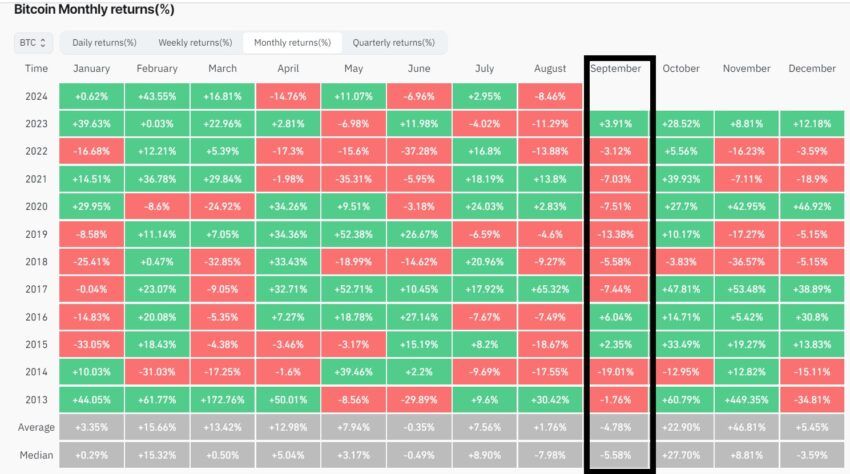

Bitcoin investors are bracing for September, traditionally the worst month for the cryptocurrency’s designate. Digital belongings platform Matrixport has issued a warning, suggesting Bitcoin could well gaze extra declines this month because of diversified looming anxiousness components.

Matrixport highlighted that Bitcoin faces extra stress this three hundred and sixty five days, which might impact its designate. In its Matrix on Target report, the firm pointed to plenty of key influences, collectively with the US tech sector’s outlook, the Federal Reserve’s decisions, and the upcoming presidential debates, all of which might weigh on Bitcoin’s efficiency.

Key Factors Impacting Bitcoin’s September Efficiency

Matrixport famed a solid correlation between AI enormous NVIDIA and Bitcoin from slack 2022 by the second quarter of 2024. Nevertheless, Bitcoin has currently lagged on the lend a hand of the AI rally, as considered in NVIDIA’s outperformance. However with every belongings now making lower highs, this skill that there might be the likelihood of a deeper correction.

Final week, NVIDIA’s shares dropped by about 8%, in spite of exceeding Q2 earnings expectations. In the same arrangement, Bitcoin’s designate fell by a same margin, even with mammoth inflows into scheme ETFs.

Be taught more: The assign To Trade Bitcoin Futures: A Comprehensive Files

Macroeconomic components, equivalent to US employment recordsdata and ability inflation defend a watch on measures, could well additionally impact Bitcoin. Federal Reserve Chair Jerome Powell has signaled that hobby rate cuts are most likely, boosting optimism among investors who mediate lower charges could well income Bitcoin.

Nevertheless, Matrixport cautioned that historic patterns point out a less straightforward result. In the course of the 2018/2019 rate-hiking cycle, Bitcoin struggled but rallied when the Fed paused charges. When charges contain been lastly cut, Bitcoin experienced a transient rally followed by a gradual decline, interrupted only by extra rate cuts.

This historic sample introduces uncertainty about Bitcoin’s response to the anticipated rate cut.

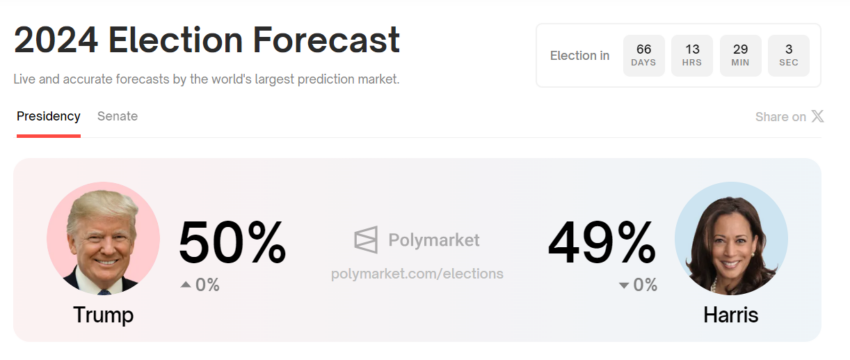

The upcoming US election adds to the uncertainty surrounding Bitcoin. While many within the crypto industry prefer a Donald Trump presidency, Vice President Kamala Harris has received foremost beef up, bolstering her campaign.

Be taught more: Bitcoin (BTC) Mark Prediction 2024/2025/2030

With every candidates expected to face off in debates imminently, this raises concerns about how the effects could well impact Bitcoin. A solid debate efficiency could well enhance the industry because of Trump’s pro-Bitcoin stance. Conversely, Harris’ victory could well introduce extra uncertainty, as she has no longer publicly clarified her assign on the main cryptocurrency.