XRP, the native token related with Ripple Labs, has recorded necessary actions within the final 24 hours. XRP, rate $4.84 billion, has hit assorted cryptocurrency exchanges internal this time-frame. This portions to a total of 1,841,500,765 XRP as actions recorded a surge amid a tag drawdown

XRP historical traits suggest breakout

XRP witnessed increased actions as market participants chose to reboot their passion within the asset. This ended in a 13% soar within the trading quantity to $4.84 billion.

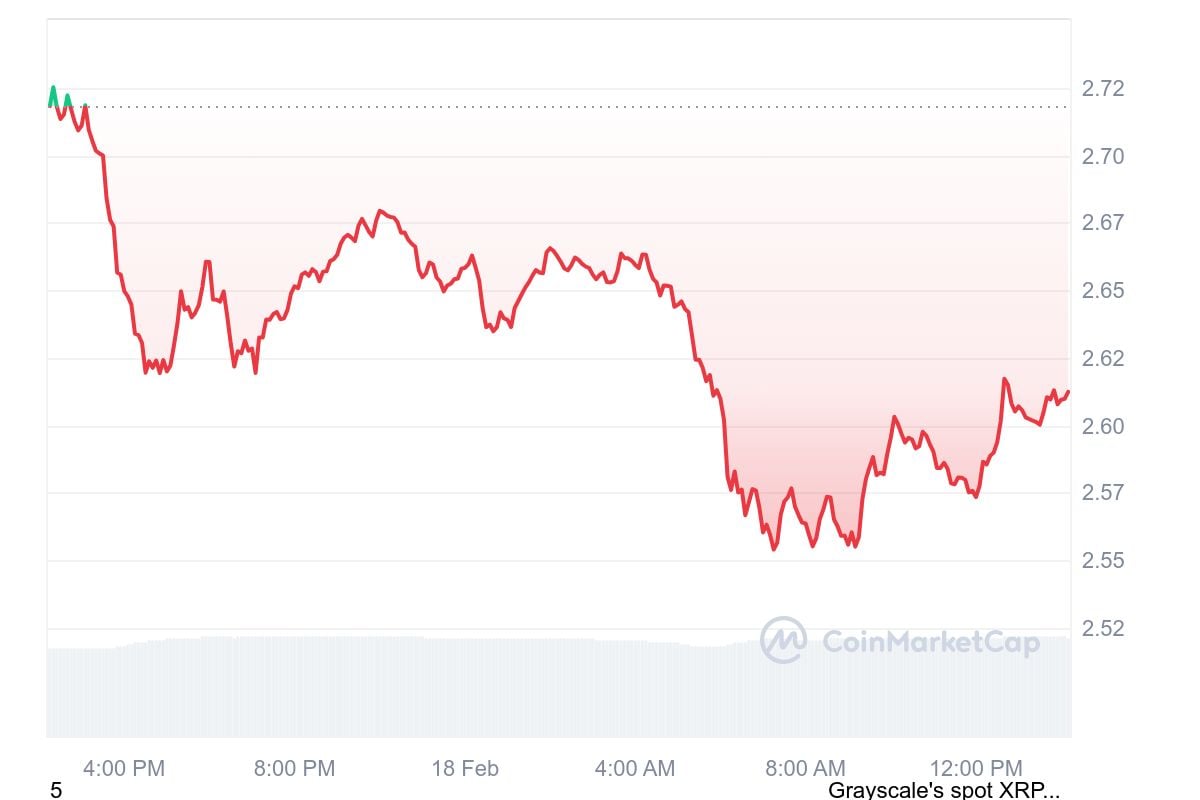

Despite this upsurge in trading quantity, XRP’s tag has no longer seriously climbed at some level of the identical time-frame. As of this writing, XRP is altering palms at $2.60, down by 3.05% within the final 24 hours.

XRP became once trading at a high of $2.73 nonetheless step by step slipped to $2.55. The coin noticed a tag reversal from that low following increased market hiss.

This reversal has fueled merchants’ hopes that XRP might well well proceed its 90-day surge of 130%.

Prominent on-chain analyst Ali Martinez has known an enticing tag sample with XRP. In accordance with Martinez, XRP forms a “cup and tackle” sample that might well well strengthen a bullish climb for XRP.

The analysts predicted that the XRP tag might well well fly as high as $3.35 if the technical indicator triggers a identical historical model. XRP merchants are concerned to query if the present upsurge in trading quantity might well well catalyze that tag prediction.

XRP ETF catalyst

Meanwhile, as market participants await a bullish restoration, the XRP ecosystem bought “bullish recordsdata” from the U.S. Securities and Trade Commission (SEC). On Feb. 14, the regulatory authority officially acknowledged the commerce-traded fund (ETF) submitting of 21Shares.

Besides 21Shares, other asset managers which possess filed to launch region XRP ETFs consist of Grayscale, WisdomTree and Bitwise.

Essentially the most modern acknowledgment from the SEC in a series of XRP ETF filings marks an loads of message, in accordance with Nate Geraci, ETF analyst. Ought to the ETF be permitted, it might well possibly well herald institutional money, serving to to gasoline a long-term XRP tag rally.