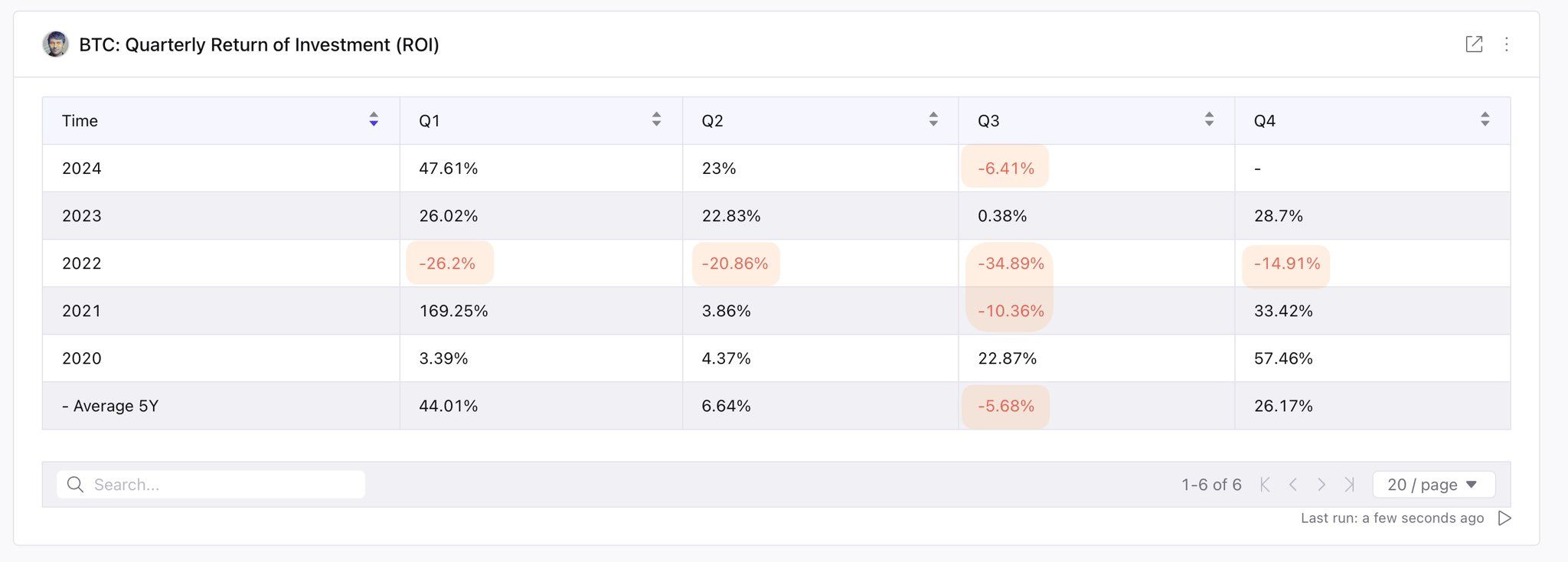

Bitcoin’s (BTC) label has skilled varying ranges of return for each and every quarter of the final five years. Nonetheless, one side synonymous with these durations is how the coin produces a favorable return between October and December.

With September forthcoming, BTC shall be shut to 1 other season where the price would possibly possibly trudge on a parabolic rally. Will it be the identical this time?

What Historical past Says About Bitcoin Performance in Q4

Traditionally, Bitcoin’s label tends to underperform within the third quarter (Q3). Nonetheless, essentially based on a chart shared by analyst Axel Adler, Bitcoin has seen a median enhance of 26% every fourth quarter (Q4) since 2019.

Let’s announce, in October 2023, BTC traded around $26,000. By December, it had surged to $44,000. In distinction, Bitcoin didn’t attain such beneficial properties in 2022 due to the FTX contagion, which pushed the market into a undergo piece.

In 2021, Bitcoin rose from $40,000 to $69,000 between September and November, before experiencing a tiny decline in December. A the same pattern passed off in 2020 when BTC’s label doubled at some level of Q4.

Be taught more: What Is Bitcoin? A Handbook to the Fashioned Cryptocurrency

If this pattern holds correct, Bitcoin’s label shall be poised for a most essential enhance as soon as September ends. To gauge this doable, it’s most essential to set in mind the modern market prerequisites surrounding the coin.

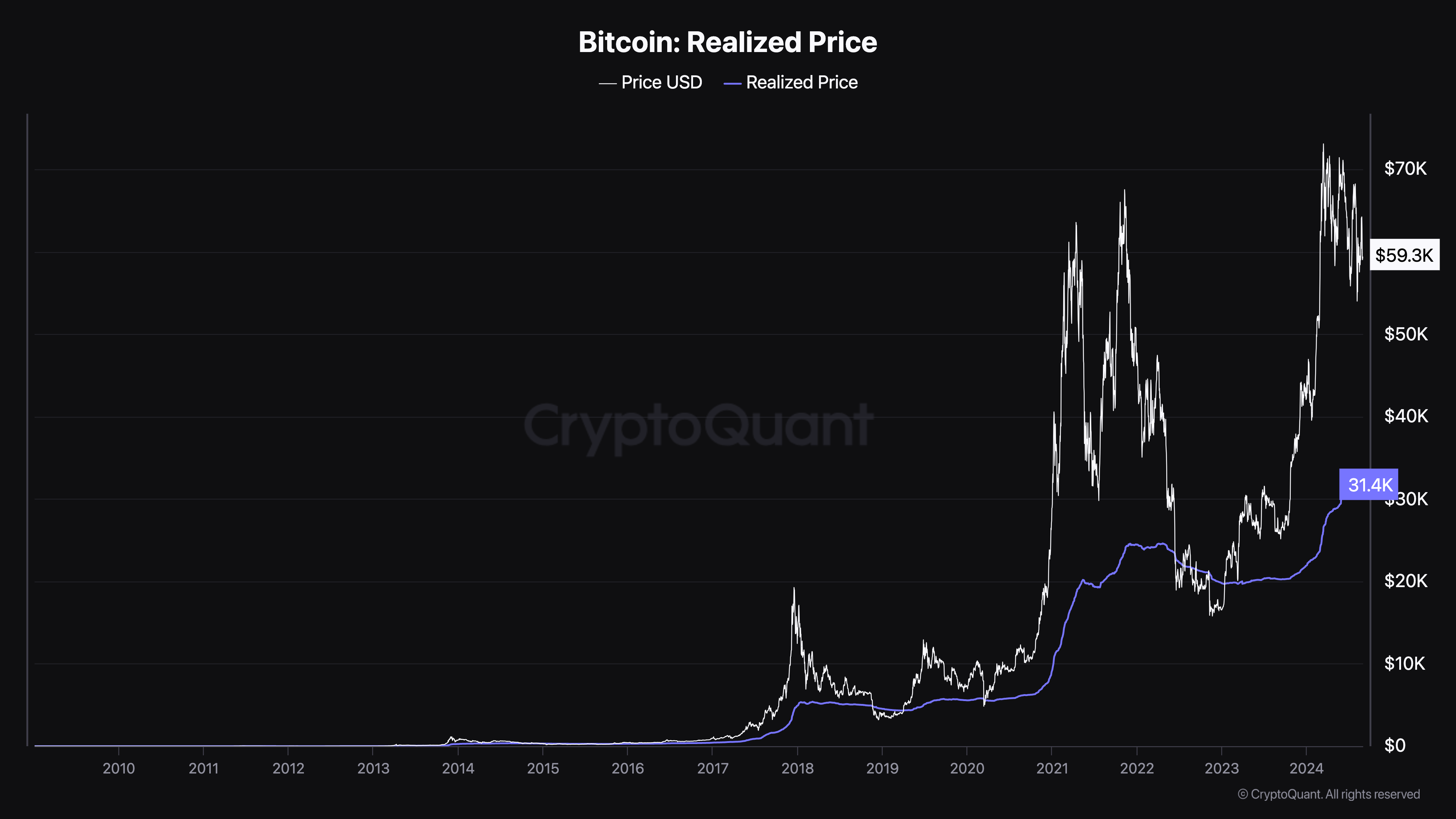

BeInCrypto particularly examines the Realized Label, which represents the moderate label the total market paid for Bitcoin. Traditionally, this metric has served as an on-chain reinforce or resistance level for BTC.

At press time, Bitcoin’s Realized Label is $31,400. This label appears to be providing reinforce for the cryptocurrency, as indicated by the CryptoQuant chart below. For the Realized Label to behave as resistance, it would must align with or exceed Bitcoin’s modern market label.

When this happens, the price tends to lower later on. Subsequently, the modern label of the metric suggests that Bitcoin soundless has an correct upside doable. Subsequently, a most essential label enhance shall be doubtless by Q4 and before the conclude of this yr.

BTC Label Prediction: The Coin Hints at a 24% Operate, Nonetheless First…

As of this writing, Bitcoin is buying and selling at $59,551, down from $64,452. Notably, this label is hovering around the 200-day Exponential Transferring Average (EMA), a key technical indicator that measures pattern direction. The 200 EMA (blue) provides insights into the long-term pattern.

When the 200 EMA rises above Bitcoin’s label, it typically stalls the uptrend or pulls it down. Conversely, when the 200 EMA is below the price, it creates room for Bitcoin to grow. At display cowl, if BTC fails to climb above this indicator, its label would possibly possibly possibly drop to $57,818 or potentially as low as $54,474.

The Chaikin Cash Circulation (CMF), which tracks the trudge with the circulation of liquidity into a cryptocurrency, additionally helps the probability of a decline. The CMF reading has dropped, signaling a lower in buying tension.

Be taught more: Bitcoin (BTC) Label Prediction 2024/2025/2030

Nonetheless, if past efficiency is any indication, BTC would possibly possibly possibly rise by 24% within the early months of Q4, pushing the coin’s label to $71,974. On the a range of hand, if the broader market experiences a most essential decline in capital influx, this prediction shall be invalidated, potentially inflicting Bitcoin’s label to tumble to $49,068.