Welcome to the US Crypto News Morning Briefing—your needed rundown of the largest trends in crypto for the day forward.

Snatch a espresso as we stare Bitcoin’s (BTC) performance relative to the S&P 500, a benchmark for US stock market performance. With rising TradFi influence, Bitcoin’s dominance as an asset class is rising when in contrast to oldschool equities.

Crypto News of the Day: BTC/S&P 500 Ratio Data All-time Excessive

Matthew Sigel, head of digital sources research at VanEck, highlighted Bitcoin’s historical outperformance in opposition to the S&P 500.

Specifically, the Bitcoin/S&P 500 ratio hit an all-time excessive of $17.725 on Would possibly per chance well 8, reflecting the pioneer crypto’s rising dominance over oldschool equities.

“All-Time Excessive: Bitcoin/S&P 500 Ratio,” Sigel wrote.

This milestone aligns with broader market traits, in conjunction with Bitcoin’s current circulate to instant surpass Google on market cap metrics, as indicated in a current US Crypto News newsletter.

For Bitcoin, the surge comes amid rising institutional influence, and the resultant liquidity influx has led to analysts to rethink the BTC cycle blueprint.

“It feels like it’s time to throw out that Bitcoin cycle blueprint… It’s more valuable to level of interest on how valuable current liquidity is coming from institutions and ETFs,” CryptoQuant CEO Ki Younger Ju said.

With rising adoption and prevailing jitters within the oldschool markets, merchants gaze Bitcoin as a hedge in opposition to monetary and US Treasuryrisks.

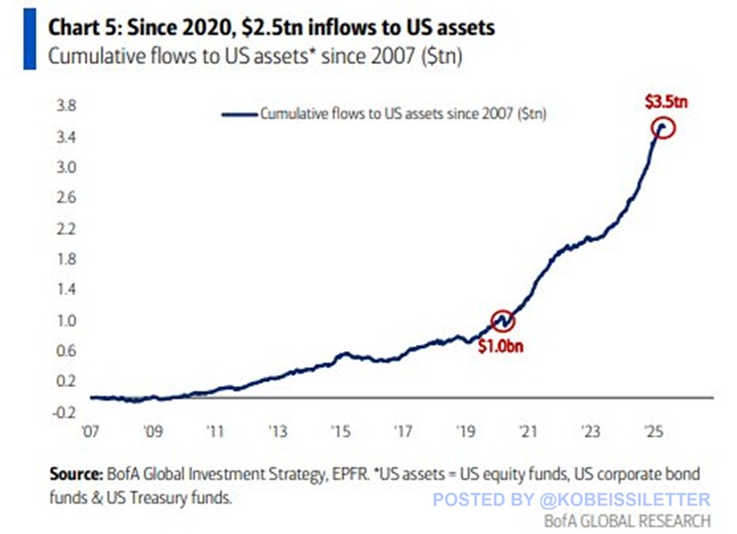

$3.5 Trillion Inflows to US Fairness, Company Bond, and Treasury Funds

Studies current $3.5 trillion in cumulative inflows to US equity, company bond, and Treasury funds since 2007. Notably, $2.5 trillion of that surge came about publish-2020.

The Kobeissi files notes a solid investor trudge for meals for US sources. Nonetheless, Bitcoin’s ratio spike suggests a parallel shift, with some merchants favoring decentralized sources amid global economic uncertainty, in conjunction with inflationary pressures and geopolitical tensions.

US equity funds, capturing $1.2 trillion of the inflows, noticed a $100 billion rating outflow all by means of the 2022 undergo market.

In step with Sigel, this indicates quick-term likelihood aversion that Bitcoin apparently sidestepped, as its long-term progress outpaced the Nasdaq over multiple timeframes.

“Bitcoin has outperformed the Nasdaq over 1 day, 1 week, 1 month, twelve months-to-date, 1 yr, 2 years, 3 years, 5 years, 10 years,” Sigel said.

Within the period in-between, rising US Treasury yields, hitting 4.641% in early January 2025, marked the most reasonable since Would possibly per chance well 2024. This dampened equity fund inflows, doubtlessly driving merchants in direction of Bitcoin as a hedge in opposition to oldschool market volatility.

Chart of the Day

At an all-time excessive, the BRR index/SPX ratio capability Bitcoin’s worth has grown seriously greater than the S&P 500. It indicates stronger investor self assurance and outperformance in crypto over stocks.

Byte-Sized Alpha

Here’s a abstract of more US crypto info to notice in the present day:

- Raoul Ideal friend predicts Bitcoin dominance has peaked, signaling the initiating up of the “Banana Zone”—a doubtless parabolic altcoin rally fragment.

- Strategy’s Bitcoin holdings bear won 50.1%, boosted by current purchases, in conjunction with 1,895 BTC for $180.3 million.

- Bitcoin surging previous $100,000 triggered the largest wipeout since 2021, with $970 million in liquidations.

- Pi Community ranks 6th amongst Finland’s top social apps. A predominant Pi ecosystem announcement is area for Would possibly per chance well 14, and users are eagerly looking out forward to a that you just would per chance perchance perchance also factor in Binance listing.

- XRP surged 8% following Ripple’s settlement with the SEC, nonetheless rising profits for immediate-term holders can also fair restrict its ability to breach the $2.38 resistance.

- MARA Holdings noticed a 30% earnings progress yr-over-yr,CleanSpark’s Q1 2025 earnings surged 62.5%, and Hut 8’s earnings fell by 58.1%.

- Cardano’s tag surged 10%, and on-chain files showed that 74.14% of ADA’s present is in profit, signaling elevated accumulation.

- Sei Labs proposes SIP-3 to transition the Sei network to an EVM-supreme mannequin, looking out down CosmWasm and native Cosmos enhance.

Crypto Equities Pre-Market Overview

| Company | At the End of Would possibly per chance well 8 | Pre-Market Overview |

| Strategy (MSTR) | $414.38 | $423.18 (+2.12%) |

| Coinbase World (COIN) | $206.50 | $203.30 (-1.55%) |

| Galaxy Digital Holdings (GLXY.TO) | $27.67 | $28.90 (+4.forty five%) |

| MARA Holdings (MARA) | $14.29 | $14.01 (-1.95%) |

| Come up Platforms (RIOT) | $8.44 | $7.forty eight (-3.73%) |

| Core Scientific (CORZ) | $9.forty five | $9.51 (+0.63%) |