Many in the crypto explain hang echoed a well-recognized sentiment over most novel months: “The four-365 days crypto market cycle is uninteresting.” Consultants from the Bull Principle command that while the four-365 days cycle would perchance per chance additionally hang come to an terminate, the Bitcoin bull speed itself is merely delayed and can stretch until 2027.

Why The Four-365 days Cycle Would possibly perchance per chance additionally Be Ending

In a most novel post on social media platform X, previously is named Twitter, the Bull Principle analysts renowned that the conception that of Bitcoin adhering to a dapper four-365 days cycle is weakening.

They highlighted that important trace movements over the final decade weren’t completely driven by Halving events; moderately, they were influenced by shifts in world liquidity.

The analysts pointed to essentially the most novel panorama of stablecoin liquidity, which remains excessive regardless of most novel downturns, indicating that greater shoppers are nonetheless engaged in the market, poised to invest when applicable macroeconomic conditions come up.

Within the US, Treasury policies are emerging as pivotal catalysts. The most novel buybacks are significant, but the analysts emphasize that the greater account lies in the Treasury Traditional Account (TGA) balance, which is presently around $940 billion—nearly $90 billion above its ordinary vary.

This surplus money is probably to drift support into the financial procedure, bettering financing conditions and adding liquidity that generally gravitates towards risk assets.

Globally, the trends seem even more promising. China has been injecting liquidity for a complete lot of months, while Japan recently launched a stimulus kit worth roughly $135 billion, alongside efforts to simplify cryptocurrency regulations.

Canada is also transferring towards easing its financial protection, and the US Federal Reserve (Fed) has formally halted its quantitative tightening (QT) measures—a historical precursor to some form of liquidity expansion.

Political And Monetary Factors Align To Invent Bullish Situation

The analysts defined that when main economies undertake mammoth financial policies simultaneously, risk assets like Bitcoin are inclined to answer more all straight away than broken-down shares or broader markets.

Furthermore, doable protection tools, such because the Supplementary Leverage Ratio (SLR) exemption—conducted in 2020 to enable banks more flexibility in rising their balance sheets—would perchance per chance additionally return, ensuing in increased credit introduction and overall market liquidity.

There would possibly be also a political dimension to set in thoughts. President Trump has discussed doable tax reforms, including abolishing earnings tax and distributing $2,000 tariff dividends.

Furthermore, the probability of a brand nonetheless Federal Reserve chair who supports liquidity support and is positive towards cryptocurrency would perchance per chance additionally bolster conditions for economic verbalize.

Prolonged Bitcoin Uptrend

Historically, every time the Institute for Present Administration’s Purchasing Managers’ Index (ISM PMI) surpasses 55, it has been adopted by periods of altcoin season. The probability of this occurring in 2026 seems to be excessive, per the Bull Principle.

The convergence of rising stablecoin liquidity, the Treasury’s injection of money support into markets, world quantitative easing, the terminate of QT in the US, doable financial institution-lending reduction, first rate-market protection shifts in 2026, and main gamers coming into the crypto sector suggests a extraordinarily assorted scenario than the veteran four-365 days halving model.

The analysts concluded that if liquidity expands similtaneously across the US, Japan, China, Canada, and other important economies, Bitcoin is unlikely to wander counter to that fashion.

Therefore, in region of experiencing a pointy rally adopted by a power maintain market, essentially the most novel atmosphere indicates a more extended and broader uptrend that would perchance per chance additionally span thru 2026 and into 2027.

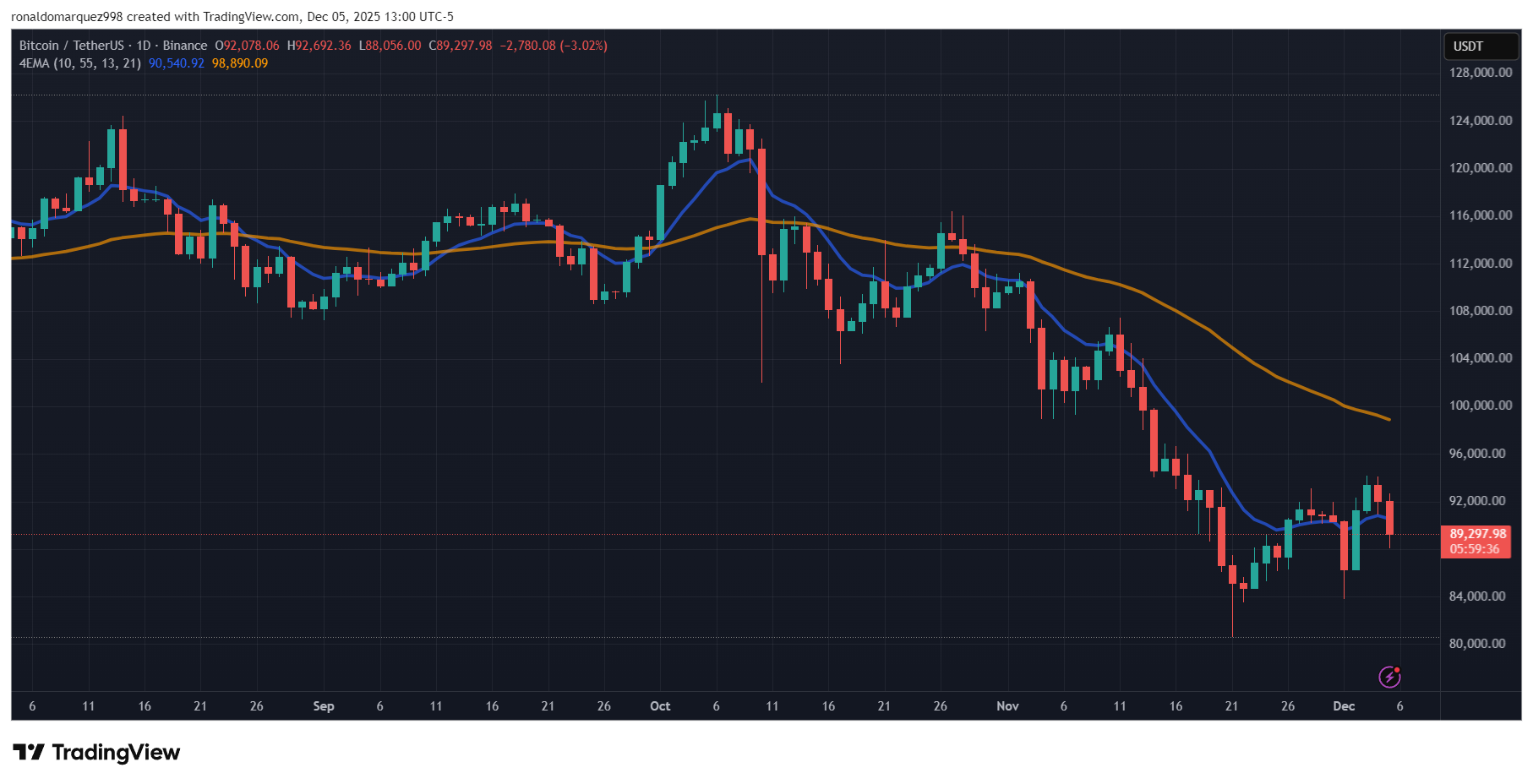

Featured image from DALL-E, chart from TradingView.com