Bitcoin has felt the affect of the ongoing world tariff tensions, with shrimp to no upward momentum. The asset appears to luxuriate in paused its bull trudge, dampening investor expectations for a come-term recovery.

For the time being buying and selling good above $77,000, BTC has declined almost 30% from its all-time excessive, together with a 1.6% descend within the final 24 hours. Amid this, a fresh perception from CryptoQuant contributor Onchained suggests that Bitcoin is nearing a significant threshold that will resolve the asset’s next significant direction.

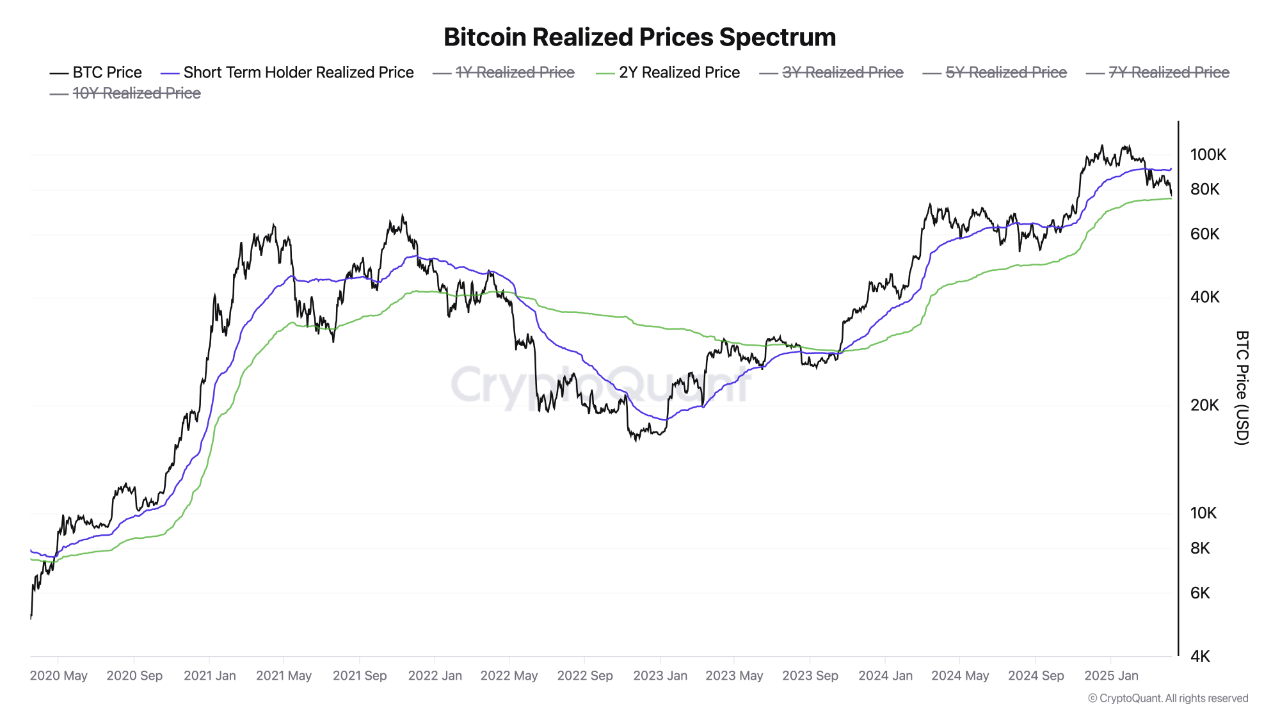

Bitcoin Realized Rate Ranges in Focal level

Onchained’s most trendy prognosis sides to the convergence of Bitcoin’s narrate tag with its 2-one year Realized Rate. This metric, derived from on-chain recordsdata, calculates the everyday acquisition tag of coins moved on the blockchain interior the past two years.

This tag band usually serves as a significant strengthen level, particularly in transition phases between endure and bull markets. Traditionally, Bitcoin affirming tag action above the 2-yr Realized Rate has signaled underlying strength among long-term holders.

Onchained notorious that BTC has stayed above this line since October 2023, a signal of sustained investor self assurance. If Bitcoin continues to aid this level, it will maybe maybe existing the establishment of a brand fresh tag floor, potentially surroundings the stage for renewed buying stress.

The prognosis provides that a bounce off this strengthen zone will seemingly be interpreted as an inflow of capital from merchants seeing this tag level as a strategic accumulation level. Nonetheless, a breakdown under the 2-yr Realized Rate would possibly maybe place off a deeper correction or a longer length of consolidation.

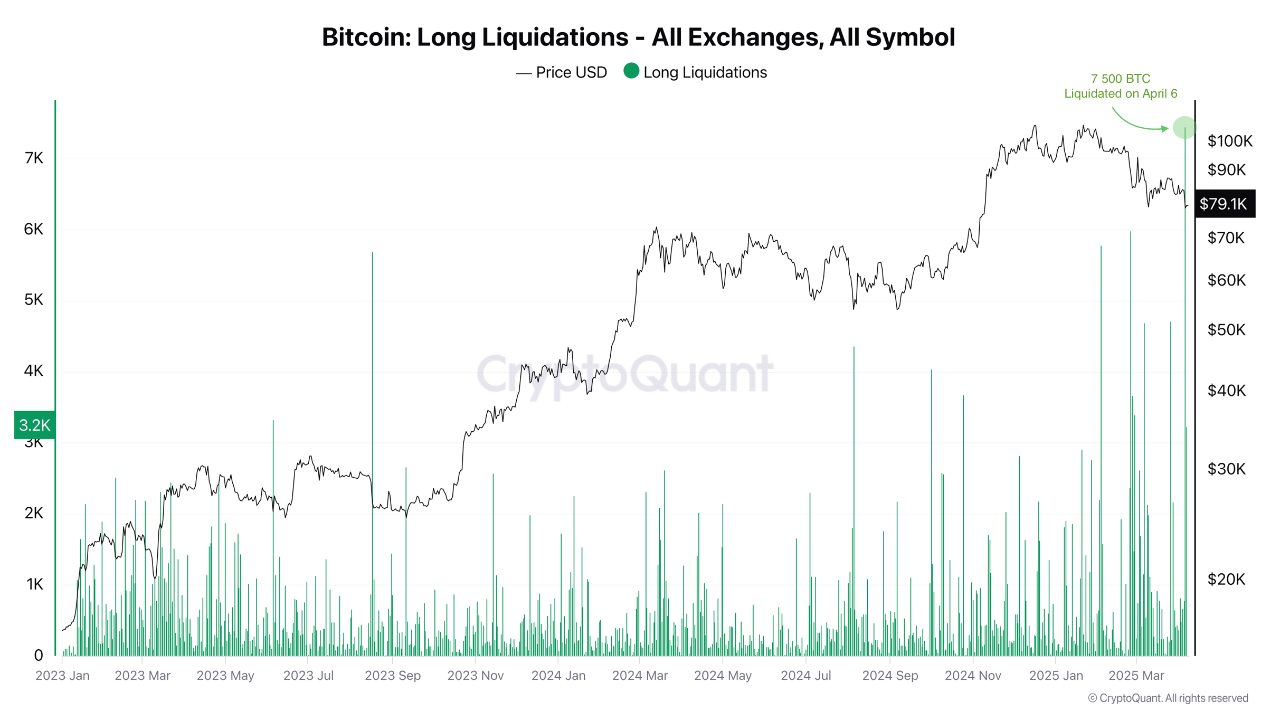

Lengthy Liquidations Lengthen Market Volatility

In a separate update, CryptoQuant analyst Darkfost highlighted a significant event that shook the derivatives market. On April 6, the greatest Bitcoin long liquidation event of the fresh bull cycle came about, wiping out roughly 7,500 BTC in long positions.

The liquidation marked the most effective day to day volume of compelled long region closures for the explanation that bull market began. Per Darkfost, this event used to be largely precipitated by rising volatility and uncertainty stemming from US financial policy considerations.

The supreme Bitcoin long liquidation event of this bull cycle

“On April 6, roughly 7,500 Bitcoin in long positions had been liquidated, marking the greatest single-day long wipeout of your complete bull trudge to this level.” – By @Darkfost_Coc

Be taught more ⤵️https://t.co/eqW2JE8TWD pic.twitter.com/IEthwRDRVz

— CryptoQuant.com (@cryptoquant_com) April 9, 2025

In issue, fears around fresh tariffs under President Trump’s administration luxuriate in added stress on world markets, together with crypto. The analyst emphasised that such liquidation occasions support as reminders of the dangers connected with excessive-leverage positions during unsure macroeconomic stipulations. Darkfost wrote:

Right here is a obvious reminder that we need to shield cautious during lessons of rising volatility luxuriate in this day. Right here is the time to care and aid your capital.

Featured image created with DALL-E, Chart from TradingView