Bitcoin’s present rebound off the $107,200 low has sparked renewed debate over whether the market has already region its local backside and is positioned to rally increased.. Just analyst Astronomer (@astronomer_zero) argues that the percentages are “90%+” that the low has been planted, citing both tag structure and his routine “FOMC reversal confluence” framework as confirmation.

Analyst Claims 90% Probability The Bitcoin Backside Is In

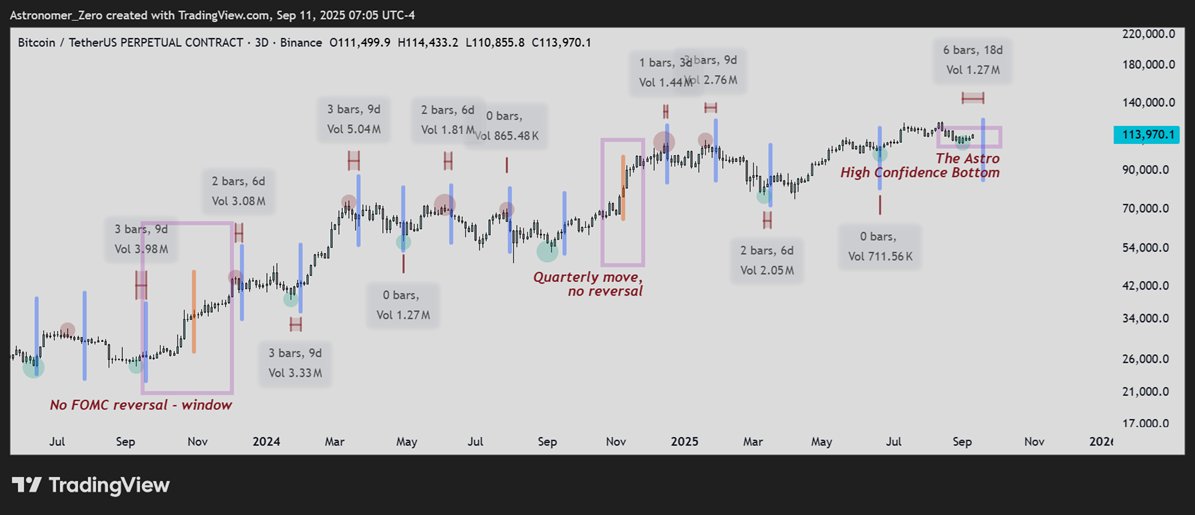

Astronomer, who publicly documented his quick-term bearish call from $123,000 all of the plot down to the $110,000–$111,000 zone, revealed that he flipped long because the plan became reached in boring August. “Alright, as if the confluences of my confidence within the backside being within the $110k space at the tip of August weren’t solid sufficient … there now is one other confluence lining up,” he wrote. Essentially basically based on him, the Federal Reserve’s policy meeting cycle has traditionally functioned as a turning level for Bitcoin trends.

He explained: “The FOMC meeting records reverses the continuing pattern at minimum 0 bars (on the date), or 6 bars at most earlier to the date, and it has executed that accurately 90%+ of the times. The few times it hasn’t, became because our quarterly long took over (which has extra energy).” In note, Astronomer argues, markets entrance-rush the event, as insiders and neatly-capitalized gamers region the put up-FOMC direction earlier to retail sentiment digests the tip consequence.

With the subsequent FOMC scheduled for September 18, he contends the downtrend from $123,000 to $110,000 already exhausted itself earlier to time desk. “Now with FOMC organising … the low is seemingly already planted, and the pattern reversed to up one more time,” he talked about.

The analyst contrasted his methodology with the broader crypto commentary ecosystem, the put many influencers continue to forecast additional downside and a “red September.” He known as such views “order nonsense” rooted in flooring-stage seasonality. “Whenever it does work, it vegetation its backside earlier to the right meeting to entrance rush the anticipation … insiders already personal region the put up FOMC tag direction, no topic the tip consequence,” he wrote, stressing that counting on generic “be cautious” warnings earlier to central monetary institution events misses the structural shift.

After his long entry at $110,000, Bitcoin has since climbed above $115,000, prompting Astronomer to snort September’s bearish thesis already invalid. “ September will conclude inexperienced. Yup, Septembears officially 6% within the nasty now. As September opened at 108,299, and value is now at 115,000. That puts September within the upper ancient quartile of how inexperienced it is for the time being,” he famed.

He additional pointed to the closing two years as evidence that September’s reputation as a seasonally broken-down month for Bitcoin has lost statistical edge. “A obvious month certainly doesn’t must quiet be inexperienced. ‘Seasonality’ is nice a cookie cutter version of correctly the usage of cycles. Sight at closing two years, September has also been inexperienced and mean to the bears,” he wrote.

For Astronomer, the conclusion is apparent: “When many confluences level within the same direction, it in general plot you’ve solved the rubik’s cube accurately and so can confidently mediate.” Mute, he tempered the conviction with effort management self-discipline, mentioning: “Pointless to screech, I’ll perchance well presumably constantly be nasty, even supposing it has been a protracted time we lost a alternate, by no plot lope all in. Rob a first rate measurement effort and sleep sound.”

With Bitcoin holding above $115,000 and the FOMC meeting days away, the market’s conclude to-term verdict on whether a sustainable backside has formed may perchance well presumably additionally reach sooner as antagonistic to later.