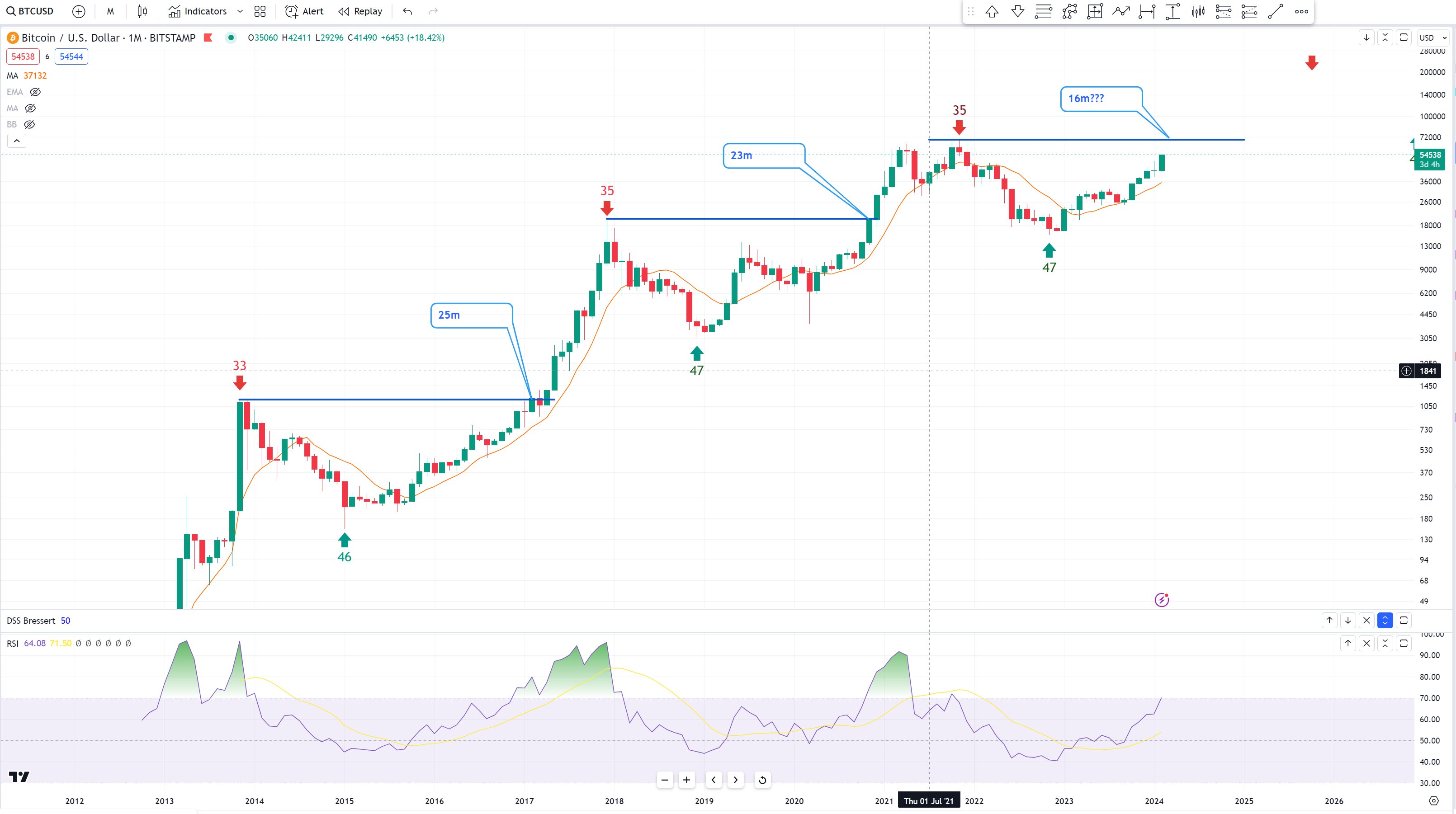

With the Bitcoin label rallying, one analyst has taken to X, highlighting the latest negate of bullish affairs. In a put up, the analyst thinks the realm’s most treasured coin is impending “accumulate away toddle,” with label circulate deviating from candlestick arrangements within the previous. Right here is regularly the case, especially when prices are impending all-time highs.

Will Bitcoin Rip Previous $70,000 In Coming Days?

The analyst notes that an on an ordinary basis BTC cycle would, at latest prices and eager on how the coin has been rallying within the previous few weeks, most regularly possess considered a pullback. The correction would then be adopted by an prolonged period of consolidation, usually stretching no longer no longer up to six months.

On the other hand, since there is a determined deviation, label circulate within the month-to-month chart, the analyst is convinced that Bitcoin is able to rob off. The resulting rally might maybe per chance maybe be at “accumulate away toddle,” the coin would without danger lengthen gains, easing previous all-time highs.

Bitcoin is firmly in an uptrend at popularity charges, occasions within the each day chart. Particularly, Bitcoin trades above $57,200 when writing, registering new 2024 highs. Correct thru the last day, the coin has broken above key resistance ranges, without danger breaking $fifty three,000 and later $55,000 in a aquire pattern continuation formation.

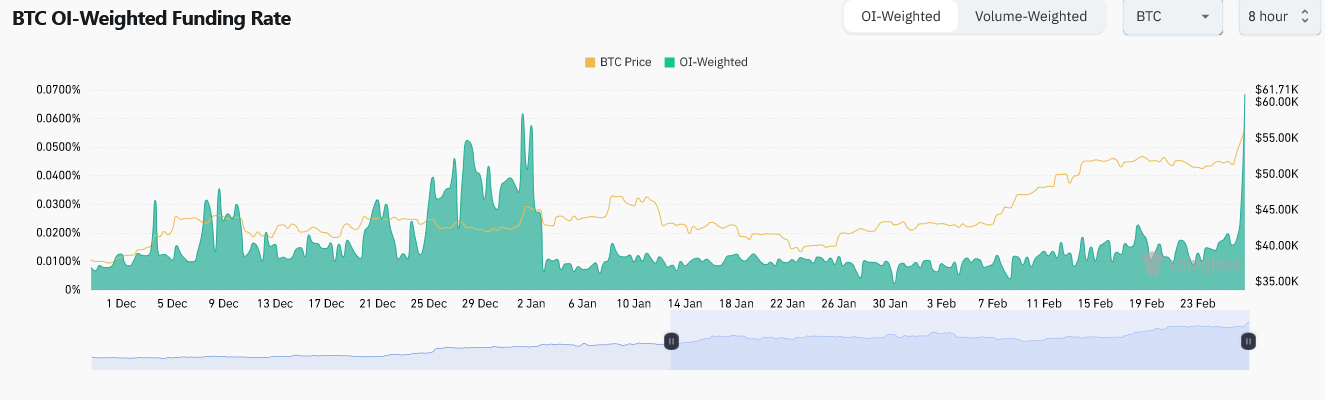

Rising Funding Charges And Open Hobby As Establishments Double Down

With hovering interest, replace info shows that there changed into a spike in annualized funding charges and originate interest all over more than one platforms, enabling the trading of Bitcoin perpetual futures. Records from Coinglass shows that the funding price in Binance is now at over 0.0686%. The identical has been seen with originate interest, which now stands at over $6.2 billion on Binance.

Changes in originate interest and funding charges are main indicators that would simply additionally be aged to gauge market sentiment. Frequently, rising originate interest and funding charges counsel growing bullish sentiment, especially among leverage traders. In this danger, the replacement of prices asserting the uptrend remains excessive.

Confidence among traders is exceptionally excessive. It’s fueled by latest institutional inclinations, macro elements, and the expectations sooner than the incoming halving tournament. For context, the ten current popularity Bitcoin replace-traded funds (ETFs) within the United States possess since obtained billions.

Observers now concern that at this straggle, and sooner than the Bitcoin halving tournament, there might maybe per chance maybe be a provide shock crisis. The risk is that after April, the series of coins released will seemingly be methodology no longer up to those being devoured by establishments. BTC prices will seemingly rally out of this, which is in a plan to be out of attain for traditional americans.