 in five hours. It be shakily recovered considerably to commerce at $63,515 at time of writing. While harrowing, the submit-high dip is now not entirely unexpected.

When on the present time’s market volatility is in comparison to old all-time highs for Bitcoin, analysts say on the present time’s wild effect actions are par for the path.

“Here’s seemingly the beginning of a good deal of volatility as we streak up,” Alex Thorn, Head of Review at Galaxy, educated Decrypt.

“The overall phrase is that bull markets climb a wall of danger,” he persevered. “Taking a stare upon 2017 and seeing eight drawdowns of 25% or more on easy strategies to all-time highs, that appears to be like cherish a wall of danger to me, so I’m now not concerned.”

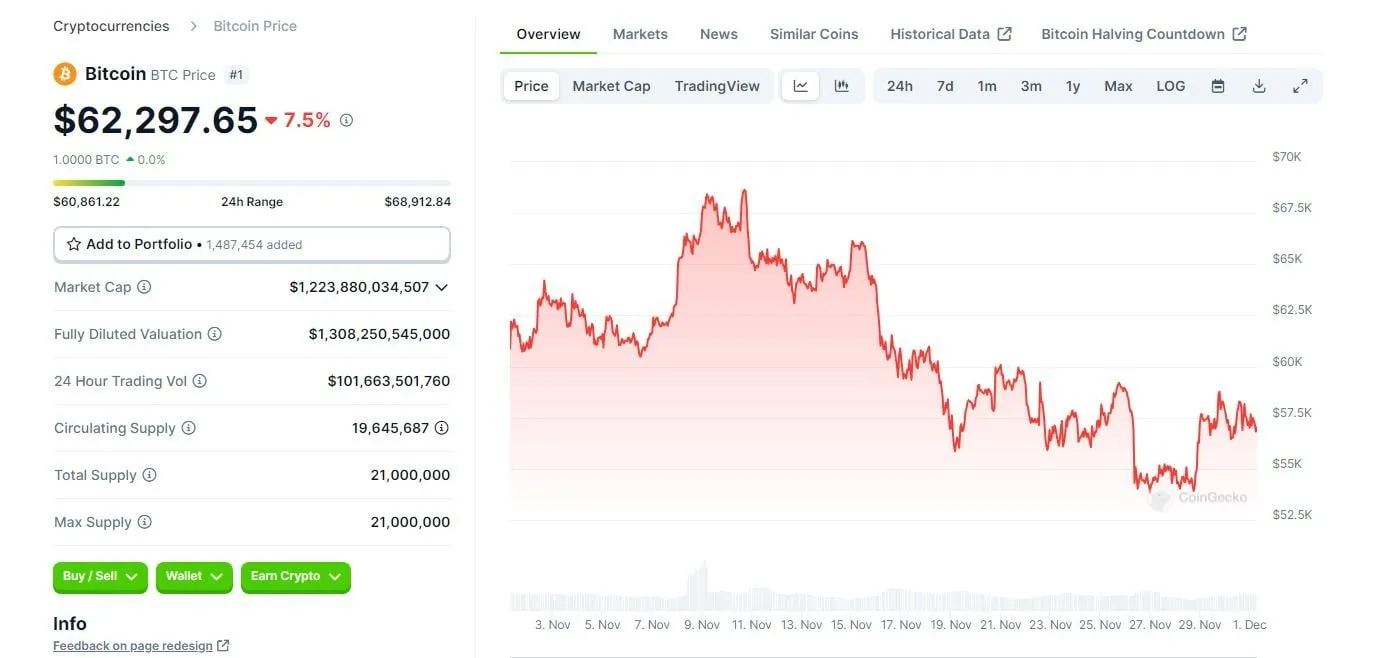

As Thorn outlined, in 2017—from January 1 to the all-time high of $20,000 on December 17— there were thirteen corrections of 12% or more. Of these, twelve were 15%, and eight were steeper than 25%. In a bull market, experiencing vital effect corrections on the ascent is entirely traditional, Thorn acknowledged. These market actions are now not linear.

He also highlighted the surge in effect breeze after the inaugurate of the COVID-19 pandemic from March 2020 to April 14, 2021; there were also 13 corrections of 10% or more, seven of which like been 15% or more.

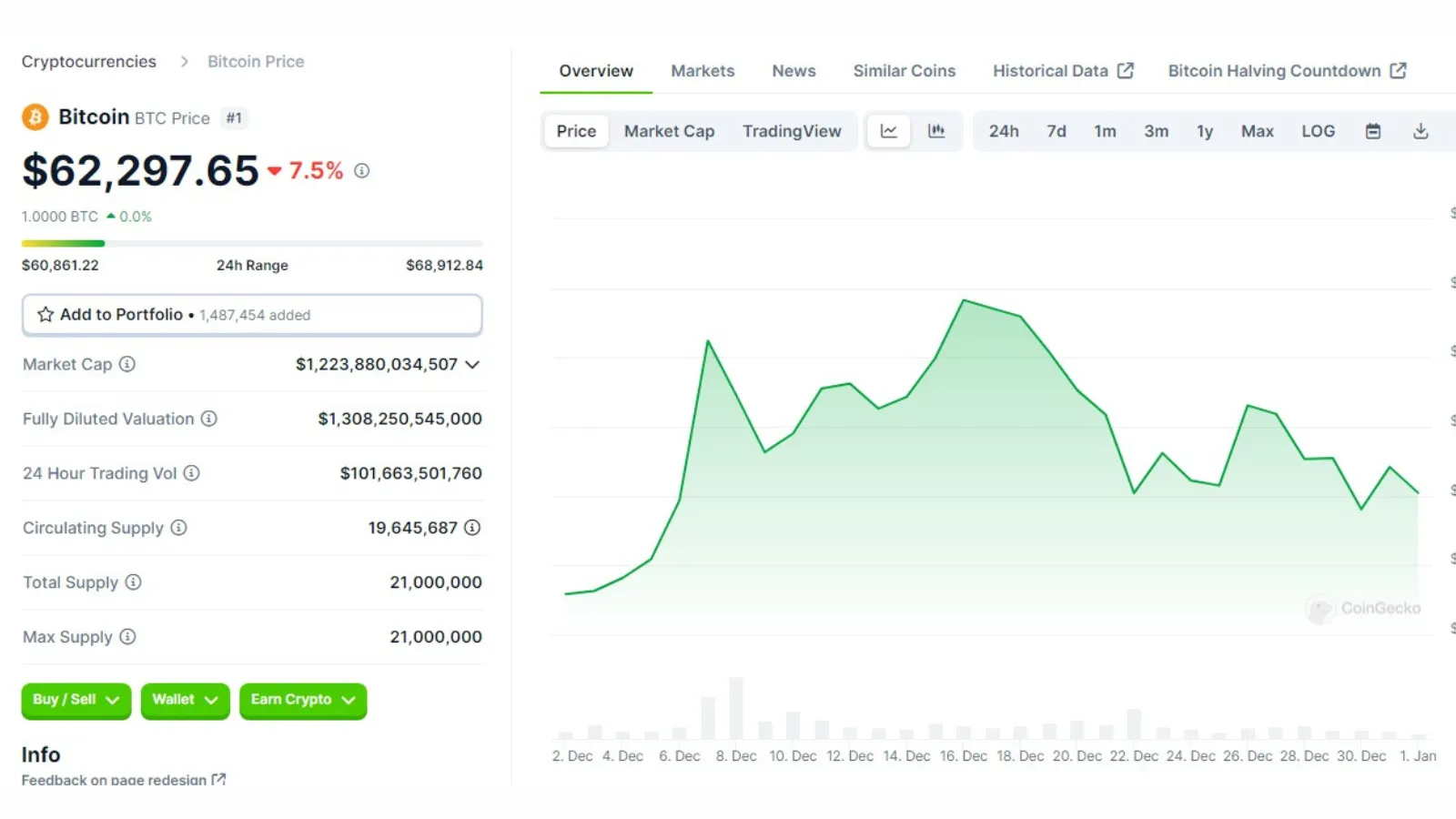

“Endure in thoughts that in Dec. 2020, BTC touched its prior all-time high of [$20,000] twice, then ranged and traded -11.3% decrease over 15 days earlier than definitively breaking ATH,” Thorn posted on Twitter. “[It’s] seemingly to gaze identical right here, and a few consolidation would be healthy after +62% YTD / +77% from YTD low (Jan 23).”

needless to say in dec. 2020, BTC touched its prior all-time high of ~$20k twice, then ranged and traded -11.3% decrease over 15 days earlier than definitively breaking ATH

seemingly to gaze identical right here, and a few consolidation would be healthy after +62% YTD / +77% from YTD low (jan 23) pic.twitter.com/mkywLKn4FC

— Alex Thorn (@intangiblecoins) March 5, 2024

To Thorn’s point, on December 14, 2017, Bitcoin reached $17,978, adopted by one other high of $19,423 on December 16.

On November 7, 2021, Bitcoin hit its most most modern all-time high of $63,153, adopted by one other all-time high of $67,617 on November 8.

“Bitcoin has a worthy historical past of unstable effect cycles and nonlinear bull markets,” he acknowledged.