Bitcoin is pressing up against one of its most consequential resistance zones of the cycle, and standard crypto analyst Trader Mayne says the following couple of days will settle whether bulls reclaim momentum—or detect the rally stall into a lower excessive.

- Bitcoin’s ability to optimistic the heavy confluence zone at $98K–$100K will dictate whether the market stages a final leg better into one year-reside or slips lend a hand into a broader downtrend.

- “This stays the most important space for me,” Trader Mayne says.

- A dapper destroy of the $98K–$100K band would possibly perchance per chance per chance flip these odds—and potentially ignite the final most important rally of the cycle.

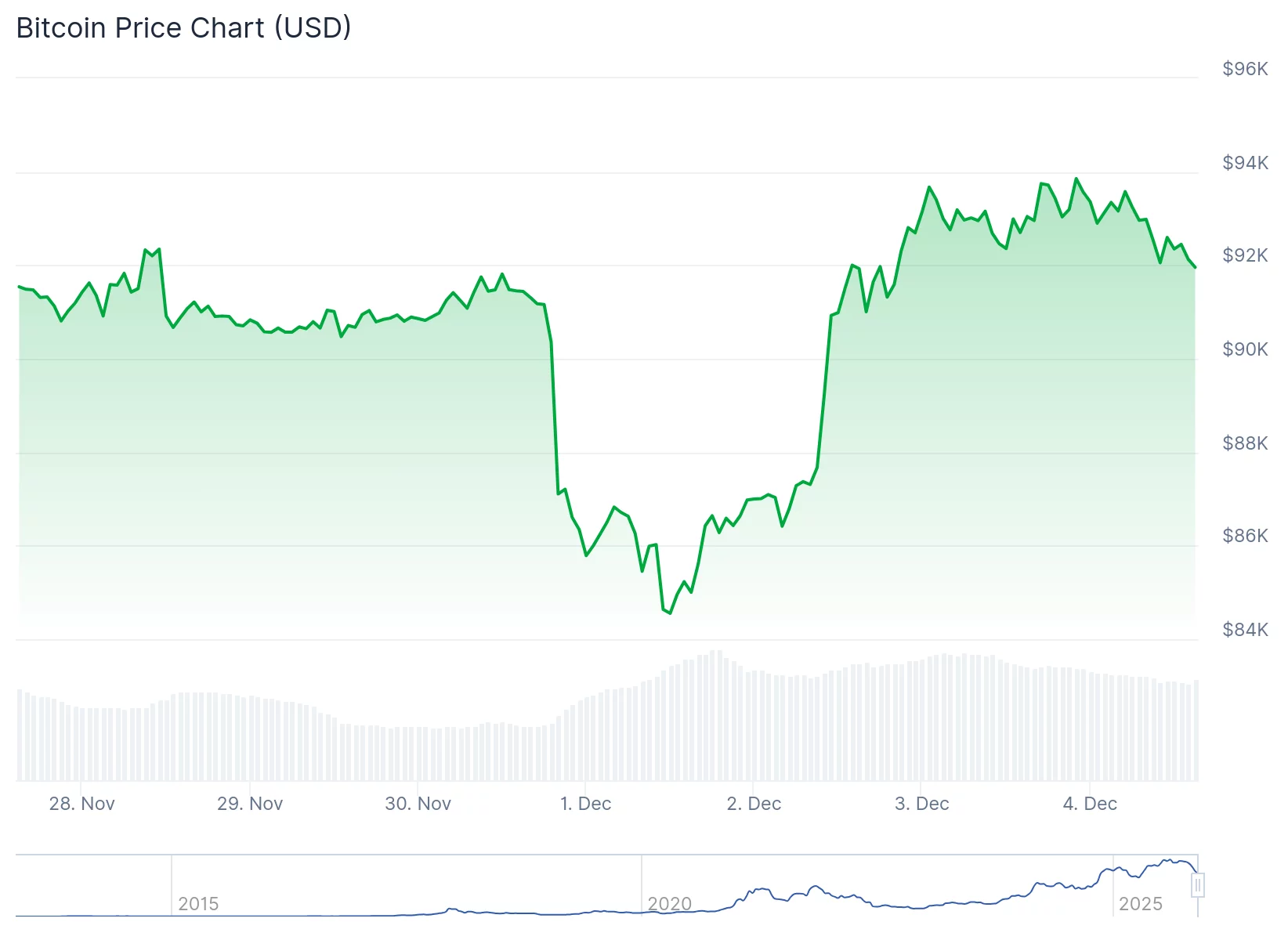

Bitcoin has climbed lend a hand to its yearly open stage after what Trader Mayne described as “ couple of substitute alternatives” following the formation of an $80,000 cycle low. The switch has broken an “aggressive downtrend,” however the analyst emphasised that the categorical test mute lies ahead: a on every day foundation downtrend line intersecting with the gentle label ground around $98,000.

The zone aligns with the series of lower highs defining Bitcoin’s macro downtrend. Clearing it would possibly perchance most likely per chance per chance stamp the most important meaningful shift in excessive-time-body building for the reason that all-time excessive come $125,000.

For now, Bitcoin has staged what Mayne known as “quite positive” label stream—better lows are forming, and a four-hour bullish building destroy is underway. However the market has yet to print a better excessive on the H4 chart. “I want observe-through,” he said. “I want a better excessive right here.”

A Lower High Earlier than the Subsequent Undergo Market?

Mayne reiterated that he mute assigns a 70%–80% likelihood to Bitcoin forming a lower excessive moderately than a contemporary all-time excessive. But that likelihood “drops to 50–60%” if bulls reclaim $98K and destroy the downtrend. The stage, he said, would additionally verify the weekly cycle low—developing what he believes would possibly perchance per chance per chance well be the final rally of the four-one year cycle ahead of a maintain market in 2026.

Cycle catalysts, he added, encompass the reside of Federal Reserve quantitative tightening, renewed liquidity expectations, and sentiment shifts similar to Leading edge enabling IBIT purchasing.

For bulls, the ideal scenario is a dapper breakout: “I are trying to take a look at label real walk. I don’t desire people to maintain time to rep in.” Uneven consolidation across the annual open would as a replace resemble a “maintain flag,” growing the potentialities the lower excessive is already in.

Mayne outlined two most important trendline guides: a destroy above the downtrend line signals bullish continuation, while a destroy of the rising momentary trendline would level to the building is “cooked.”

Despite the come-time length optimism, Mayne stressed out caution. His non-public blueprint is to promote dwelling positions into strength—ideally come $100K or better—ahead of a better cyclical pullback that can per chance per chance revisit $50K–$60K.

“Any stamp of weak spot at the annual open, 98K, 100K, 105–110K—derisk, hedge, ready to rep the **out,” he said.

Need to mute Bitcoin fail to destroy better, he expects alternatives on the short facet: “A maintain market is real the inverse of a bull market…real invert the chart.”

Buck Dynamics Align—for Now

Mayne said macro signals are supportive, noting USD dominance is pulling lend a hand and the U.S. dollar index is rejecting a key resistance. “We are trying to take a look at this create one more low. That’s the ideal case for shares, for crypto, for the full lot.”

Bitcoin is perched on its most important resistance since topping out. A decisive push through $98K–$100K would possibly perchance per chance per chance shift market building, sentiment, and cycle dynamics . Failure there would possibly perchance per chance per chance verify the tip is already in.

As Mayne set it: “The bulls mute maintain work to complete. The bears are mute as much as speed.”