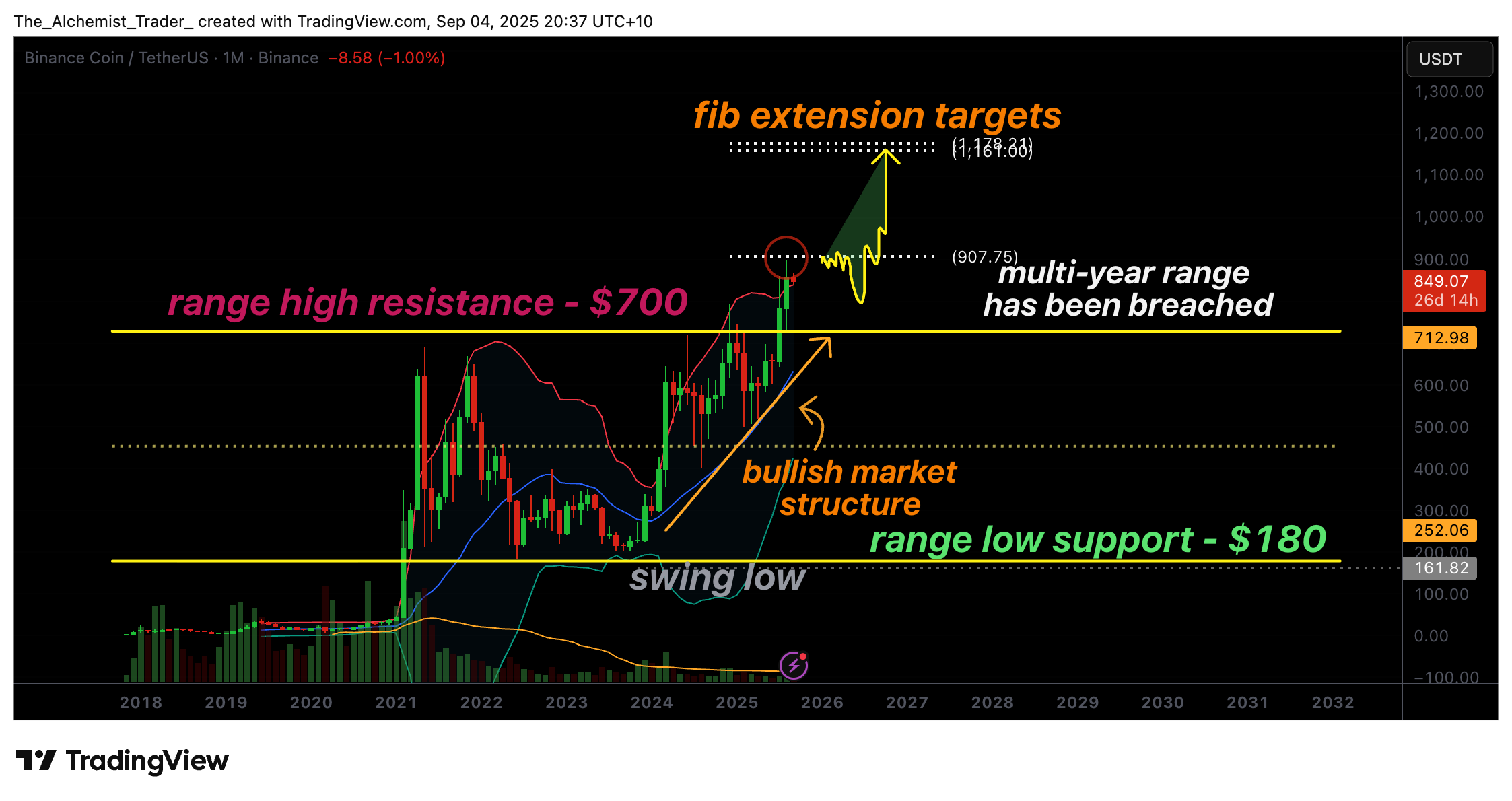

Binance value has surged above the $700 multi-300 and sixty five days differ excessive, confirming a bullish breakout. With sturdy market structure intact, technical targets now lengthen in the direction of $1,000 and doubtlessly $1,450.

- BNB breaks out above the $700 multi-300 and sixty five days resistance differ.

- Market structure stays bullish with increased highs and increased lows intact.

- Fibonacci extensions project upside targets of $1,000 and $1,450.

Binance (BNB) is procuring and selling in firmly bullish territory after breaking thru the multi-300 and sixty five days resistance at $700. This breakout highlights sturdy market momentum that has been constructing since aid at $180 modified into once established, marking a multi-300 and sixty five days differ bottom. Binance is committing essential resources to accomplish bigger in Mexico’s monetary sector, further strengthening prolonged-length of time sentiment round BNB. With Fibonacci extensions pointing in the direction of increased phases, there are indicators for continuation.

Binance value key technical aspects

- Differ Breakout: BNB has breached the $700 multi-300 and sixty five days resistance on a closing basis.

- Market Constructing: Consecutive increased highs and increased lows remain intact since the $180 differ low.

- Fibonacci Targets: $1,000 acts as the speedy resistance, with $1,450 as the next bullish extension.

The decisive breakout above $700 represents a essential milestone for BNB. This level acted as resistance inside a multi-300 and sixty five days differ, containing value for a protracted length. A confirmed shut above it indicates acceptance at increased phases and signals that the consolidation portion can have confidence transitioned valid into a trending market.

BNB’s bullish market structure has been intact since it bottomed at $180, the put value established a definite increased low sooner than starting its sustained rally. Since then, the chart has continuously printed consecutive increased highs and increased lows, a defining characteristic of bullish continuation. This structure no longer most attention-grabbing validates the energy of the breakout but also increases self belief within the likelihood of further upside.

The Fibonacci extension phases add one other layer of technical confluence. The $1,000 location has already been quickly tested, acting as each and each a psychological and technical milestone. If BNB can reclaim this resistance and shut above it, the next measured switch aspects to the $1,450 extension level. This projection suggests that whereas non permanent consolidations could well maybe happen, the broader trajectory stays firmly skewed in the direction of the upside.

Volume dynamics also aid this breakout. While the initial switch above $700 passed off with a surge in task, the market is now consolidating, expecting renewed influxes of quiz. Sustained bullish quantity shall be required to force continuation, particularly as value approaches psychological phases the put sellers are inclined to emerge.

What to await within the upcoming value motion

As prolonged as BNB stays above $700, the bullish outlook stays proper. A reclaim and breakout above $1,000 could well maybe trigger acceleration in the direction of $1,450, persevering with the multi-300 and sixty five days uptrend. Failure to withhold $700 would weaken the bullish thesis.