Crypto markets saw a limited pickup after the US Federal Reserve’s widely expected price decrease on Wednesday, and an even bigger bounce is liable to be subsequent, bid analysts.

The central monetary institution has accomplished three consecutive hobby price cuts totaling 0.75% over a 3-month duration from September to December.

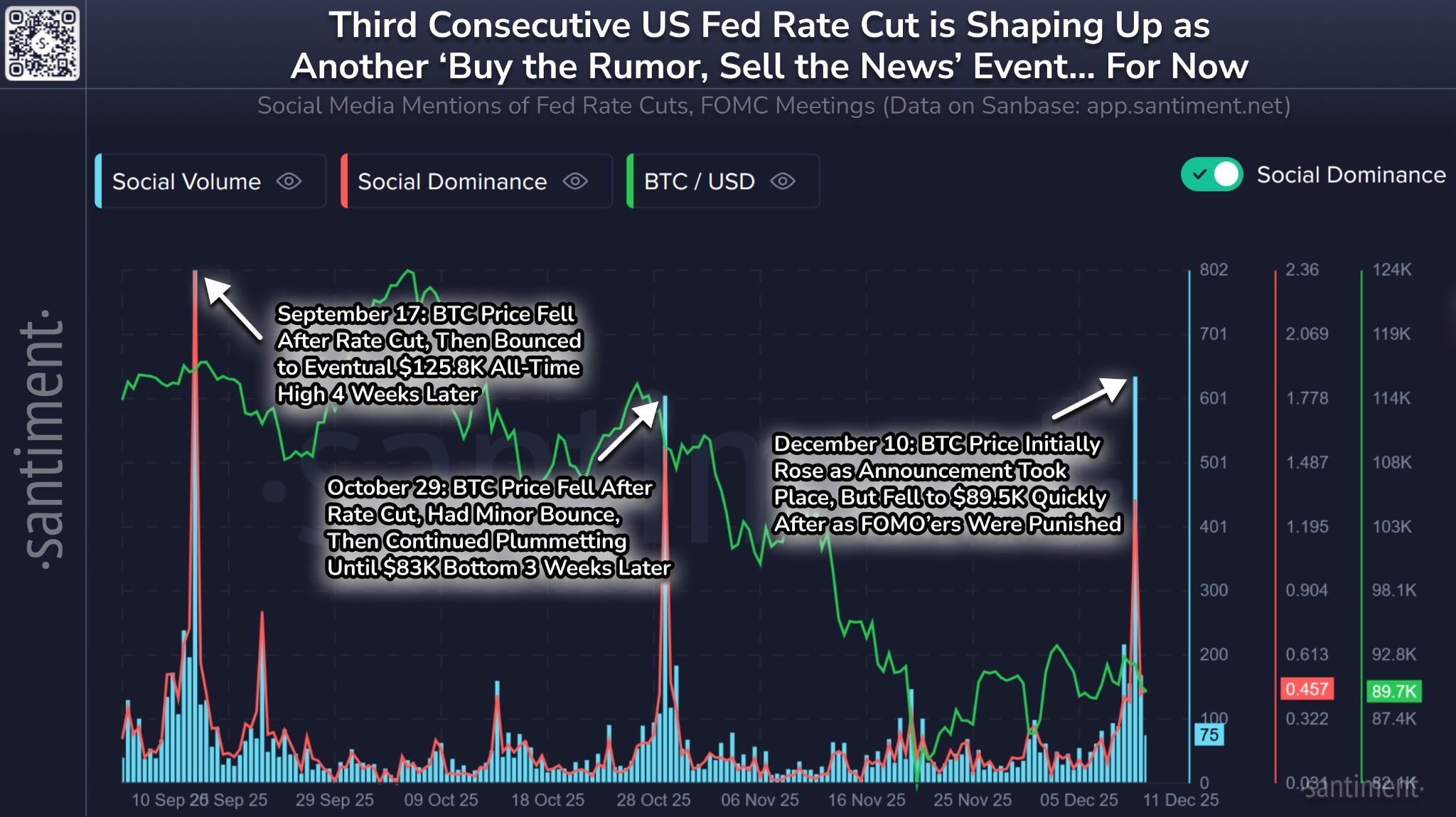

Despite being essentially bullish for crypto someday, every decrease prompted non everlasting sell-offs, following a traditional “aquire the rumor, sell the news” pattern, the onchain analytics company Santiment said on Thursday.

On the opposite hand, there would possibly be “in most cases a bounce after the dirt settles,” it added, which is able to present predictable trading alternatives.

“To this point, this most new price decrease has been no different. Gape for a limited level of FUD or retail sell-off to point to that the relaxed put up-decrease downswing has ended.”

Decrease charges and cheaper borrowing costs in most cases fabricate bigger chance skedaddle for food and capital flowing into speculative sources, much like crypto.

Fed price decrease widely expected

CoinEx chief analyst Jeff Ko suggested Cointelegraph that the Fed’s most new price decrease became as soon as “widely expected and pretty powerful priced in,” but its up to this point dot space exhibiting where Fed policymakers think the velocity is headed subsequent “leaned barely of hawkish.”

Linked: Conflicted Fed cuts charges but Bitcoin’s ‘fragile differ’ pins BTC beneath $100K

Extra importantly, Ko said, the $40 billion non everlasting Treasury purchases are a “technical maneuver for monetary machine liquidity to decrease non everlasting charges, no longer a huge-scale, stimulus-driven program.”

“Nevertheless the markets interpreted this as mildly bullish, with US stocks transferring increased and serving to Bitcoin stage a rebound alongside broader chance sentiment.”

Bitcoin markets are maturing

Director of Global Macro at Fidelity Investments, Jurrien Timmer, checked out the longer timeframe, noting on Thursday that Bitcoin (BTC) has underperformed this one year in contrast with stock markets. On the opposite hand, he said that markets were maturing in contrast with earlier cycles.

“It’s onerous to philosophize in staunch time whether or no longer a new [crypto] iciness is upon us, but taking a study the evolving wave structure of Bitcoin’s maturing network curve, we are able to think that the most up-to-date bull market appears pretty outdated skool.”

There became as soon as a limited uptick in crypto markets at some stage within the Friday morning trading session, with Bitcoin improving from its put up-decrease dip beneath $90,000 to spike to $93,500 on Coinbase.

On the opposite hand, resistance at this level proved to be too strong any other time, sending the asset back to $92,300, where it trades at the time of writing.

Journal: XRP’s ‘now or never’ moment, Kalshi faucets Solana: Hodler’s Digest