Binance observed an uptick in exercise within the past month, with the finest enhance coming from the futures market. The particular bullish pattern expanded question for active procuring and selling with leverage, to respect the most efficient of the market’s direction.

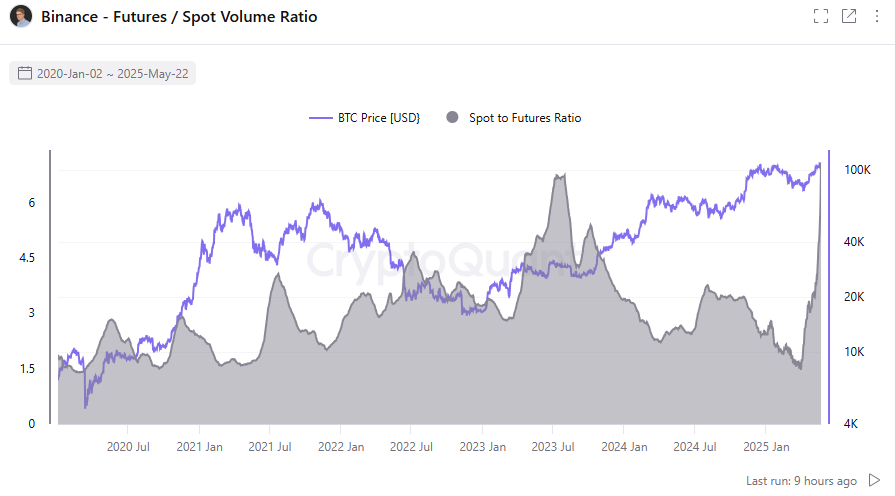

Binance is once extra predominantly a futures market, increasing the ratio of futures to station procuring and selling. The dominance of futures procuring and selling is advance a 1.5-year high, reflecting the increased commence hobby for BTC and various active sources. The ratio increased vertically within the past month, reflecting the shift in sentiment and threat-taking.

Binance carries $12.8B of the total BTC commence hobby, final the most active market with a cramped trace top class on the futures markets.

Futures volumes concentrated on Binance in 2025 as the undisputed leader. Alternatively, OKX futures markets confirmed a affirm pattern within the year so a long way. In Might per chance per chance per chance honest, Binance futures markets carried a entire of $1.25T in procuring and selling volumes, no longer off target to surpass the ranges from April. Loads of the crypto futures volumes are also concentrated on Bybit and Bitget.

Futures procuring and selling facets to speculative pattern

Rising futures procuring and selling suggests the crypto market is support in threat-on mode. Leveraged futures procuring and selling provides the finest non everlasting return, in particular all the blueprint in which via instances of generally particular sentiment.

On Binance, futures traders are 4.9 instances extra active in contrast to station traders. Whereas accumulation continues for BTC and ETH, in particular by institutions and whale wallets, non everlasting gains are smooth actually appropriate for altcoins or sizzling sources.

The affirm in futures procuring and selling translated into a larger Awe and Greed Index. Previously week, the index moved up from 70 facets to 78 facets, crossing over into vulgar greed territory. Even the dread of liquidations does no longer quit traders from having a bet on the BTC reversal of direction.

For the time being, many of the bets on BTC are within the differ of $110,000 to $112,000, the two trace ranges with the finest liquidity in futures positions.

Previously day, rapid positions on BTC also expanded to over 53% on most indispensable exchanges, against 46% for long positions. The dangerous vendor habits would possibly per chance per chance honest translate into one other rapid squeeze. Long traders are exhibiting bullish sentiment, however remain cautious against liquidations.

Stablecoins disappear out of station exchanges

The indispensable supply of increased futures and derivative exercise is the provision of stablecoins. Binance is the indispensable point of curiosity for USDT inflows, smooth carrying over $24B in accessible tokens. Binance increased its influence, currently keeping over 22% of all replace reserves.

Dispute exchanges barely lift a reserve of $90M in ERC-20 USDT stablecoins. No matter the all-time low of BTC and ETH reserves, station shopping for from commence markets remains great slower. Predict from whales, ETFs and company traders also depends on OTC desks and private deals.

The various supply of futures and derivative exercise comes from the realm market exercise on Binance. The replace has blocked most of Europe from procuring and selling derivatives since 2022. Kraken has tried to derive that niche, offering fully regulated crypto derivatives for the European market.