Analysts predict the Bitcoin (BTC) market cap will reach $1.5 trillion amid surges in space trade-traded funds (ETF) from BlackRock and others and the trade quantity of the pause 10 crypto resources. Jurrien Timmer from Fidelity predicts that Bitcoin will rapidly capture 25% of the non-industrial gold market.

Institutions and analysts occupy became bullish that surges in XRP, ETH, and BTC, coupled with ETF-fueled hobby from institutions, will peek the crypto market develop its capitalization by no longer decrease than $500 billion.

Why the Bitcoin Market Cap Is Rising

This week, Elon Musk implicitly counseled Bitcoin as a lawful forex in response to a 2016 assertion from Warren Buffett. Buffett talked about in 2016 that time, no longer money, used to be precious for him.

Musk spoke back with ‘time is forex,’ echoing reflections from an anonymous creator, Gigi, who talked about that Bitcoin block height is a time size. Musk’s tweet comes amid feverish hypothesis in regards to the future of Bitcoin. Newest surges in XRP, ETH, and BTC costs occupy elevated cryptocurrency market capitalization to over $2 trillion.

“This day, it’s miles every other time a timekeeping gadget that is transforming our civilization. a clock, no longer computer systems, is the lawful key-machine of the stylish informational age. And this clock is Bitcoin,” Gigi wrote.

Be taught extra: What Is Market Capitalization? Why Is It Major in Crypto?

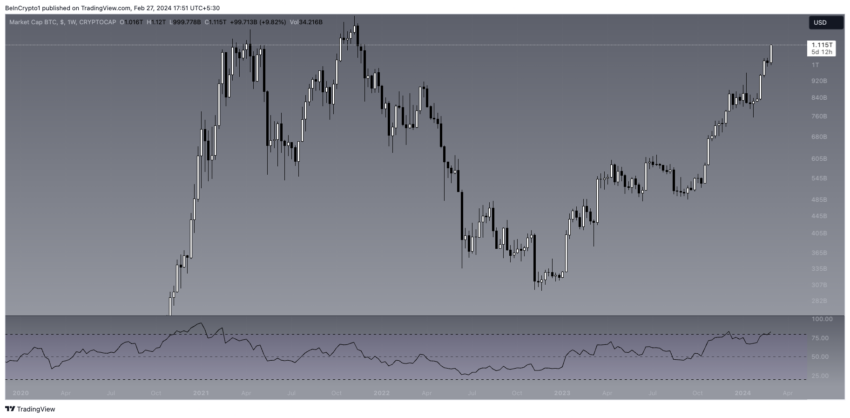

Properly-known analyst Kevin Svenson talked about that Bitcoin might well perhaps double in response to how carefully its impress has tracked a most recent trendline. Svenson well-known by approach to on-chain diagnosis that Bitcoin’s impress will double a so-known as ‘Tainted 3’ price in accordance with parabolic crypto buying and selling patterns seen in every cycle. Earlier this year, the asset’s impress reached $forty five,000 at Tainted 3, which manner a $90,000 impress is doable.

How the BlackRock Space Bitcoin ETF Coaxed Firms

Institutions that quick decided of Bitcoin are indubitably embracing it, some at arm’s length. JPMorgan, whose CEO known as Bitcoin a pet rock, recently upgraded the stock of US crypto trade Coinbase to neutral, arguing that Bitcoin’s rally after the US Securities and Alternate Price authorized space ETFs has proven sustainable. Jurrien Timmer, Director of World Macro at Fidelity Investments, recently supplied a bullish steal on Bitcoin’s taking the market part of so-known as monetary gold, i.e., gold that’s no longer extinct in jewellery or manufacturing.

“In accordance to the calculations outlined in my outdated threads, I estimate that Bitcoin will at final capture spherical a quarter of the monetary gold market. At 40%, monetary gold is for the time being price spherical $6 trillion, while Bitcoin is price $1 trillion,” Timmer talked about.

Funding advisory firm Carson Team recently onboarded four of the 10 Bitcoin ETFs, in conjunction with Fidelity’s. Bitcoin ETFs from Fidelity and BlackRock were the largest, with BlackRock’s turning into the fifth-biggest ETF among all asset classes.

Be taught extra: What Is a Bitcoin ETF?

Nonetheless Buffett, one amongst the arena’s most renowned and a hit investors, is unexcited unconvinced. Supreme year, he told investors at a Berkshire Hathaway shareholder assembly that Bitcoin had zero price.

His comments were equivalent to those in a most recent critique from the European Union. They talked about in a most recent liberate that Bitcoin can no longer generate money drift, nor can investors see it as a commodity. BeInCrypto requested Berkshire Hathaway for his or her point of view on Bitcoin nevertheless had no longer heard reduction at press time.

Disclaimer

The total knowledge contained on our web pages is published in upright faith and for overall knowledge capabilities handiest. Any action the reader takes upon the simple job chanced on on our web pages is precisely at their very dangle menace.