In latest weeks, important has been said about the wealth erased from a range of cryptocurrencies’ valuation. As an illustration, in the seven days main up to December 24 – and no matter the rally on the day – Bitcoin’s (BTC) valuation collapsed by nearly $200 billion.

Light, for the final frustration rising from the apparent cancellation of the ‘Santa Claus’ rally, 2024 stays an exceptionally obtain year across the board, with the a range of coins and tokens being overwhelming winners in the final 365 days.

Bitcoin up more than $1 trillion in 2024

Bitcoin itself, no matter erasing roughly $200 billion in the final ten or so days, stays more than $1 trillion more precious as an asset at press time on December 27 than it modified into once on January 1.

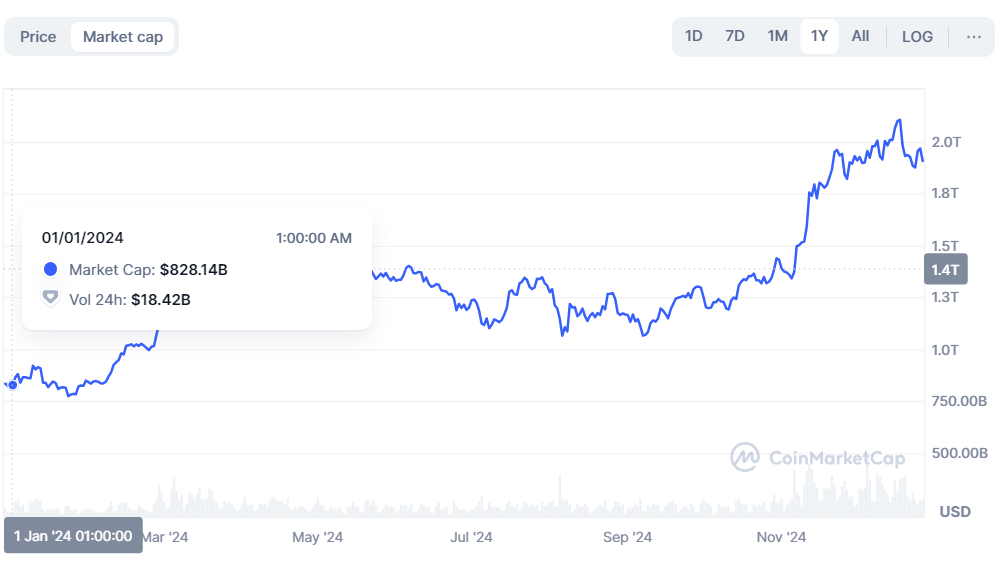

Namely, files retrieved by Finbold from CoinMarketCap shows that originally of the now-outgoing year, BTC’s market cap stood at $828 billion, whereas at press time, it is as excessive as $1.91 trillion.

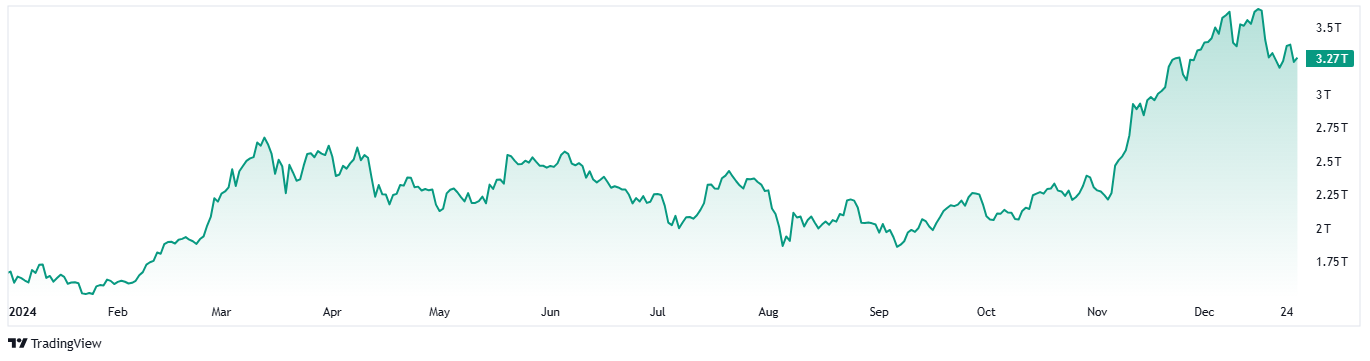

The build is highly identical for digital property as a complete. TradingView files shows the final cryptocurrency valuation on January 1 as $1.67 trillion and shows that, on December 27, it is at $3.27 trillion – a $1.6 trillion distinction.

Light, the marginally much less encouraging side of the chart is that it simultaneously methodology that Bitcoin’s dominance amongst coins and tokens stays valuable, as BTC accounts for roughly two-thirds of the growth.

On the flip side, this reality would perhaps perhaps bolster the ‘alt season’ tale for 2025 as it would perhaps perhaps designate that diverse cryptocurrencies are critically undervalued.

Would perhaps additionally 2025 be as obtain for cryptocurrencies as 2024?

At final, it is value declaring that for the successes of 2024 – and stagnation in the year’s final month – predictions for the contemporary year dwell exceedingly bullish.

Though Bitcoin has again taken heart stage with 12-month designate targets running as excessive as $800,000, albeit with a rising consensus that the next transfer for BTC would perhaps very nicely be a tumble toward $70,000 or even $60,000, it is removed from the finest digital asset merchants are bullish about.

XRP, as an instance, is considered as boating a particularly immense development security as it appears to be like poised to solely determined the regulatory roadblocks with some on-chain analysts – with Ali Martinez on X being, presumably, potentially the most excellent – seeing a doable rally to as excessive as $Forty eight: 2,100% above the click time costs at $2.18.