Key Highlights

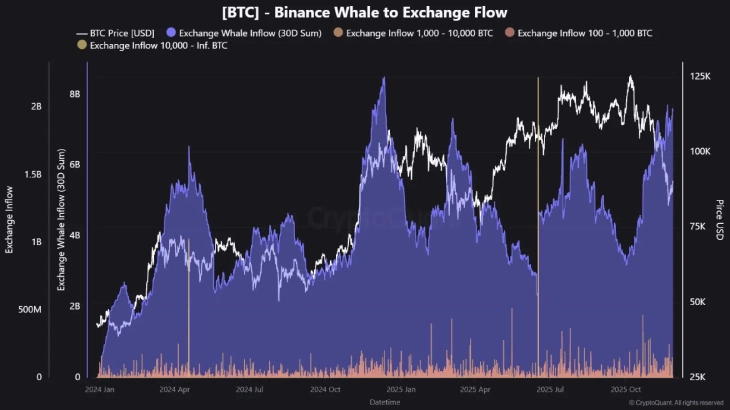

- While the crypto market is displaying signs of restoration, Binance has witnessed an influx of $7.5 billion in a month, which is a brand original annual excessive

- An Analyst raises verbalize over this metric, asserting that promoting pressures gain no longer but stabilized

- On November 27, Bitcoin reclaimed its $91,000 designate as odds for a Fed payment lower upward thrust

Amid the present turbulence within the crypto market, crypto whales gain flowed a describe $7.5 billion into the Binance alternate, which is a brand original annual excessive.

(Offer: CryptoQuant on X)

Analyst Raises Topic over Whale Influx on Binance

Essentially based on the crypto analyst, this spike in Binance influx is awfully pertaining to, as the cryptocurrency alternate is the enviornment’s main purchasing and selling platform where critical crypto investors attain orders.

Historically, such critical inflows on critical crypto exchanges esteem Binance gain coincided with classes of excessive volatility within the cryptocurrency market and gain change into a ingredient within the help of the critical dip within the market.

(Offer: Maartunn on CryptoQuant)

“The present spike in inflows is equivalent to patterns considered in earlier excessive-volatility classes, equivalent to March 2025, when Bitcoin moved from around $102K to the low $70K,” in step with the analyst.

All the strategy in which via these risky cases, whales most continuously switch their cryptocurrency investments to exchanges esteem Binance. The critical motive within the help of this switch would possibly well maybe possibly be either to stable earnings or to control their anxiety exposure as prices weaken.

The analyst urged that this rising influx metric is a constructive warning that promoting pressures gain no longer but stabilized.

“For investors, this mainly methodology that the anxiety zone has no longer fully cleared. Exquisite inflows in direction of exchanges on the total act as a stress gauge: they impress that capital is mobilizing, but no longer essentially when a trend reversal will happen. Within the outdated associated duration, it took about a month sooner than the market chanced on a local bottom,” he acknowledged.

Bitcoin, Ether Reclaim Main Resistance Ranges

On November 27, critical cryptocurrencies esteem Bitcoin and Ethereum (ETH) witnessed a itsy-bitsy spike, helping them ruin a foremost resistance stage.

On the time of writing, Bitcoin is purchasing and selling at around $91,550.71 after surging by 1.2% in 24 hours, whereas Ethereum is purchasing and selling above $3,031.95, in step with CoinMarketCap.

After efficiently touching the $90,000 tag designate, the crypto market is now attempting to identify Bitcoin’s subsequent technical hurdles.

Bitcoin has in the end reclaimed the $90K differ

So where’s the following staunch resistance?

First close: the 50-week EMA, for the time being sitting around $100K

That makes it each and every a technical ceiling and a psychological stage

However the explicit resistance is sitting a miniature increased

The next critical… pic.twitter.com/ZvYLiGjtVu

— Lark Davis (@TheCryptoLark) November 27, 2025

The quick barrier is the 50-week exponential transferring moderate, which is for the time being standing sooner or later of the $100,000 designate. This stage isn’t any longer most effective a technical designate, but it no doubt is moreover a critical psychological threshold for traders.

On the opposite hand, the largest resistance is projected to be increased. The crypto analyst, Lark Davis, mentioned a severe zone between $108,000 and $110,000, where a lot of technical indicators converge to create a solid resistance cluster.

This draw aligns with the 0.168 Fibonacci retracement stage, which represents a critical horizontal resistance from prior building.

Crypto Market Rises as Fed Price Sever Odds Lengthen

The cryptocurrency market is step by step gaining momentum as November approaches to whole. Today, the whole market capitalization of the cryptocurrency market stands at around $3.12 trillion.

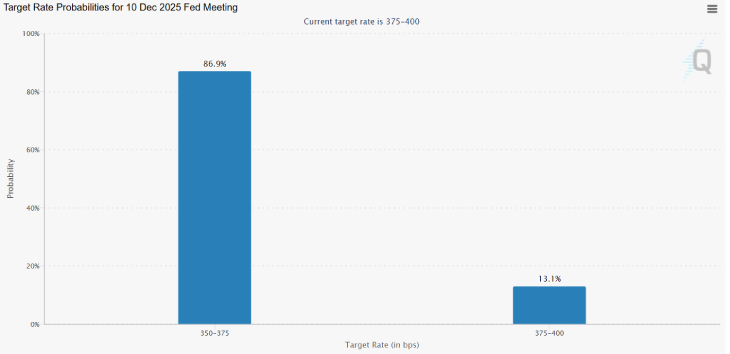

(Offer: CME Community)

This constructive lag mainly comes from rising investor self perception that the Federal Reserve will quickly lower hobby rates.

The critical motive within the help of this upward trend is the rising expectations for a Federal payment lower in December’s FOMC meeting. The probability of a payment lower has surged to 85%, which is a giant jump from beneath 40% actual days ago, in step with the CME FedWatch draw.

“While the following FOMC meeting remains a shut name, we now think relating to the latest spherical of Fedspeak tilts the probabilities in direction of the Committee deciding to lower rates in two weeks from this day,” J.P. Morgan’s chief U.S. economist Michael Feroli acknowledged within the latest comment.”We’re help to attempting to secure a final lower in January.”

Other critical cryptocurrencies, in conjunction with Solana and Ripple, gain moreover adopted the market sentiment with weekly gains between 3% to 7%. While purchasing and selling process has been aloof, it shows a staunch climb as a substitute of a speculative frenzy.