After climbing over 3% within the previous 48 hours, Bitcoin word is attempting out the upper fluctuate of its fresh consolidation shut to $111,300. Alternatively, because the worth nears the upper Bollinger Band and horizontal resistance at $112,400, early signs of exhaustion are surfacing. The query now is whether or no longer or no longer Bitcoin word as of late can exact a breakout above this resistance or if bulls will step serve and enable a non permanent correction.

What’s Occurring With Bitcoin’s Ticket?

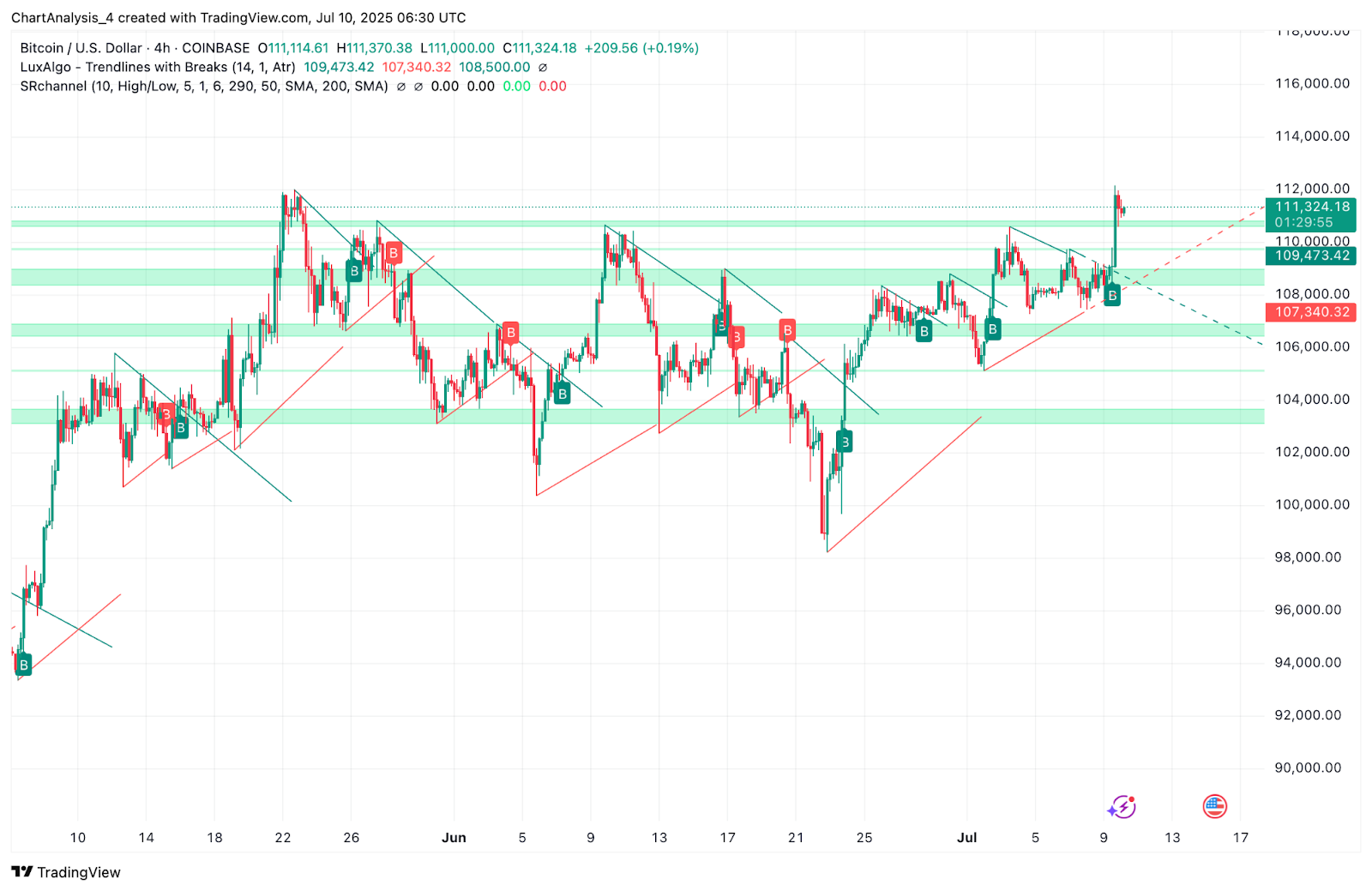

Bitcoin has surged out of a two-week ascending triangle, supported by a stable trendline from slack June. The breakout above $110,000 became once accompanied by a quantity spike, pushing word into the $111,300–$111,600 space.

On the each day chart, BTC is drawing shut the upper Bollinger Band at $112,377, with word presently going thru rejection shut to this line.

The EMA cluster (20/50/100/200) is entirely stacked under word and showing wholesome bullish alignment. The nearest dynamic give a take to now lies at the EMA20 shut to $108,100, with additional give a take to from the EMA50 at $105,770.

Key horizontal provide zones from earlier in May perhaps well and June converge around $112,400, which has now flipped loyal into a decisive resistance barrier. With out a stable shut above this stage, the rally could simply stall.

Why Is The Bitcoin Ticket Going Up On the present time?

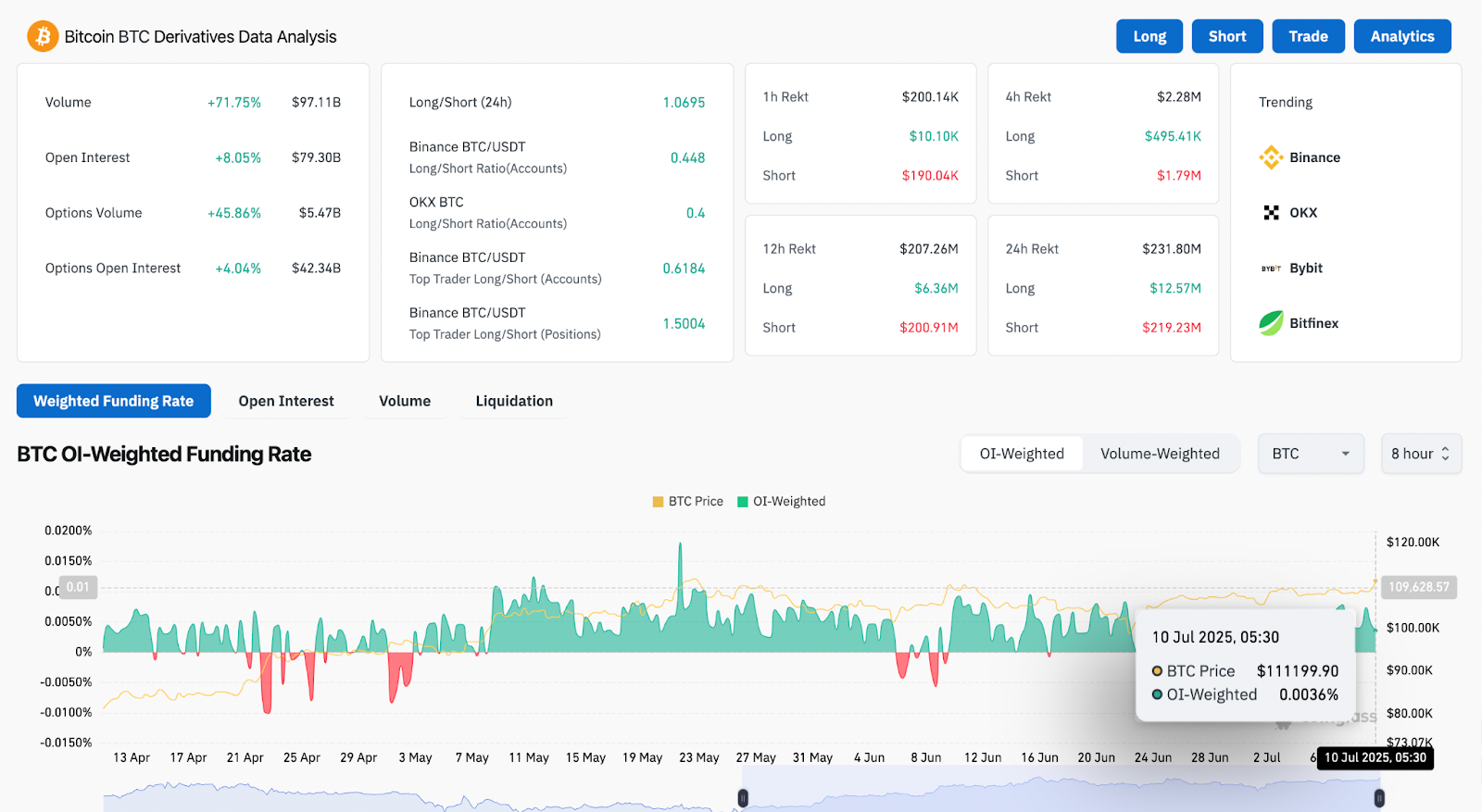

The reason within the serve of why Bitcoin word going up as of late is basically driven by stable derivatives inflows and technical breakout momentum. In step with doubtlessly the most modern records:

- Derivatives quantity surged 71.75% to $97.11B

- Open hobby jumped by 8.05%, reaching $seventy nine.3B

- Funding charges dwell obvious at 0.0036%, reflecting lengthy-biased sentiment

- Binance high trader lengthy/short ratio hit 1.5, indicating aggressive lengthy positioning

The 30-minute chart reveals a symmetrical triangle breakout shut to $111,200, with VWAP presently keeping correct under the worth at $111,192. Parabolic SAR dots have flipped under word, including to the bullish affirmation.

Alternatively, warning is warranted. On the 4-hour chart, word has touched the upper channel resistance of a rising wedge whereas indicators love RSI start to flatten. Instantaneous resistance lies at $112,226 (pivot R4) and $112,500, where confluence zones could simply trigger earnings-taking.

Supertrend, DMI, and Bollinger Bands Signal Short-Time length Tug of Battle

The Supertrend indicator on the 4H chart stays bullish with give a take to at $108,287, confirming the breakout structure. This give a take to also aligns with the outdated fluctuate high shut to $108,000, now a likely retest zone.

The Directional Motion Index (DMI) reveals +DI (26.8) leading -DI (8.5) with a rising ADX (21.6) — a mixture that helps an brisk uptrend, although no longer but at height energy.

Bollinger Bands on the each day chart are widening but again, with word hugging the upper band. This veritably signifies pattern continuation, but overextension here could even trigger a non permanent proceed if quantity would now not apply thru.

BTC Ticket Prediction: Short-Time length Outlook (24H)

In the following 24 hours, Bitcoin word desires to shut decisively above $112,400 to substantiate a sustained breakout. If bulls prevail, word could speed toward $114,900, the following R5 pivot resistance and better channel boundary.

Alternatively, failure to raise most modern ranges could simply ship a pullback to the $109,000–$108,200 give a take to cluster. This zone entails the lower trendline, Supertrend give a take to, and horizontal ranges seen within the July 7–9 accumulation share.

As lengthy as BTC holds above $108,000, the pattern stays optimistic. However merchants have to show screen quantity carefully, especially as short liquidations dry up and momentum indicators flatten.

Bitcoin Ticket Forecast Table: July 11, 2025

| Indicator/Zone | Stage / Signal |

| Bitcoin word as of late | $111,305 |

| Resistance 1 | $112,400 |

| Resistance 2 | $114,900 |

| Make stronger 1 | $109,000 |

| Make stronger 2 | $108,200 |

| EMA Cluster (20/50/100/200) | Bullish stack, lowest at $95,970 |

| Bollinger Bands (Day-to-day) | Greater Band at $112,377 (attempting out) |

| VWAP (30-min) | $111,192 (word above, bullish) |

| DMI (14) | +DI 26.8 / -DI 8.5 / ADX 21.6 (bullish) |

| Supertrend (4H) | Bullish above $108,287 |

| Derivatives Quantity | +71.75% ($97.11B), Long bias |

| Funding Rate | +0.0036% (obvious) |

| Parabolic SAR (30-min) | Dots under word (bullish) |

Disclaimer: The records introduced in this article is for informational and tutorial functions ultimate. The article would now not represent financial advice or advice of any form. Coin Edition is no longer liable for any losses incurred as a outcomes of the utilization of convey material, merchandise, or services and products talked about. Readers are educated to bid warning sooner than taking any action linked to the firm.