Today time, the crypto market anticipates the expiration of almost $1.85 billion in Bitcoin (BTC) and Ethereum (ETH) alternate solutions.

Market participants are carefully monitoring these expirations, which may per chance additionally lead to elevated volatility and value fluctuations.

Macroeconomic Components and Alternatives Expiry: How They Form Crypto Costs

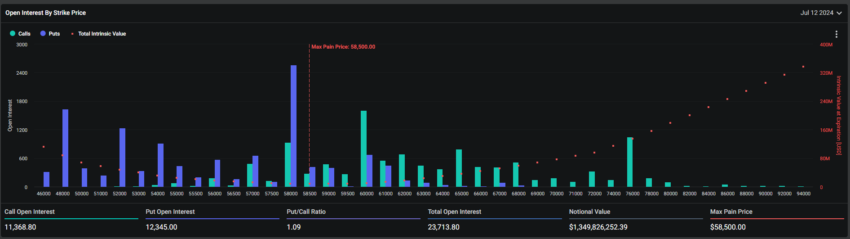

In step with Deribit’s data, 23,832 Bitcoin contracts, worth roughly $1.37 billion, are put of dwelling to elope out at the present time. This tranche is bigger than final week’s figures, which own been 18,339 contracts. These expiring contracts own a keep-to-call ratio of 1.09, with a most exertion point of $58,500.

Within the crypto alternate solutions market, basically the most exertion point represents the worth level that inflicts basically the most money discomfort on possibility holders. Within the intervening time, the keep-to-call ratio suggests a prevalence of aquire alternate solutions (calls) over sales alternate solutions (places).

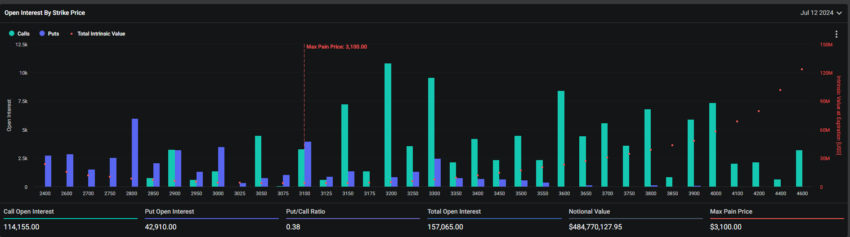

As successfully as to Bitcoin alternate solutions, 156,792 Ethereum contracts will also expire at the present time, keeping a notional cost of over $488.05 million. Ethereum’s keep-to-call ratio is 0.38, with a most exertion point of $3,100.

This week, the crypto market has been influenced by broader economic factors. On July 11, the Bureau of Labor Statistics (BLS) released the US User Designate Index (CPI) data, showing a 3% three hundred and sixty five days-over-three hundred and sixty five days (YoY) inflation rate for June. This figure was lower than market expectations.

Bitcoin hasty reached $59,000 in the end of contemporary economic updates, whereas Ethereum was trading at $3,105, showing a miniature type bigger. This sure development occurred in spite of market stress from most critical Bitcoin sell-offs by the German and US governments. Adam, an analyst at the crypto alternate solutions instrument Greeks.live, supplied perception into the new sentiment in the crypto alternate solutions market.

“The total [implied volatility] IV level has rebounded enormously. In case you in deciding out a bigger IV, you can maybe maybe additionally inaugurate a sell define. The enormous quantity of funds delivered in the quarter will atomize the IV support at any time,” he wrote.

Historically, moving impress actions from alternate solutions expiration are inclined to be transient, with markets stabilizing almost in the present day after. On the opposite hand, merchants may per chance maybe maybe mute stay careful in analyzing technical indicators and market sentiment to navigate this volatile length successfully.