Binance, the sphere’s ideal cryptocurrency replace, announced the proof-of-reserve system to fetch the lowering have confidence in Bitcoin exchanges after the surprising economic extinguish of FTX.

In this context, Binance, which publishes reserve reviews at traditional intervals, has printed the twenty third Document (snapshot date October 1) of its reserves.

As opposed to Bitcoin (BTC), the document entails USDT, Ethereum (ETH), BNB, Solana (SOL), FDUSD, XRP, USDC, TUSD, Dogecoin (DOGE), Polygon (MATIC), Polkadot (DOT), Chainlink (LINK), SHIB, Arbitrum (ARB), Litecoin (LTC), Optimisim (OP), Chilliz (CHZ), UNI, Aptos (APT), GRT, SSV, CHR, ENJ, 1INCH, CRV, WRX, MASK, HFT, BUSD and CVP and Pepecoin (PEPE) used to be featured.

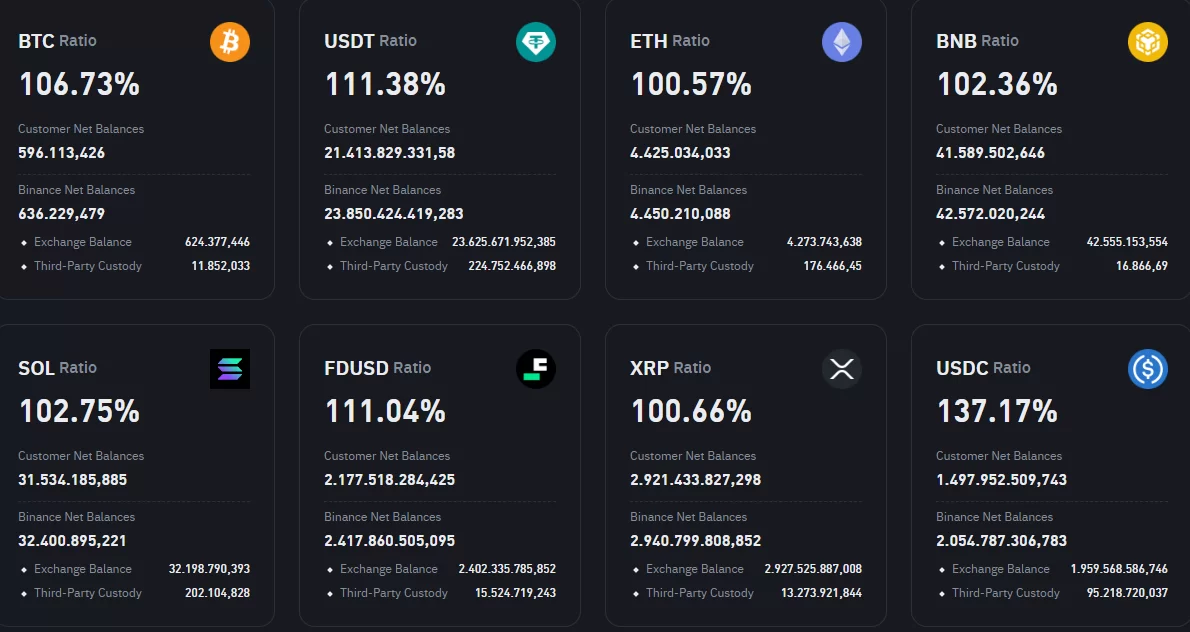

Accordingly, customers’ Bitcoin resources decreased by 1.58% when put next to the old document to 596 thousand BTC, whereas USDT resources decreased by 3.16% to 21.4 billion.

It used to be additionally considered that customers’ BNB resources increased by 2.17%, reaching 41.58 million.

Lastly, when taking a gape at customers’ Ethereum resources, it used to be considered that it decreased by 1.37% to 4.42 million.

Binance’s latest proof of reserves presentations that no matter the dwindling resources, BTC, USDT, and ETH reserves dwell overcollateralized by 106.73%, 111.38%, and 100.57%, respectively.

*This just isn’t funding advice.