Though Bitcoin (BTC) on-chain smartly being remains get slouch, from a label level of view two crucial strengthen levels must be maintained for a continued bullish uptrend, notes ARK Put money into its most as a lot as the moment monthly file.

Bitcoin’s Healthy On-Chain Metrics, What Does It Imply?

In its file, ARK Invest posits that Bitcoin requires some upside if its market structure is to be maintained. The file notes that in August 2024, BTC’s label slid by 8.7% to $58,972. The main digital asset used to be furthermore unable to beat its 200-day transferring practical, making two key strengthen areas at $52,000 and $46,000 serious for its bullish momentum.

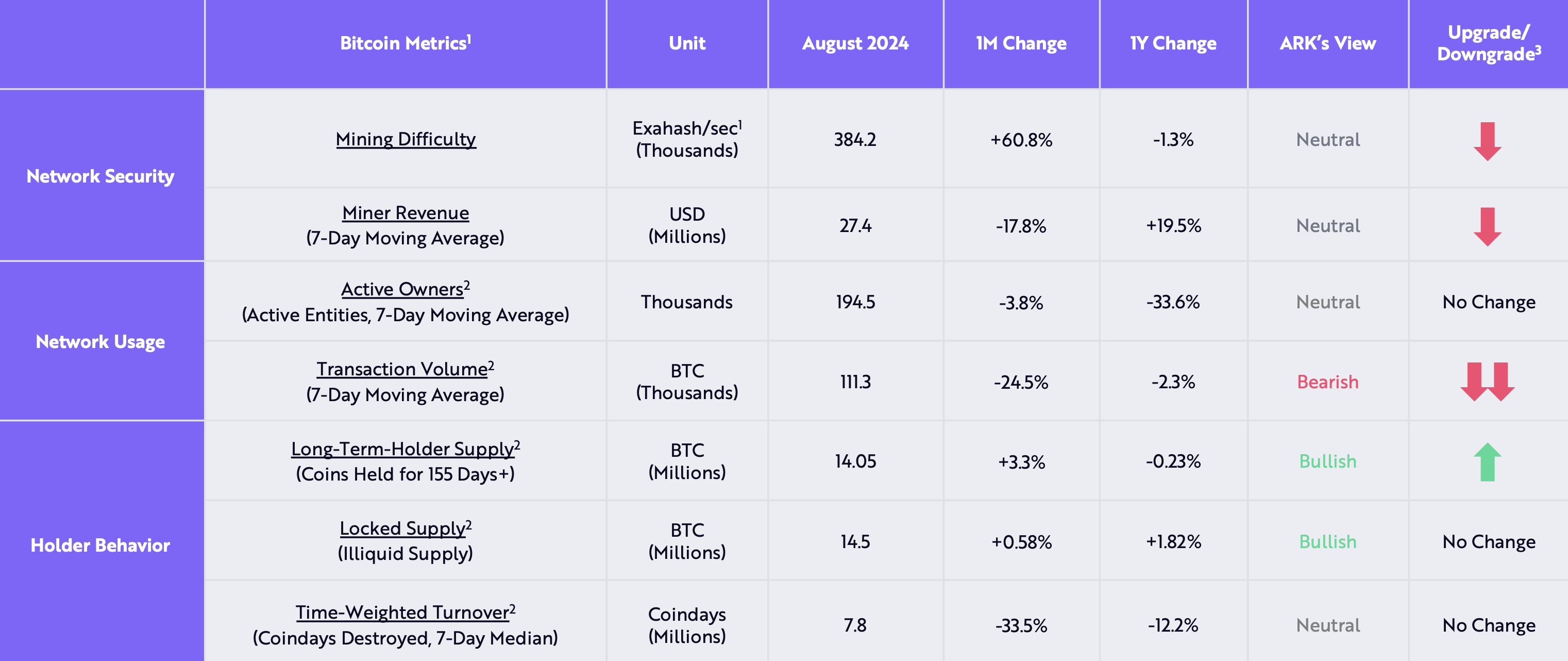

The file states that in spite of the quick headwinds confronted by Bitcoin, its on-chain smartly being remains ‘get slouch.’ In actuality, the Bitcoin community is get bullish all the plan thru assorted on-chain metrics akin to community safety, community usage, and holder behavior.

Bitcoin’s long-time duration holder provide, or BTC held for more than 155 days by holders, is up 3.3% month-over-month (MoM) and down a marginal 0.23% year-over-year (YoY). Moreover, Bitcoin’s locked provide has elevated in every MoM and YoY phrases by 0.58% and 1.82%, respectively.

Bitcoin’s transaction quantity has tumbled by 24.5% MoM and a pair of.3% YoY, a bearish on-chain indicator. On the other hand, Bitcoin’s bullish on-chain metrics overshadow the one bearish indicator, permitting its on-chain smartly being to remain get slouch.

One other key performance indicator strengthening ARK Invest’s bullish stance on Bitcoin is its short-to-long liquidation dominance. In actuality, this metric measures non permanent liquidations relative to long-time duration liquidations over the final 90 days, and came upon that it’s at its lowest since Q2 2023.

Bitcoin ETF Traders Underwater At Astronomical

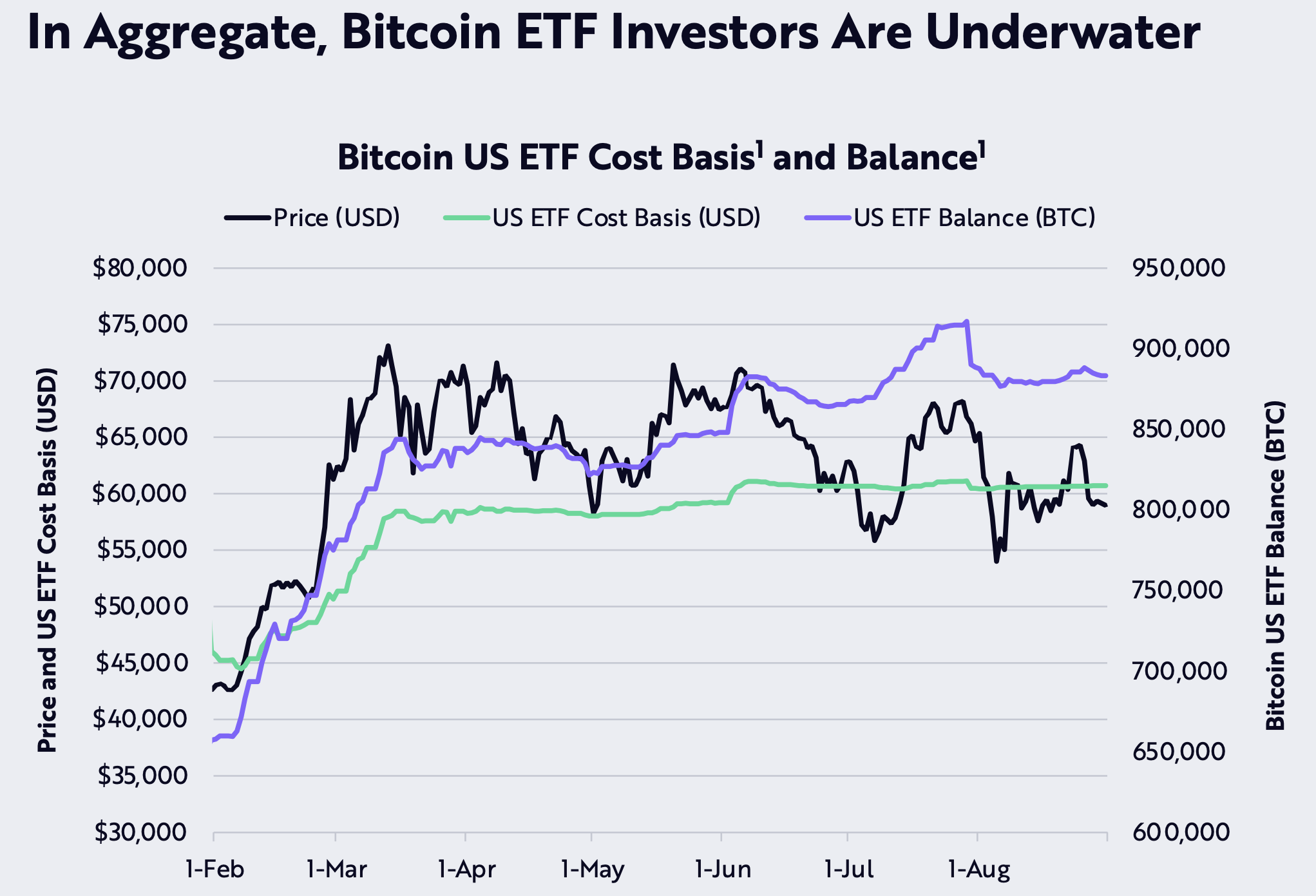

The file highlights that on the raze of August 2024, the estimated price foundation of US plot commerce-traded-fund (ETF) participants used to be higher than BTC’s label, hinting that the frequent ETF investor will likely be at a loss. The upper estimated price foundation of US plot ETF participants in comparison with its label can even be confirmed from the chart beneath.

The US Securities and Substitute Rate (SEC) licensed plot Bitcoin ETF earlier this year, which made it more uncomplicated for institutional and retail traders to assign publicity to the sphere’s greatest cryptocurrency thru a compliant funding product.

Bitcoin ETFs are witnessing extraordinary hobby from institutional traders. Namely, Wall Aspect dual carriageway titans akin to Goldman Sachs and Morgan Stanley maintain poured millions of bucks into Bitcoin ETFs. Conversely, Ethereum ETFs haven’t but piqued institutional hobby at linked levels.

At press time, Bitcoin trades at $57,836, up a minimal 0.2% within the previous 24 hours. BTC’s total market cap stands at $1.14 trillion.