Concerns that crypto stablecoins will hurt US banks by cannibalizing banking deposits are sick-placed and don’t assist in mind the true-world makes expend of of the tokens, per Coinbase researchers.

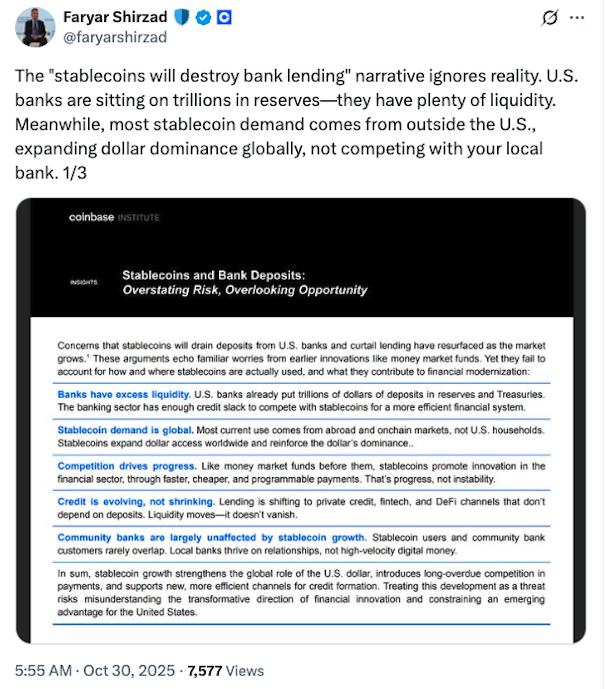

“The ‘stablecoins will execute financial institution lending’ fable ignores fact,” Coinbase protection chief Faryar Shirzad stated on Wednesday.

“Most stablecoin quiz comes from birth air the US, rising greenback dominance globally, not competing along side your native financial institution.”

Shirzad shared a market present that stated the arguments over stablecoins impact on financial institution deposits and lending “echo familiar worries from earlier enhancements admire money market funds. Yet they fail to story for how and where stablecoins are in reality long-established.”

US banking groups have argued that stablecoins offering yield can also compete with financial institution accounts and trigger financial institution outflows, and have urged Congress to clamp down on products and services offering yield on stablecoins.

Stablecoin quiz is world, not US-centric

Coinbase argued in its present that the most quiz for stablecoins comes from “world users searching for greenback exposure” and never from US patrons.

It stated emerging markets expend US greenback stablecoins to hedge in opposition to native currency depreciation, and the tokens are a “good fabricate of buck access” for the underbanked.

The present added that around two-thirds of stablecoin transfers happen on decentralized finance or blockchain platforms. “In that sense, they are the transactional plumbing of a unusual financial layer that runs parallel to, but largely birth air, the domestic banking system,” Coinbase stated.

“Treating stablecoins as a threat misreads the 2d: they beef up the greenback’s world feature and free up competitive advantages that the US shouldn’t constrain,” Shirzad stated.

Community banks obtained’t crumple, Coinbase claims

Coinbase argued the troubles that neighborhood banks will likely be hit exhausting by long-established stablecoin expend additionally lack credence, explaining that the conventional stablecoin user “just isn’t the an analogous because the conventional neighborhood financial institution buyer.”

“Community banks and stablecoin holders barely overlap,” Shirzad stated, adding that banks “can also toughen their products and services with stablecoins.”

Associated: Western Union picks Solana for its stablecoin and crypto network

Coinbase additionally stated forecasts of trillions of bucks flowing into stablecoins over the following 10 years “ought to be in moderation scrutinized.”

“Despite the truth that stablecoin circulation reached $5 trillion globally, a majority of that rate would peaceable be foreign-held or locked in digital settlement methods, not diverted from US checking or savings accounts,” it stated.

Coinbase famend that business financial institution deposits within the US exceed $18 trillion and claimed that the impact of stablecoin on deposits would “remain marginal, while the realm affect of the US greenback would drastically lengthen.”

Multiple immense banks and fundamental financial establishments have launched stablecoin products and services or are exploring provides after the US passed the GENIUS Act earlier this 365 days, which regulates how stablecoin carrier providers operate within the nation.

Journal: Bitcoin is ‘amusing internet money’ in some unspecified time in the future of a crisis: Tezos co-founder