Bitcoin money stamp rebound 5% to reclaim $490 on Could per chance maybe unbiased 24, fresh movements noticed amongst BCH whales suggests more upside also can agree to.

Ethereum ETF Promote-the-News Sends BCH Mark Spiralling 8%

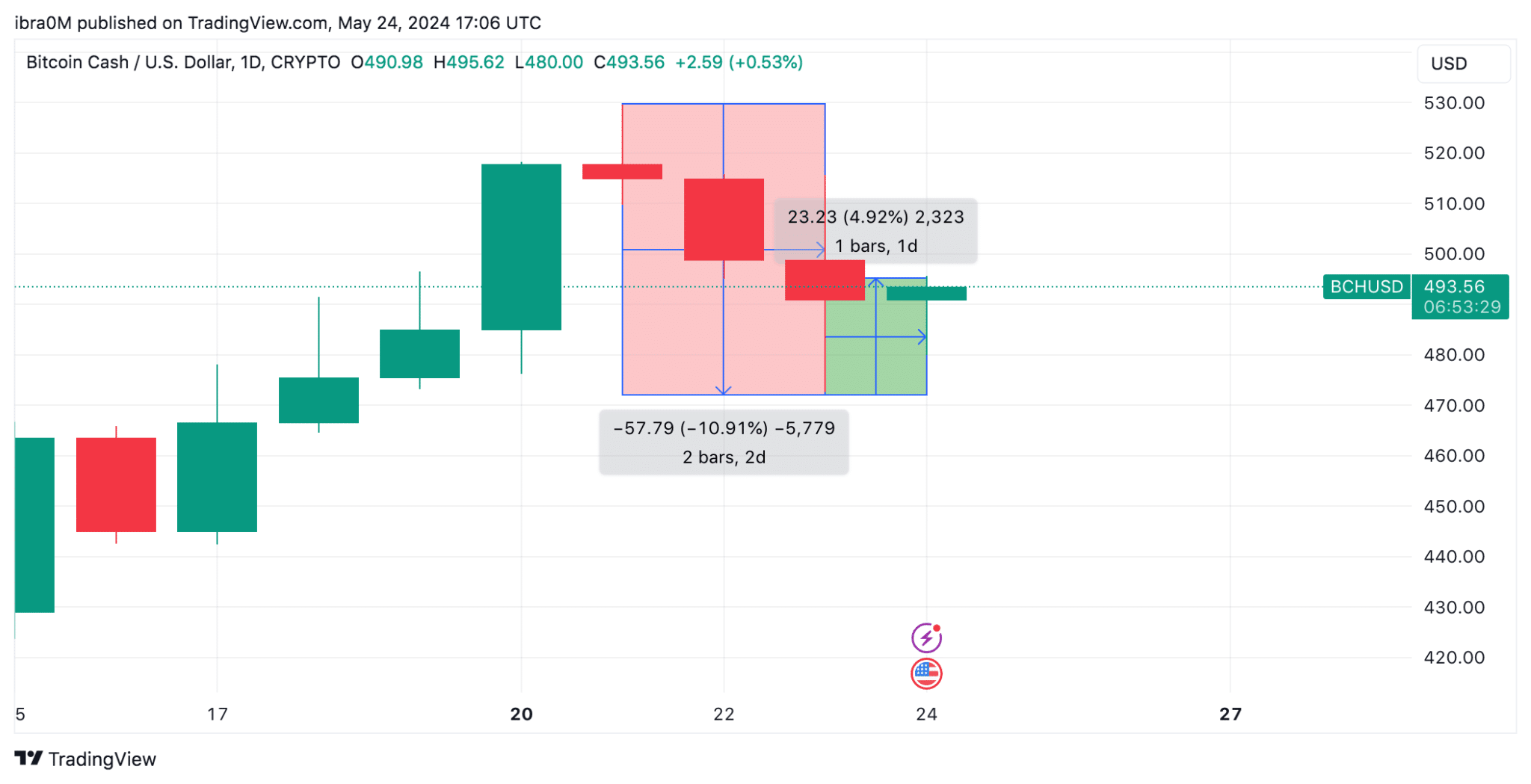

BCH stamp descended into an 11% tailspin over the supreme 72 hours before rebounding 5% to reclaim the $490 territory on Friday evening at 5 pm CET.

The Bitcoin Cash stamp volatility comes on the back of Ethereum ETF approval by the SEC on Could per chance maybe unbiased 23, which sent swing traders and paper-hand traders staunch into a “sell-the-news” frenzy.

The “sell-the-news” belief is standard contrarian technique in crypto procuring and selling where traders all without prolong sell-off their holdings ethical on the cusp of a foremost bullish news occasion, lock-in early earnings before the euphoria fades out, then procuring at lower costs.

This yarn appears to accept as true with played out in the BCH markets over the supreme 24 hours. As considered in the chart above. After the Ethereum ETF educated approval verdict on Could per chance maybe unbiased 23, BCH stamp tumbled 11%, dropping to a weekly low of $472. But within hours, BCH stamp has rebounded 5% to reclaim $490 level.

Whale Investors Reacted with 10,000 BCH Acquisition

Nonetheless, on-chain data shows that the “sell-the-news” wave used to be mainly restricted to swing traders and retail traders, while Bitcoin Cash whale traders maintained a bullish stance.

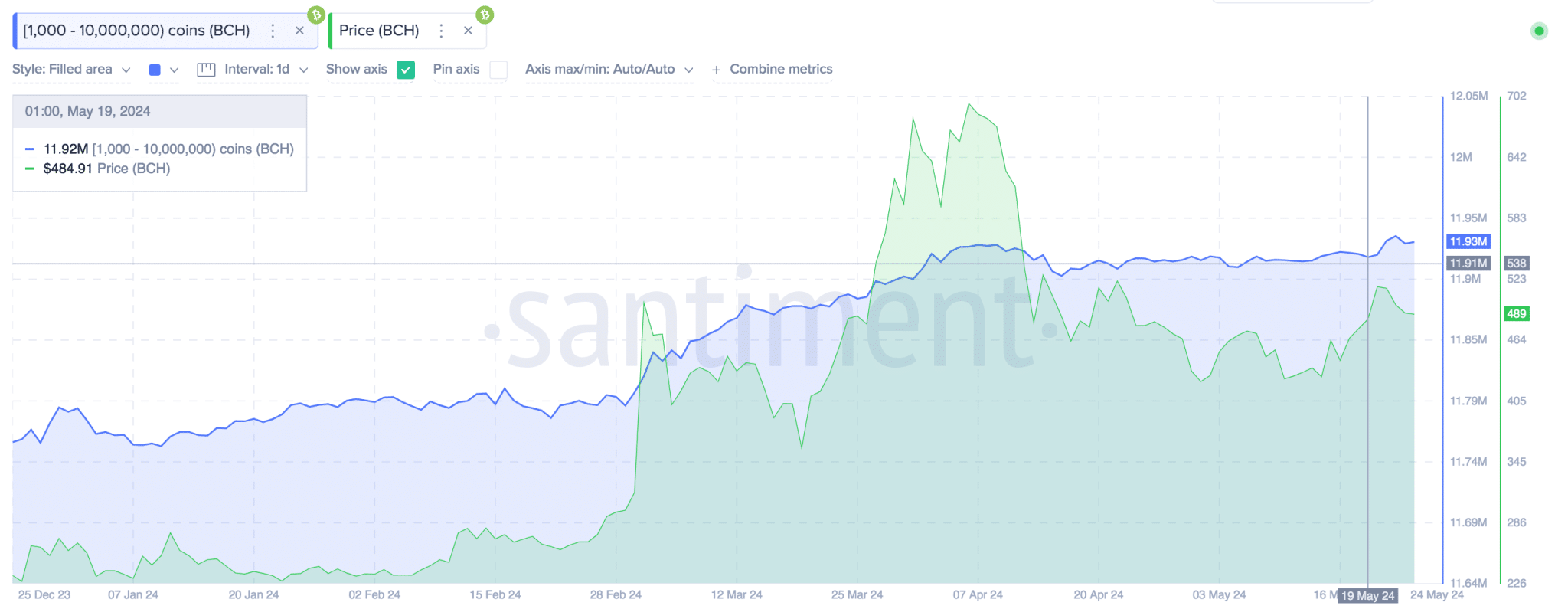

The Santiment chart below tracks the series of coins in custody of whale wallets keeping balances of a minimal of 1,000 BCH (~$500,000).

The chart above shows that BCH whales held a total of 11.92 million BCH in their cumulative balances as of Could per chance maybe unbiased 19. But since Bloomberg analysts broke the news of the Ethereum ETF approval on Could per chance maybe unbiased 20, the whales all without prolong elevated their procuring stress.

In nominal phrases, since Could per chance maybe unbiased 20, Bitcoin Cash whales accept as true with obtained 10,000 BCH, bringing their cumulative balances to 11.93 million.

Valued on the unique stamp of around $493 per coin, the Bitcoin Cash whales accept as true with effectively invested roughly $5.2 million.

Most often, when whales originate to aquire such gigantic volumes of coins within a short duration, it establish intense bullish stress on the cost of the underlying asset for 2 key causes.

In the starting effect, the foremost establish a matter to from whales reduces the on hand provide available in the market, riding up costs attributable to elevated scarcity. Secondly, whale accumulation often indicators self belief in the asset’s future efficiency, encouraging other traders to agree to suit, extra amplifying the cost lift.

This dynamic partly explains the like a flash 5% rebound in BCH costs noticed on Could per chance maybe unbiased 24. If the whales retain the procuring pattern, BCH’s stamp also can ascend in direction of the elusive $600 purpose in the impending days.

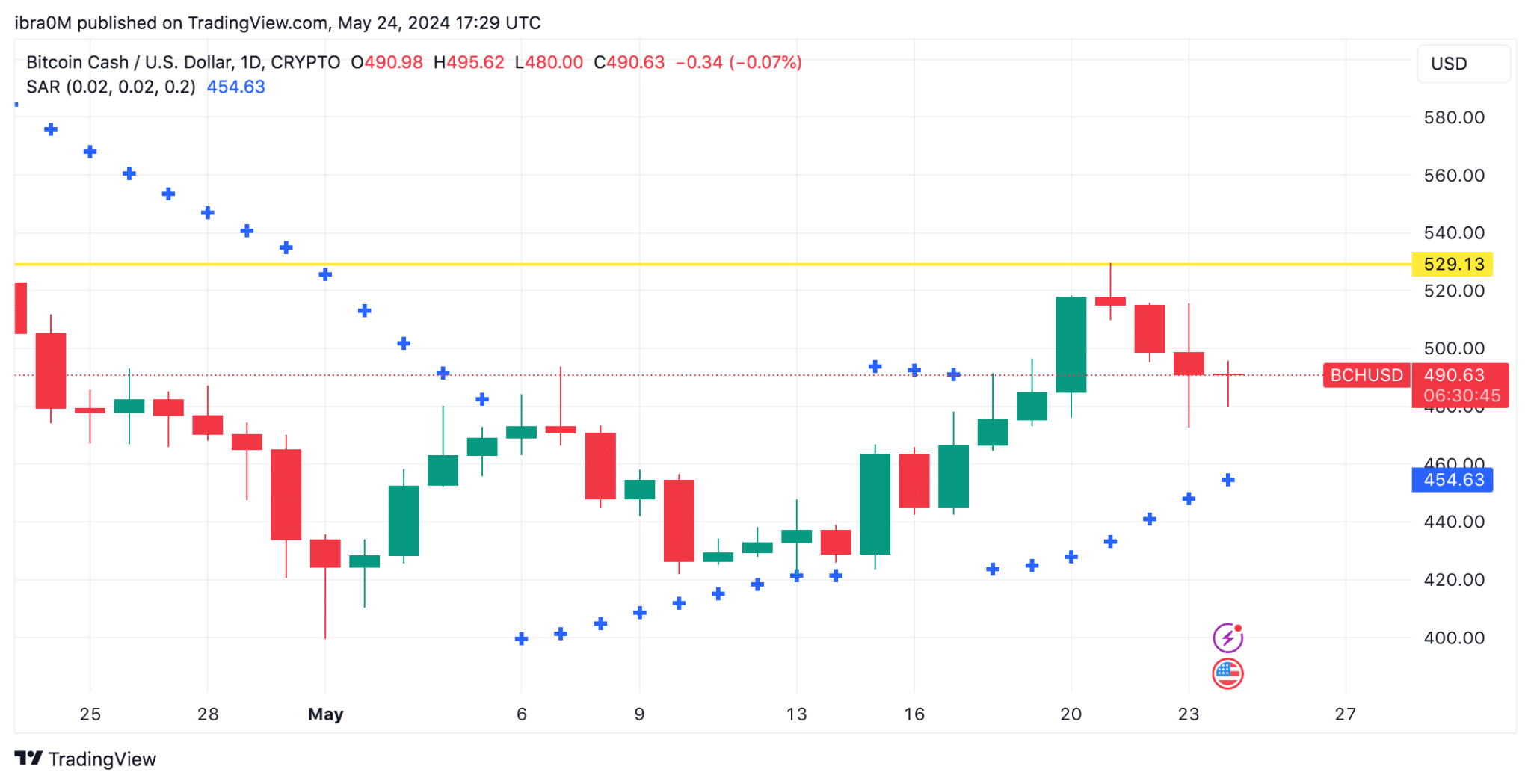

BCH Mark Forecast: $530 Resistance Looming Gargantuan

After the 5% rebound recorded after Ethereum ETF approval, Bitcoin Cash stamp now appears situation for any other leg-up in direction of $600. Essentially based fully totally on the unique on-chain movements, a continuation of the whales’ $5.2 million procuring pattern will likely crowd-out the paper-handed swing traders promoting into the market euphoria.

The Parabolic Stop and Reverse (SAR) technical indicator also affirms this bullish BCH stamp forecast. For the time being the Parabolic SAR dots are pointing in direction of $454 level which is much-below the unique BCH stamp at $493.

This alignment happens when the markets are in a stable uptrend, providing a solid toughen level that can also prevent foremost downward circulation.

On the flip facet, the previous market top at $530 also can effect a key temporary resistance level. If BCH can destroy via this resistance, it may maybe per chance maybe presumably likely attract extra procuring passion, likely propelling the cost in direction of the $600 purpose.