-

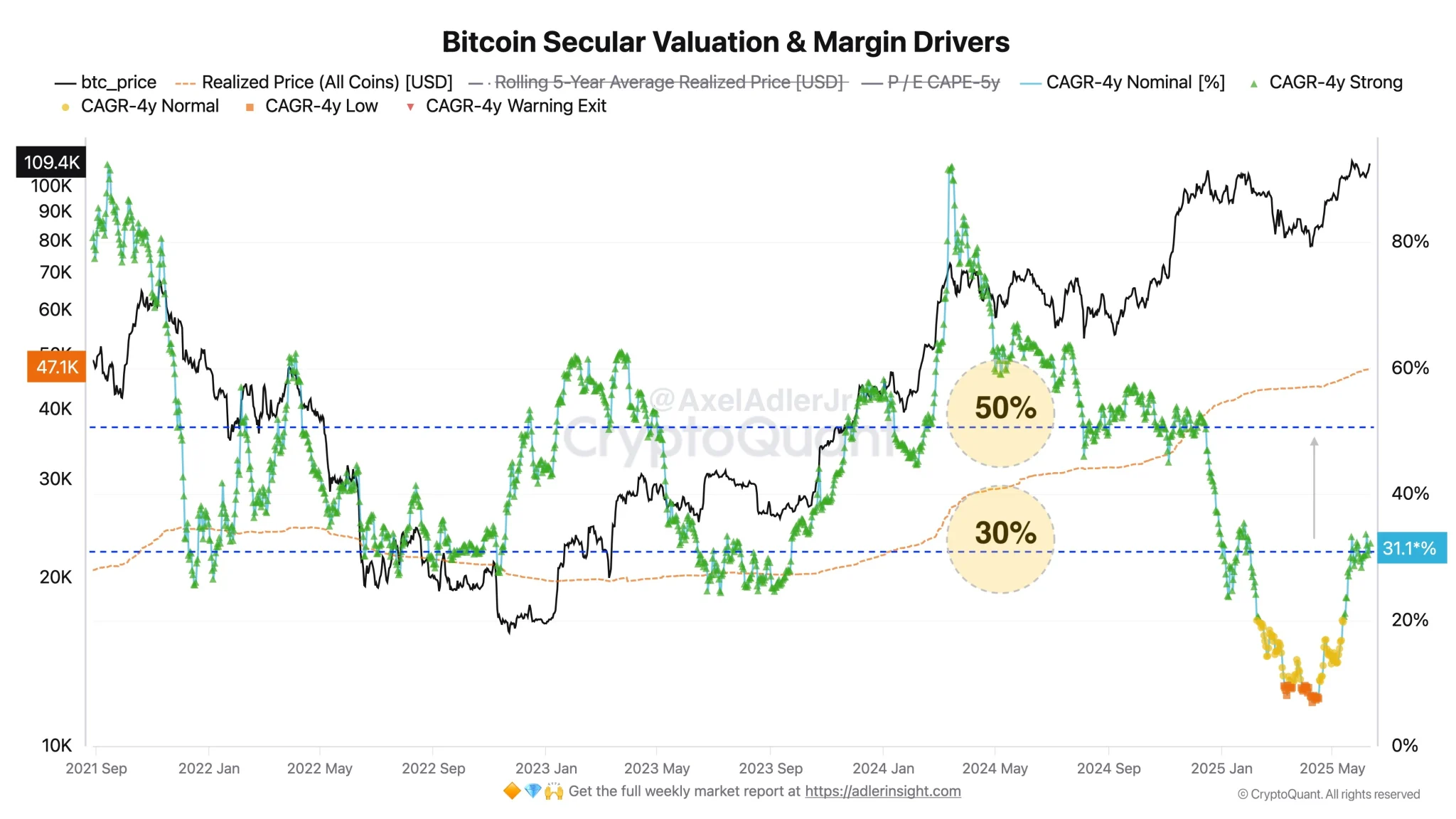

Bitcoin’s CAGR jumps from 7% to 31% as stamp rallies 46% in beneath two months, signaling renewed prolonged-length of time bullish momentum.

-

Analyst Axel Adler Jr forecasts BTC might possibly possibly hit $168K by October 2025 if leverage and futures momentum proceed.

Bitcoin’s stable efficiency in April and Could well has reignited hopes for a essential bullish breakout. From April 9 to Could well 22, the Bitcoin stamp surged by 46.32%, in conjunction with an 18.48% rally between Could well 5 and 22. The associated price recovery has furthermore pushed its Compound Annual Boost Payment (CAGR) better, signaling renewed market optimism.

BTC CAGR Spikes as Mark Recovers

Crypto analyst Axel Adler Jr no longer too prolonged ago highlighted a critical spike in Bitcoin’s 4-year CAGR. In April 2025, it had dropped to honest 7%, reflecting Bitcoin’s unstable open to the year. In January, BTC grew by 9.54%, however the next months saw appealing declines—down 17.5% in February and 2.19% in March. The associated price even touched a low of $74,446.79 in April.

Nevertheless, the market rebounded strongly. By June 2025, Adler experiences that Bitcoin’s CAGR climbed reduction to 31%.

“This appealing rebound shows how snappy the prolonged-length of time style can shift when stable purchaser momentum enters the market,” Adler acknowledged.

But, he notes that 31% CAGR is still beneath historical bull market peaks, implying more space for enhance.

$168K BTC by October?

Axel Adler Jr forecasts a likely Bitcoin stamp target of $168,000 by October 2025, assuming momentum within the futures market and leverage continues.

He bases this projection on accelerating enhance and historical patterns noticed at some stage in prior bull runs.

Adjusting for Risk: CAGR vs. Normal Deviation

Within the dialogue thread, X user Manu suggested a more sophisticated system to clarify CAGR—by dividing it by the favorite deviation to construct away with volatility and highlight threat-adjusted returns.

Adler agreed with the vogue, pointing out it provides a cleaner watch of market efficiency, however furthermore emphasised one other serious point:

“The accurate inflection point comes when investors open taking earnings essentially based mostly completely on expected returns.”

Per him, the threat of a undergo market grows as soon as BTC trading quantity crosses 1 million cash, as immense-scale earnings-taking can disrupt offer-seek data from steadiness.