Key takeaways:

- Our investing blueprint entails long-term maintaining of quality crypto assets. (Read extra about our investing map and outcomes.)

- We can private extra earnings by the use of staking products – fancy investing in ardour-bearing accounts. (Read extra on How to Stake.)

- One of the most necessary client-pleasant staking products is Coinbase Create, which permits users to stake extra than one tokens in staunch just a few clicks. (Right here’s easy the system to space it up.)

- Coinbase staking rewards can fluctuate per the ask for staking on the underlying protocol.

- On this half, we list the easiest staking charges for Coinbase Create, so possibilities are you’ll well per chance per chance also come across which tokens possess earned the most rewards. (Present: the long term would possibly per chance well idea varied.)

Staking on Coinbase Create

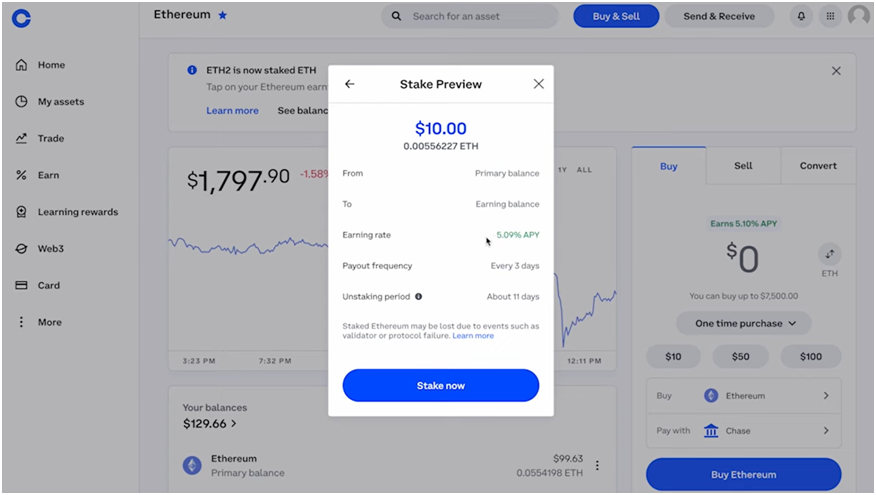

Staking is the flagship carrier of Coinbase Create, a product that you users attach your crypto to work by staking your digital assets on the platform to private rewards.

Coinbase Create provides incomes alternatives for added than one cryptocurrencies that are powered by Proof of Stake (PoS) algorithms. That’s why you won’t gain bitcoin listed there—it makes use of a Proof of Work (PoW) consensus mechanism.

As of this writing, Coinbase supports the next assets for staking:

- Ethereum (ETH)

- Cosmos (ATOM)

- Solana (SOL)

- Polkadot (DOT)

- Polygon (POL)

- Tezos (XTZ)

- Cardano (ADA).

To open staking, possibilities are you’ll well per chance per chance also deposit as diminutive as $1 of crypto.

Benefits to Coinbase Create

There are several the clarification why Coinbase Create is our top opt for crypto staking:

- There are several PoS coins, and staking on every network one after the other requires necessary effort to tune all balances and rewards and tune changes. With Coinbase Create, possibilities are you’ll well per chance per chance also with out pronounce stake all eligible coins from a single dashboard.

- Ethereum has the most staked coin. On the other hand, to change into a validator, it be essential to deposit now not decrease than 32 ETH, roughly $100k as of this writing. Coinbase Create lowers the entry barrier for Ethereum staking because it pools staking capital and doesn’t impose any threshold on users.

- Coinbase Create is client-pleasant and is fabulous for rookies who would possibly per chance well now not realize all the intricacies of staking.

- Coinbase takes measures to decrease all dangers related to validator failure, known as slashing, which would possibly per chance outcome in loss of staked funds. Coinbase has never skilled a slashing loss.

In varied words, Coinbase Create does all the in the support of-the-scenes work for staking crypto assets while users simply reap the advantages.

In return for this consolation, Coinbase takes a 35% commission. You would possibly per chance per chance well per chance also decrease this price to around 26% for particular tokens by becoming a member of Coinbase One. (More data on costs here.)

Previous Coinbase’s commission, the blockchain network dictates the staking price. Right here is why the staking charges fluctuate critically from coin to coin. More on this beneath.

Most efficient Staking Charges This present day

Present that greater reward charges don’t necessarily counsel greater investments.

To illustrate, Polkadot (DOT) in the mean time pays over 9% in staking rewards, however it absolutely has the very most life like inflation price amongst major tokens.

In other locations, Solana (SOL) in the mean time pays decrease than 5%, however it absolutely has been the most efficient-performing Layer-1 coin since 2023, and the cost amplify has been reflected in the return.

Our map is to speculate long-term in essential tokens, and come across staking rewards as extra boost on your funding. Put money into the token, now not in the staking price.

Staking Charges Fluctuate

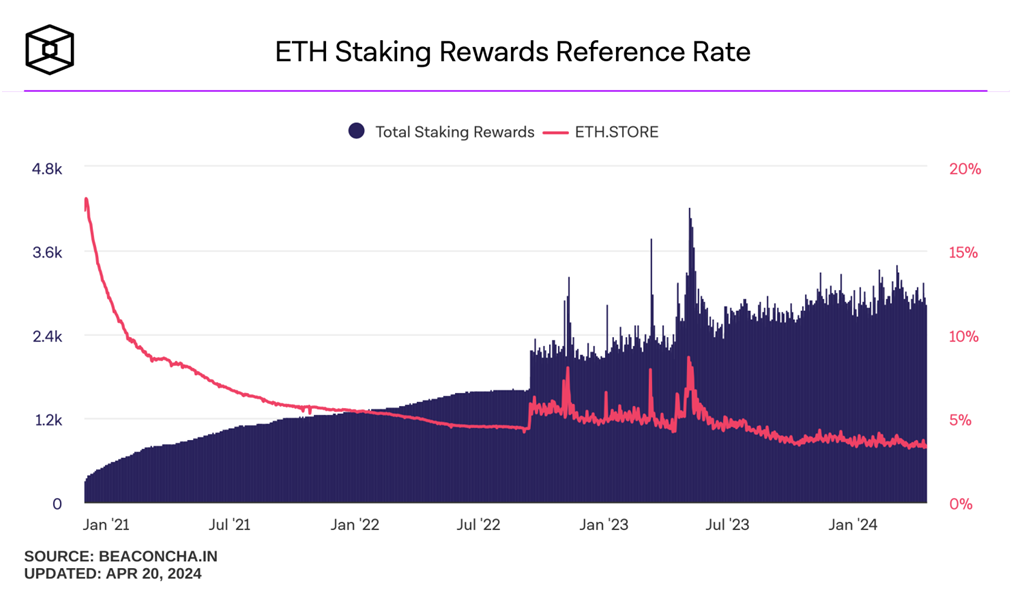

Crypto investors would possibly per chance well aloof also private in mind the fluctuating nature of staking rewards.

To illustrate, one year ago, Coinbase Create offered an annual percentage yield (APY) of 3.83% for Ethereum (ETH) and a pair of.5% for Solana (SOL).

These fluctuations depend on the underlying chains. As a rule, two major components force staking yields: the amount of staked coins, and the participation price. When extra crypto holders stake, the reward price tends to decrease, as all people appears sharing the identical pie.

The Position of Restaking for ETH Holders

Ethereum is an isolated case because it has a complete staking alternate built around it.

EigenLayer launched a staking innovation known as restaking, which enables ETH holders to assemble bigger staking rewards by repurposing the staked ETH to catch decentralized functions (dapps). (Detect our handbook to EigenLayer here.)

It’s price noting that while the rising recognition of restaking and liquid staking protocols enhances the charm of ETH staking, it dilutes the total rewards, alongside side the yields offered by Coinbase Create. (Some other time, extra people, however same-dimension pie.)

Which Platform Affords Most efficient Staking Charges?

Coinbase would possibly per chance well build one of the most very most life like costs amongst custodial staking platforms, however many crypto investors settle it for its simplicity, safety, belief, and popularity.

Right here is how Coinbase Create compares to varied staking platforms. (Be aware that Coinbase commission would possibly per chance well additionally be diminished to 26.3% for eligible Coinbase One people.)

How to Procure Started with Coinbase Create

Getting started with staking at Coinbase is easy. Right here are the most necessary steps:

- Put up your Coinbase Anecdote: For the length of registering, possibilities are you’ll well per chance per chance also settle the fable form you ought to possess – particular person or industrial – after which portion your data, collectively alongside side your title and e-mail address. Model particular that to space a stable password.

- Take a look at your e-mail and cellphone amount and provide extra private data.

- After ending registration, possibilities are you’ll well per chance per chance also aloof battle by the KYC verification route of, which requires you to upload ID documents after which hyperlink a fee manner to assemble deposits.

- Enable 2FA – We strongly point out enabling two-element authentication (2FA), which is able to reduction catch your fable extra, in case your password is compromised.

- Birth staking with Coinbase Create – after registering and depositing funds, scuttle to the Create page and opt one in all the eligible crypto coins or click “Create” on your fable. Right follow the easy instructions to stake crypto and private rewards.

Present that the frequency of reward payouts varies by protocol and that crypto funds would possibly per chance well aloof be unstaked before they would possibly per chance well additionally be traded. Searching on the protocol, unstaking can rob just a few hours to a couple weeks.

Basically the most efficient manner to attenuate staking dangers is to invent a staking portfolio and allocate to extra than one coins.

Investor Takeaway

Coinbase Create provides an accessible manner to stake crypto assets, with low limitations to entry and a consumer-pleasant interface, making it ideal for rookies.

With this handbook, possibilities are you’ll well per chance per chance also come across which crypto investments are paying the most rewards. But take into accout, put money into quality crypto assets first, and revel in the staking rewards as gravy.