Over the last 24 hours, Bitcoin has surged by an impressive 6.2%, with a weekly assemble of 18.3% and a staggering 158% enlarge all over the last twelve months. However what’s riding this excellent rally, and the draw are market sentiments reacting to the info? Let’s dive in.

The recent spike in Bitcoin’s worth would perhaps also be attributed to a well-known enlarge in institutional hobby, following the approval of 11 Bitcoin alternate-traded funds (ETFs) in america earlier this year. This fashion has opened the floodgates for institutional traders, who are now flocking to the crypto market attempting for profitable alternatives.

Adding fuel to the fireplace is the highly anticipated Bitcoin halving event, scheduled for April this year. Historically, halvings relish triggered big bull runs, as the mining rewards are nick in half of, effectively decreasing the inflation rate of recent Bitcoin provide by 50%.

Very Bullish Bitcoin Indicators on Charts

A confluence of technical indicators capabilities to an especially bullish outlook for Bitcoin. The relative strength index (RSI) at the 2d stands at 86/100, suggesting that BTC is being extraordinarily overbought. Which formula traders story for merely about 86% of the market and a long way outweigh sellers.

The fashionable directional index (ADX) for Bitcoin, which measures the strength of a particular worth movement, is at the 2d at 39, indicating a sturdy upwards fashion. Generally, the ADX is view of as to be balanced when it hovers around 20.

Furthermore, the separation between the Bitcoin 10- and 55-day exponential moving averages (EMA10 and EMA55) is widening day-to-day, signaling that the cost is accelerating upwards as time progresses.

Grasping, Grasping Bitcoin Traders

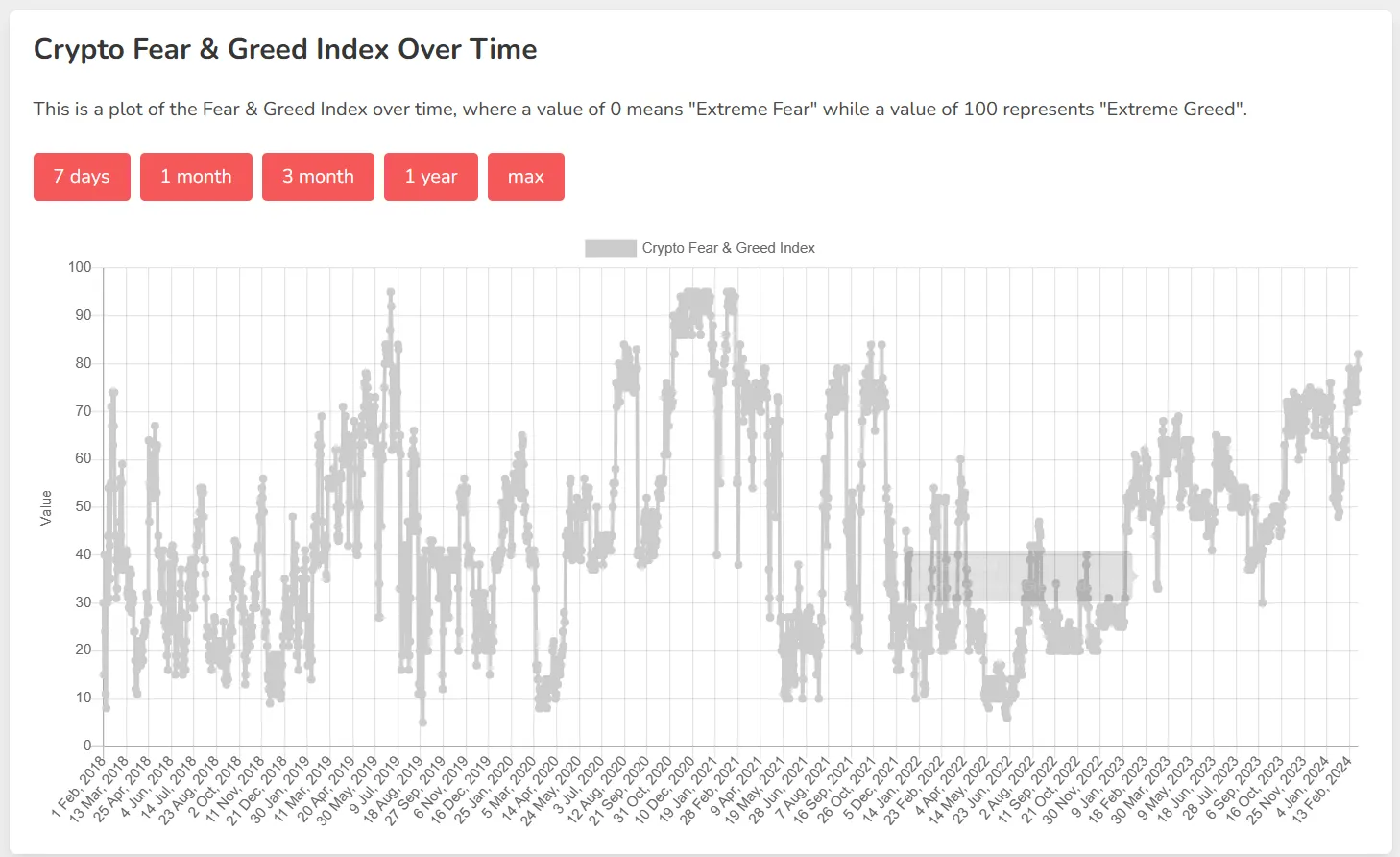

The Crypto Peril and Greed Index, a trademark that measures the total sentiment of the crypto market on a scale of 1 to 100, is at the 2d sitting at 82. Markets are in a section of “gruesome greed” for the necessary time since 2021, underscoring what the charts already record: a highly bullish sentiment among traders.

Interestingly, this marks the necessary time for the reason that inception of the Crypto Peril and Greed Index that the market sentiment has shown a consistent upward pattern. Rather than reacting volatilely to info and occasions, traders relish step by step gained self belief in an upward momentum since June 2022.

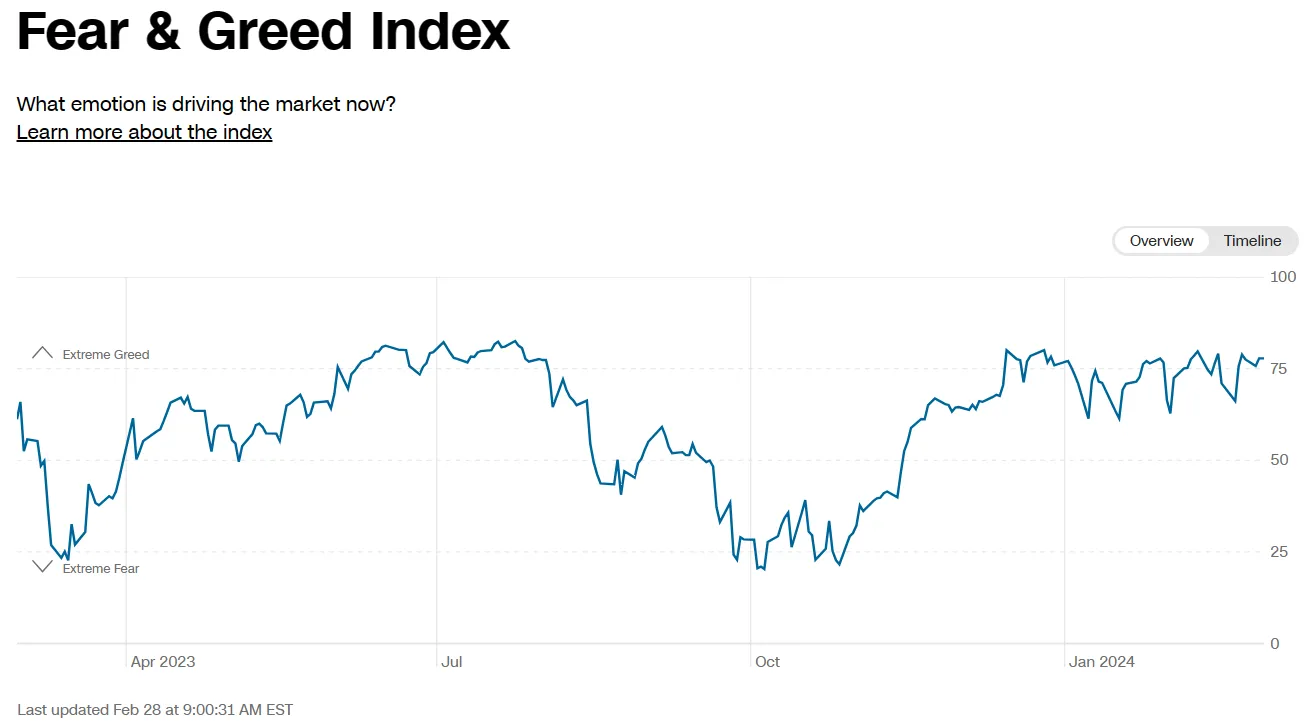

In distinction, the Peril and Greed Index for the S&P 500 has been lingering in “gruesome greed” territory since December 2023. It has been primarily driven by the hype surrounding AI stocks, which propelled the index’s recovery last year.

The total crypto market is mirroring Bitcoin’s bullish sentiment, with the total market capitalization rising by $1 billion within the last 24 hours, from $2.2 trillion to $2.3 trillion, with PEPE main the spherical at +41% in 24 hours and BitTensor (TAO) registering the worst performance at merely -3%.

Edited by Stacy Elliott.