Right here’s a everyday diagnosis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

DXY vs BTC

Remaining week, the Federal Reserve (Fed) delivered its first passion fee fee lower since December, while signaling more easing within the arrival months. But, despite this dovish switch, the dollar index (DXY), which tracks the buck’s fee against most predominant currencies, completed the week with a dragonfly doji on the weekly chart – a conventional bullish reversal fee suggesting a USD rally ahead.

The dragonfly doji will get its title from its distinctive “T” form, which resembles the soundless wings of a dragonfly or the blade of a bamboo-copter toy. This sample forms when the originate, high, and shut costs are nearly identical, accompanied by a prolonged lower shadow that reflects a racy impress decline mercurial reversed by procuring for rigidity.

The DXY within the inspiration fell on the guidelines of the Fed fee lower, briefly dipping below the July low of 96.37, only to jump back and terminate the week largely unchanged at 97.65, supported by resilience in U.S. Treasury yields.

The look of the dragonfly doji after a valuable downtrend and at serious make stronger, as in DXY’s case, suggests an impending bullish shift available within the market model.

Traditionally, dollar energy corresponds with weak point in dollar-denominated and broader threat resources, environment a curious stage for the week ahead.

Bitcoin BTC$114,472.99 mirrored this theme within the week ended Sept. 21, forming an indecisive Doji candle on the serious resistance marked by the trendline from 2017 and 2021 bull market peaks. Provided that this Doji regarded at any such critical prolonged-term trendline, it leans more bearish, signaling hesitation among bulls to lead the fee action and renewed selling rigidity from the most predominant hurdle.

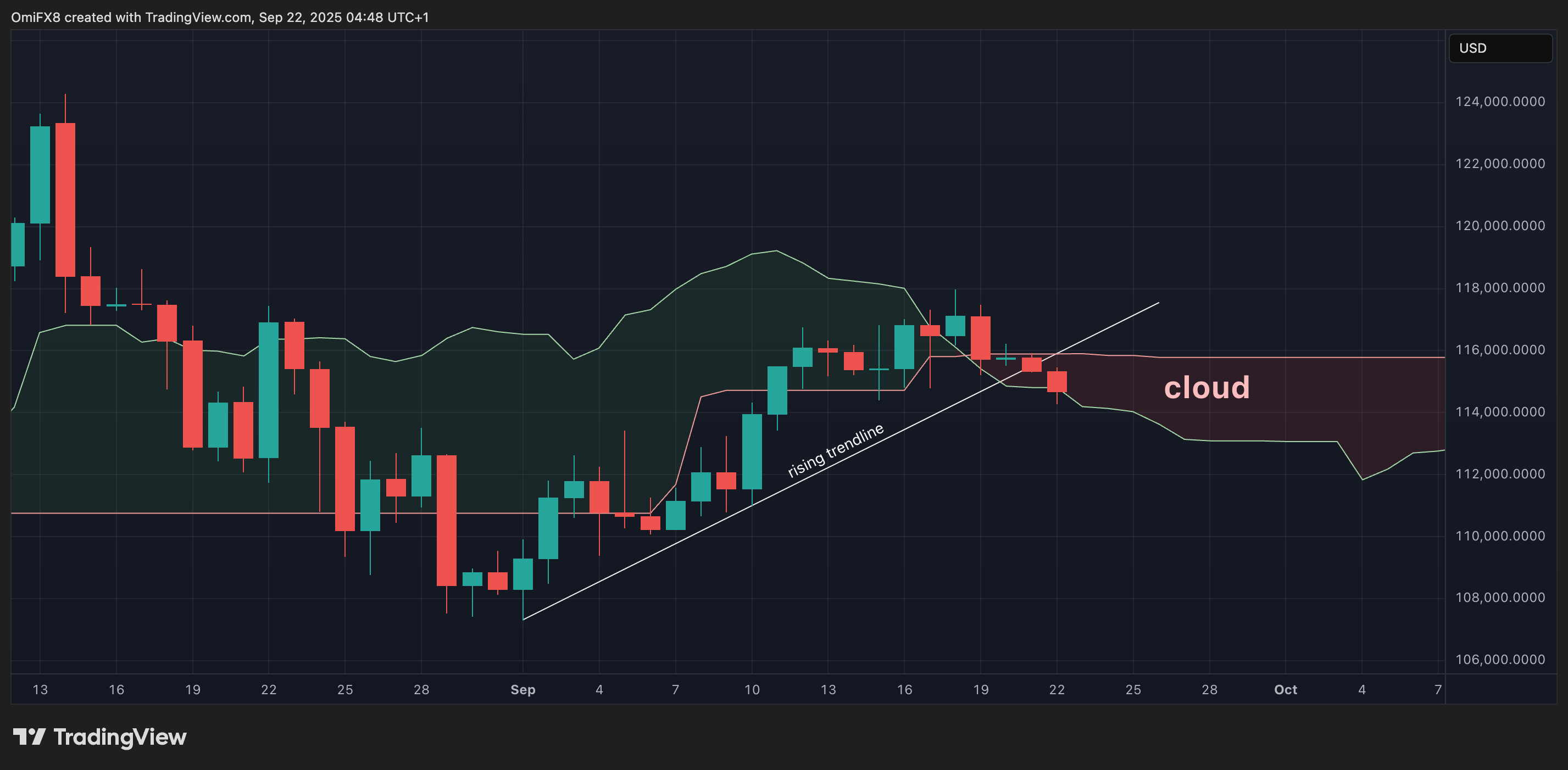

On the everyday chart, BTC are teasing a switch below the Ichimoku cloud, with the trendline drawn from Sept. 1 lows breached, implying capacity downside threat.

The first line of make stronger is considered at $114,473, the 50-day uncomplicated exciting moderate, adopted by Sept. 1 lows attain $107,300. The previous week’s high of $118,000 must be overcome to weaken the bearish case.

Ether differ breakdown

Ether (ETH) faces its possess technical predicament; it hovers below the lower terminate of the contracting triangle sample on the everyday chart, suggesting renewed seller dominance and capacity for deeper losses. The breakdown has put specialize within the Aug. 20 low of $4,062 adopted by the psychological make stronger of $4,000. The 24-hour high of $4,458 is the degree to beat for the bulls.

XRP’s MACD flips bearish

Meanwhile, XRP gives a frustrating picture for bulls. Whatever the present debut of an XRP ETF within the U.S. on Thursday, the MACD indicator has crossed bearish on the weekly chart, indicating a renewed downside bias. Label means that XRP is slipping back to the upper boundary of a descending triangle on the everyday chart. Though a tentative breakout occurred last week, it did not ignite a sustained rally, leaving merchants cautious.

Level of curiosity on the Fed direct and PCE

This week, Fed Chairman Jerome Powell and nine other officials are scheduled to talk, with markets inclined to closely leer the identical for cues on the fervour fee trajectory. Whereas the Fed lower charges last week, signaling more easing ahead, Powell threw chilly water over optimism by stressing a>

President Donald Trump appointee Stephen Miran will moreover direct of his independence as a policymaker, having dissented in desire of an outsized 50 basis level fee lower last week.

On Friday, the U.S. core PCE index, the Fed’s preferred measure of inflation, is scheduled to be launched. Per Amberdata, the guidelines is expected to video show that inflation rose 2.7% 365 days-on-365 days, with core leaping 2.9% in August, marking a small uptick from the old month.