- AVAX stamp struggles near $18.50 beef up as long liquidations and bearish strain develop like a flash.

- Delivery Interest, funding rates, and mature indicators counsel capital is leaving whereas sellers reduction protect watch over.

Avalanche (AVAX) saw its stamp tumble 2% on Wednesday, trading at $18.67. This placed the token appropriate above a essential beef up that had remained intact since mid-April. The strain at this level has increased, and any discontinuance under it would possibly possibly possibly possibly perchance perchance possibly push the stamp even lower.

A weakening presence in derivatives markets shapes the current outlook. Data from Coinglass shows Delivery Interest (OI) has fallen to $445.03 million, its lowest point within the previous month. The 1.80% dip in OI in fair 24 hours signals declining capital inflow into AVAX-linked positions.

This fading hobby is extra mirrored in liquidation numbers. Over the similar 24-hour duration, $1.38 million worth of long positions were wiped out. In comparability, handiest $107,210 in shorts were liquidated. That brings total liquidation to $1.49 million, clearly reflecting the loss of bullish bets.

Bearish Bias Strengthens Amid Technical Indicators

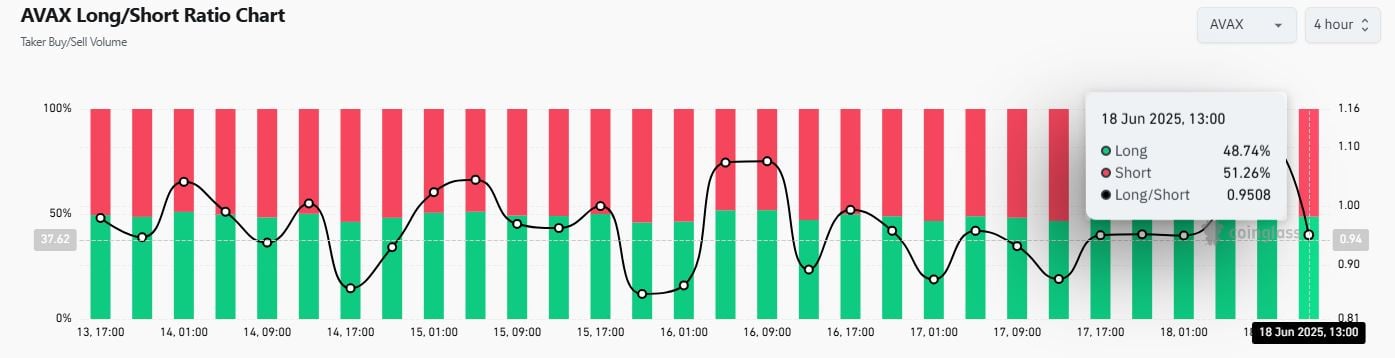

The shift in sentiment is visible all thru a pair of indicators. The long-short ratio on the four-hour timeframe has fallen to 0.9508, suggesting bears are a small of forward in active positioning. In the period in-between, the Delivery Interest-weighted funding rate has been hovering near the neutral line, final recorded at 0.0045%.

On the charts, the MACD indicator continues to point downwards. It has no longer been ready to depraved above the mark line, and growing crimson bars under the zero line counsel sellers remain up to the stamp. The RSI sits at 37, above the oversold zone nonetheless mild removed from signaling energy. There’s dwelling for additional plot back if current strain continues.

Supporting this case is the Chaikin Money Slip with the movement (CMF), reading -0.08, which scheme more capital is leaving AVAX than coming into it. An identical sample comes from the Balance of Energy (BoP), which is at -0.14, signaling dominance of selling exercise over procuring strain.

Avalanche Risks Slipping to $16.14 or Decrease

AVAX has these days bounced from a low of $18.13 recorded on Tuesday, nonetheless stamp motion stays under strain. Prolonged upper wicks on most modern candles counsel sellers are rejecting increased levels. If AVAX breaks the $18.50 beef up line, next plot back levels take a seat at $16.14. This whisper became mentioned by vendor Ian Cooper, who added that a tumble in Bitcoin would possibly possibly possibly perchance possibly hasten AVAX extra toward the year’s low of $14.66.

Cooper identified that AVAX is nearing a key beef up level at a descending trendline and that it would possibly possibly possibly possibly perchance perchance possibly offer procuring hobby searching on Bitcoin’s next cross. This underlines the current dependence of altcoin momentum on Bitcoin’s broader route.

Then all yet again, there’s moreover a dilemma in which AVAX holds the $18.50 beef up. If the broader market stabilizes and procuring hobby recovers, the token would possibly possibly possibly perchance possibly take a look at the 50-day EMA positioned at $21.11. That would possibly possibly possibly perchance possibly require a shift in sentiment, which stays fragile for the time being.