As of on the present time, Bitcoin slipped below $90,000, marking a 1.8% decrease in the previous 24 hours. Essentially based on CryptoQuant analyst Crazzyblockk, one key element contributing to this downward circulate appears to be like to be increased selling force from natty Bitcoin holders.

Whales and Graceful Holders Drive Promoting Stress on Binance

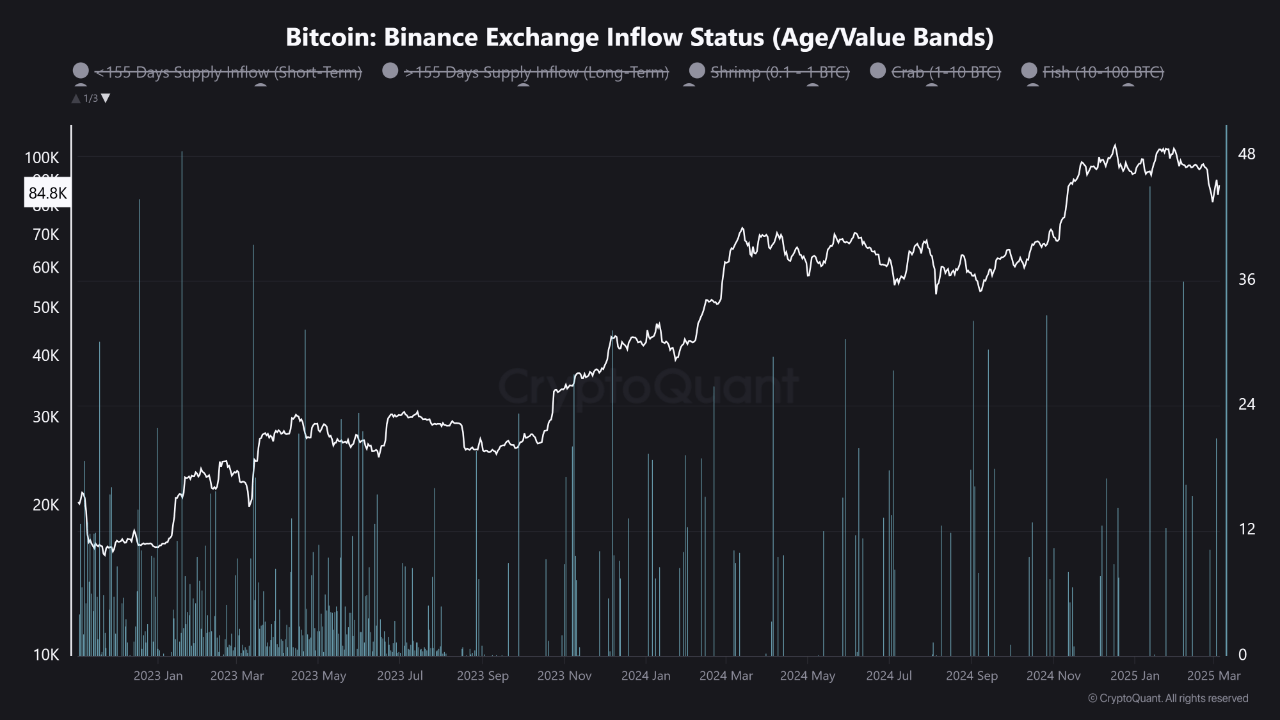

Crazzyblockk in his most up-to-date insight highlights how whales and diversified natty traders on Binance are actively offloading BTC as costs rise. This model means that experienced traders are taking benefit of market optimism to exit their positions, potentially limiting Bitcoin’s momentary upside capacity.

Whale to Binance Jog alongside with the trot Hits 3-Month Excessive at $7.3B Over Closing 30 Days

“This frequently occurs alongside heavy changes in ticket and reveals that natty holders settle Binance as their replace. Watching whale deposits is excessive, as their strikes can force the market.” – By @JA_Maartun pic.twitter.com/psD3zuDXf3

— CryptoQuant.com (@cryptoquant_com) March 6, 2025

The model additionally comes at a time when whale to Binance poke sees a consistent enhance. Crazzyblockk’s diagnosis of on-chain records from Binance in particular indicates that natty Bitcoin holders—categorized as fish, sharks, and whales—are selling into market rallies.

The records finds that the upper the holder, the more strategically they distribute their Bitcoin holdings. These entities account for an increasing part of day-to-day sell-aspect notify on Binance, suggesting that they are actively shaping Bitcoin’s ticket movements.

As Bitcoin’s ticket trends upward, whale notify on Binance has intensified, with more BTC flowing into the replace. The document highlights that whereas retail traders—frequently known as shrimps—hang remained fairly sluggish, whales and sharks are capitalizing on rising costs to rob profits.

This consistent distribution from excessive-fee holders has created sustained downward force, combating Bitcoin from making a parabolic pass increased.

Bitcoin Market Outlook: Can Accumulation Offset Whale Promoting?

With natty holders persevering with to offload BTC, the possibility stays that any longer upside could additionally trigger even more selling force, reinforcing resistance levels.

This dynamic way that Bitcoin’s ticket circulate could additionally remain constrained unless unusual accumulation from long-duration of time traders or institutional investors offsets the selling model.

Crazzyblockk emphasizes that tracking Binance’s whale notify is necessary for notion market direction. Since these natty holders are no longer simply members however additionally ticket movers, their actions can present insight into momentary market trends.

If whale selling slows and unusual accumulation picks up, Bitcoin could additionally obtain support and salvage momentum. Alternatively, if the original model continues, additional shrink back force stays a possibility.

Featured image created with DALL-E, Chart from TradingView