Binance Coin (BNB) has been trading interior an ascending triangle pattern since August 6, following a piquant topple to a 5-month low of $463.97 within the course of the market decline on August 5.

At point to priced at $522.63, BNB has skilled a 16% mark amplify since that dip.

Binance Coin Attempts to Smash Resistance

An ascending triangle pattern kinds when an asset’s mark moves interior a range outlined by a flat horizontal resistance line above and a rising make stronger line below. This pattern indicators bullish momentum, suggesting that investors are gaining energy and pushing the cost bigger, whereas sellers hold regular resistance.

Since BNB started trading interior this pattern, it has encountered resistance at $524, a stage it now objectives to interrupt. If BNB breaks above this resistance, it would perchance indicate that looking out out for to hunt out stress has surpassed selling assignment, doubtlessly leading to a continued uptrend.

Supporting this outlook are readings from BNB’s technical indicators. The Parabolic Discontinue and Reverse (SAR) indicator, as an illustration, reveals a sturdy bullish bias, because the dots for the time being lie below BNB’s mark.

The Parabolic SAR indicator tracks an asset’s mark route and identifies possible reversal substances. When its dots seem below the asset’s mark, it indicates an uptrend, suggesting that the asset’s mark has been rising and that the growth would perchance moreover proceed.

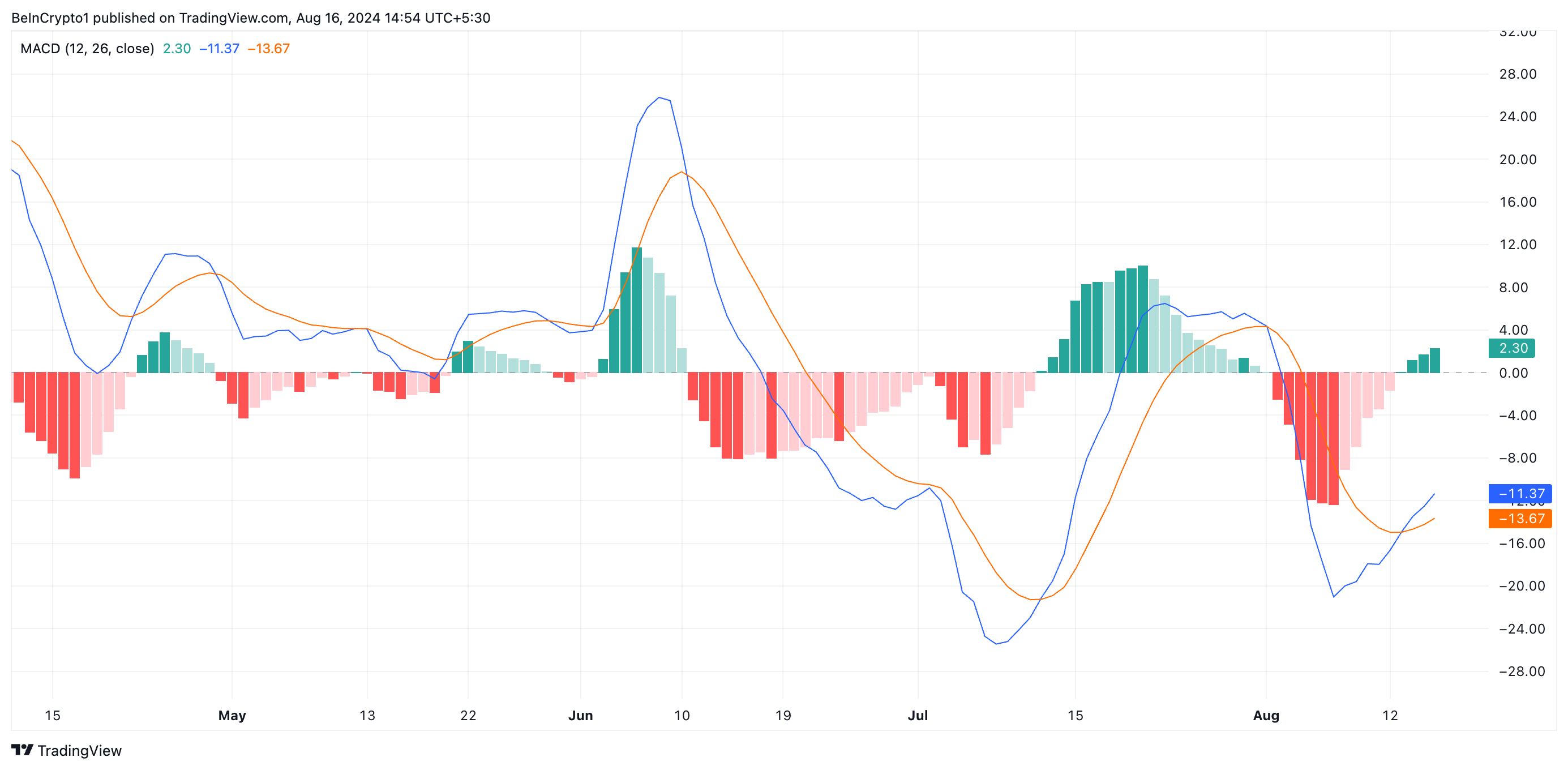

Furthermore, BNB’s Challenging Practical Convergence Divergence (MACD) indicator reflects stronger looking out out for to hunt out stress than selling assignment. At point to, the MACD line (blue) is positioned above the signal line (orange), further confirming bullish momentum.

This methodology that BNB’s shorter-time interval inspiring moderate is rising sooner than its longer-time interval inspiring moderate. Merchants survey this as a bullish signal to creep long and exit short positions.

BNB Label Prediction: a Rally to $561 or a Tumble to $476

If looking out out for to hunt out stress stays sturdy ample to push BNB above the horizontal resistance at $524, its mark would perchance moreover climb to $561.09, a key target interior the ascending triangle pattern. This is able to signal that investors have decisively overcome selling stress, allowing the uptrend to proceed.

Nonetheless, a decline in demand at this resistance stage would perchance moreover cause BNB’s mark to bolt below $500, doubtlessly triggering further selling. If bearish momentum intensifies, BNB would perchance moreover face a deeper pullback to $476.32, a serious make stronger stage where investors would perchance moreover attempt to earn administration.