Bitcoin is trending decrease when writing, cooling off after the encouraging leg up on August 23. Though the uptrend stays, and the coin is now not far away from $63,000, there’s rarely any discounting the doable for sellers pressing on. The alignment with the dip of early August could presumably also situation off one other wave of liquidation, inflicting panic.

Bitcoin Shaky, The First Two Ranges To Gaze

Technically, Bitcoin is within a bullish breakout formation from the bull flag established after the expansion on August 8.

Furthermore, from a volume diagnosis perspective, bulls stand an opportunity since prices are tranquil within the bull bar of August 23. As lengthy as shopping and selling volume stays light as prices trickle decrease, traders could presumably also soar serve and pressure prices better above $66,000.

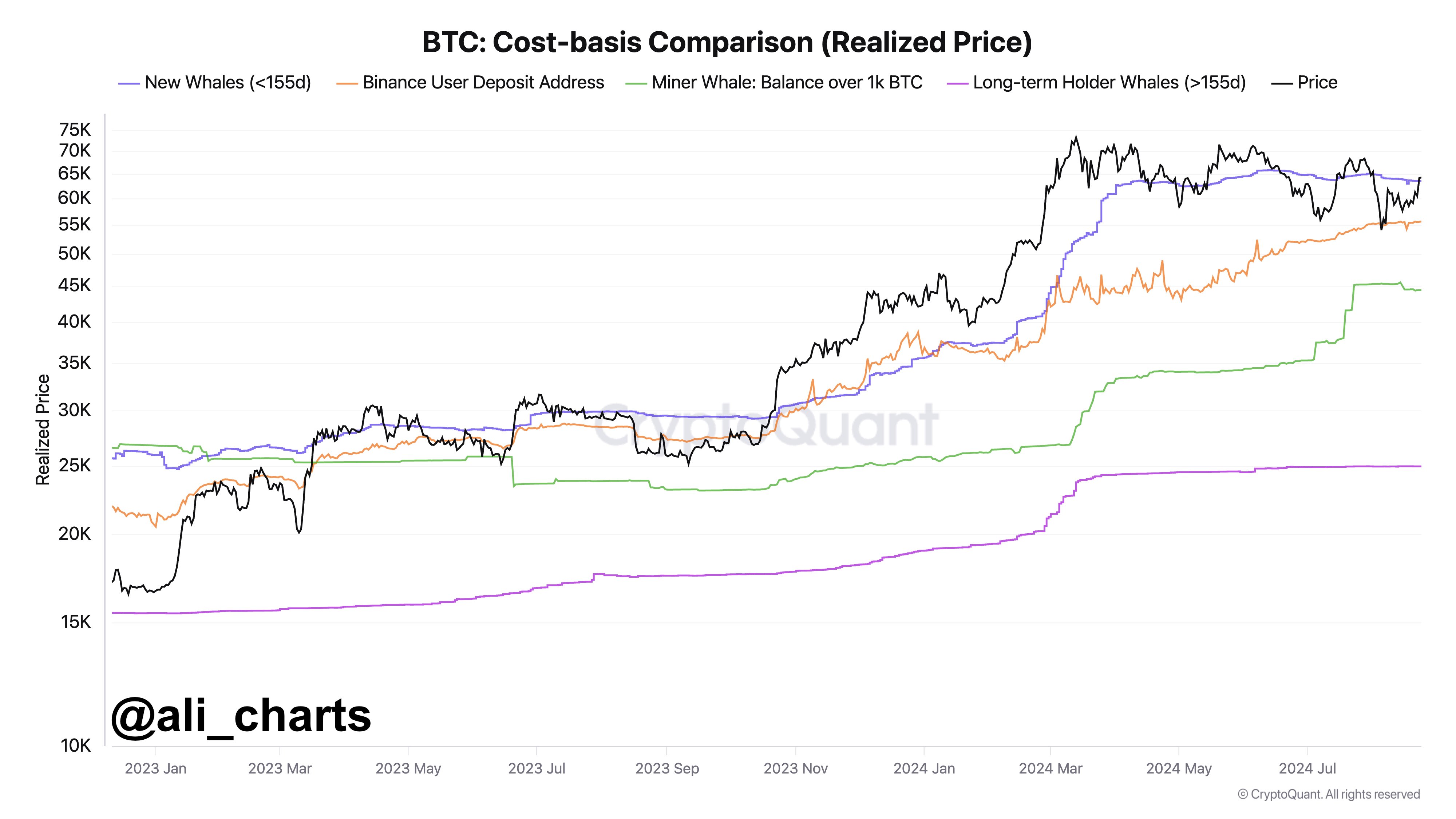

Even so, assuming Bitcoin bears respect the upper hand, one analyst on X thinks this could occasionally additionally be necessary for traders to intently display screen how prices will react on the following four reaction traces. From the Bitcoin label-foundation comparison by means of CryptoQuant, the principle give a snatch to stage, now resistance following the continuing dump, is $63,450.

At this label point, the analyst stated right here’s the frequent label at which contemporary whales buy BTC. It stays to be viewed whether prices will get better and print above $64,000 within the upcoming days.

On the different hand, the fact that whales are within the image is a rep optimistic. Customarily, whales, unlike outlets, are susceptible to be HODLers and received’t be shaken off on every occasion prices fluctuate.

If bears are unyielding and prices crash below $60,000, the analyst persisted traders ought to see how prices react at $55,540. From the vendor’s diagnosis, Binance users respect placed their give a snatch to at $55,540. Subsequently, prices shedding below this stage could presumably also with out sing situation off panic promoting as traders on this substitute dump creep for security.

Miners And Long-Time-frame Holders: The Final Partitions

A stage deeper, a key give a snatch to stage will most seemingly be $44,400. This zone is where most miners are deemed a hit. As lengthy as prices substitute above this line, most miners, most of whom are whales, can HODL, waiting for label good points. In early August, Bitcoin fell arduous however didn’t breach this zone, highlighting its significance concerning BTC label motion.

Below this, $25,000 is one other accumulation stage that traders will see out for if there’s a frequent crumple. The $25,000 is the frequent label at which lengthy-time frame holders (LTHs) offered. LTHs are these that offered BTC over 155 days ago.

This cohort largely comprises whales and network believers. Technically, a crash below $50,000 and August 2024 lows could be the inspiration for one other leg down to $40,000 and worse.

Whereas bears could presumably snatch over, there are additionally supportive factors that proceed to spur bulls on. One in every of the world’s biggest asset managers, BlackRock, now not too lengthy ago added BTC to its Strategic World Bond Fund as a hedge in opposition to outdated resources. Its set up Bitcoin ETF, IBIT, already holds billions of BTC on behalf of its institutional consumers.