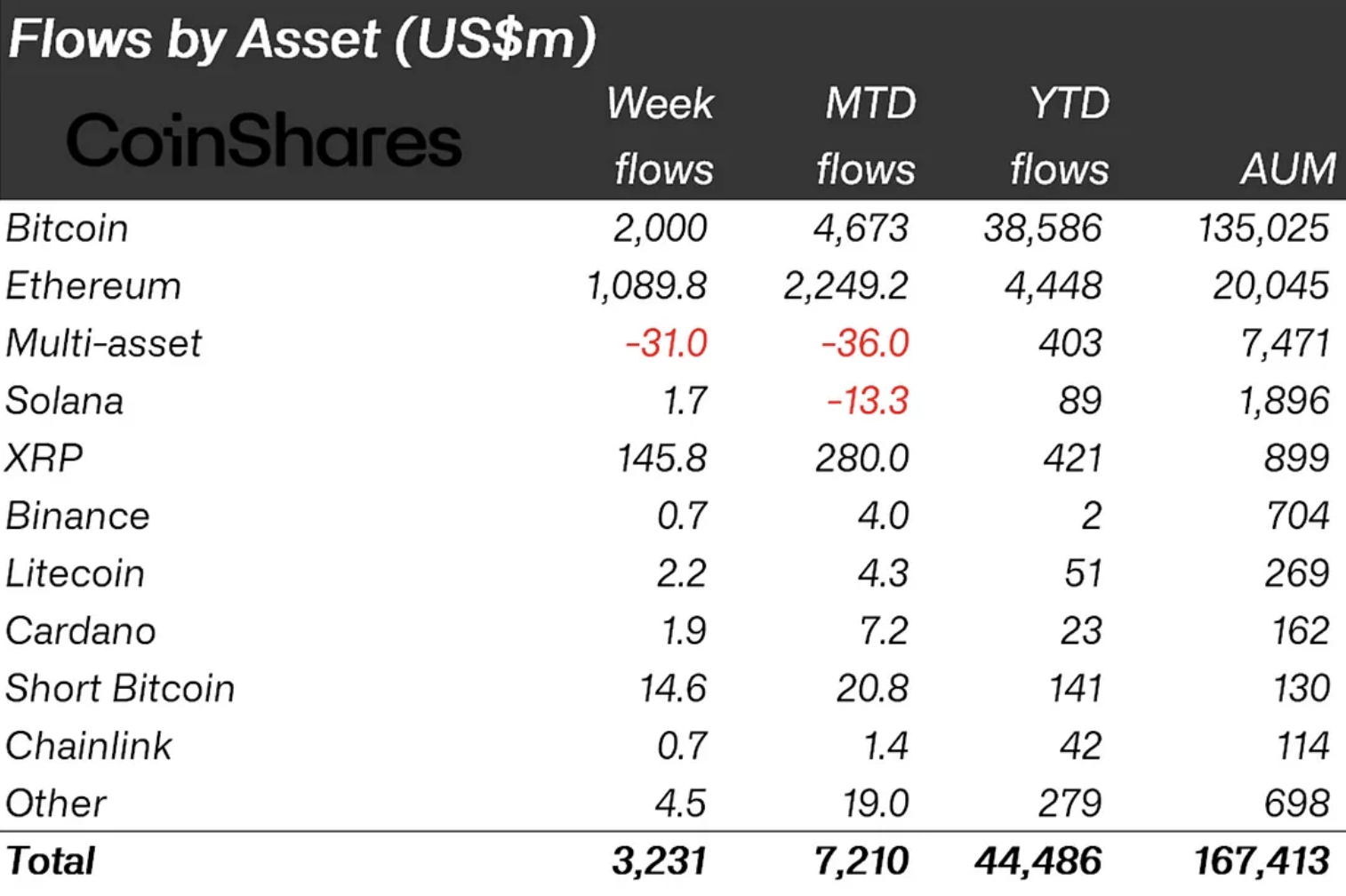

As extra and further of us explore to the digital asset funding products area, Cardano (ADA) made a title for itself in closing week’s inflows, standing out from the team in a extremely aggressive landscape. Per CoinShares, funds flowing into digital asset ETFs reached $3.23 billion, marking its 10th consecutive week of development. This brings the 2024 total to an excellent $44.5 billion — a quantity that’s unmatched by outdated years.

Whereas Bitcoin used to be the colossal winner with $2 billion in inflows, Ethereum kept up its precise skedaddle. Ethereum-linked products introduced in $1 billion for the seventh consecutive week, bringing the total for the duration to $3.7 billion. Other altcoins saw less dramatic nonetheless clean valuable inflows, with XRP attracting $145 million amid optimism around a doable ETF.

In this crowded area, Cardano is value declaring for its performance. ADA-linked ETPs saw inflows of $1.9 million closing week. Whereas these positive aspects are modest compared to the market leaders, they tell that zeal within the asset is precise and rising.

Since the origin of the 365 days, $23 million own flowed into Cardano funding products, with a third of that coming in December by myself. There is shrimp doubt that the momentum is good, bringing the total resources under administration in Cardano ETPs to $162 million.

The numbers tell that it is miles preserving its have. Cardano can also merely no longer be as colossal as Bitcoin or as hyped as Ethereum, nonetheless its inclusion among cryptocurrencies with devoted ETPs is clean a colossal deal. It in all fairness rare for a digital asset to derive this extra or less institutional recognition, and even rarer for it to relieve it over time.

The broader market also saw inflows for Polkadot and Litecoin, with $3.7 million and $2.2 million, respectively. But Cardano’s precise development and consistent count on tell that it is miles expounded among an rising array of altcoin funding alternatives.