Avalanche (AVAX) has been one of doubtlessly the most talked-about cryptocurrencies in recent months. After a interval of tag drops, it appears to be like AVAX is in a roundabout intention nearing the tip of its downward correction. Investors and traders are now closely staring at to see if this is able to well make a staunch comeback and goal for the $35 charge. But what components are driving AVAX’s tag, and what can we request in the shut to future? On this Avalanche tag prediction article, we’ll stumble on the present say of AVAX, its doable advise, and what might possibly well happen subsequent in its tag high-tail.

How has the Avalanche (AVAX) Ticket Moved No longer too long ago?

Avalanche (AVAX) is currently priced at $25.90, with a 24-hour trading volume of $611.20 million. Its market capitalization stands at $10.52 billion, giving it a market dominance of 0.49%. Over the last 24 hours, AVAX has viewed a tag magnify of 3.70%.

The ideal tag AVAX ever reached used to be $146.18 on November 21, 2021. Conversely, its lowest tag used to be $2.79 on December 23, 2020. Since hitting that every-time excessive (ATH), the lowest AVAX tag recorded used to be $8.69 (cycle low), and the ideal level since that low used to be $65.26 (cycle excessive). At the moment, the sentiment for AVAX’s tag outlook is honest, with the Fear & Greed Index moreover reflecting a honest stance at 49.

Today, there are 406.05 million AVAX tokens in circulation, out of a most offer of 715.75 million. The once a 365 days offer inflation rate is 14.63%, resulting in the introduction of 51.81 million AVAX over the closing 365 days.

Why is Avalanche (AVAX) Ticket UP?

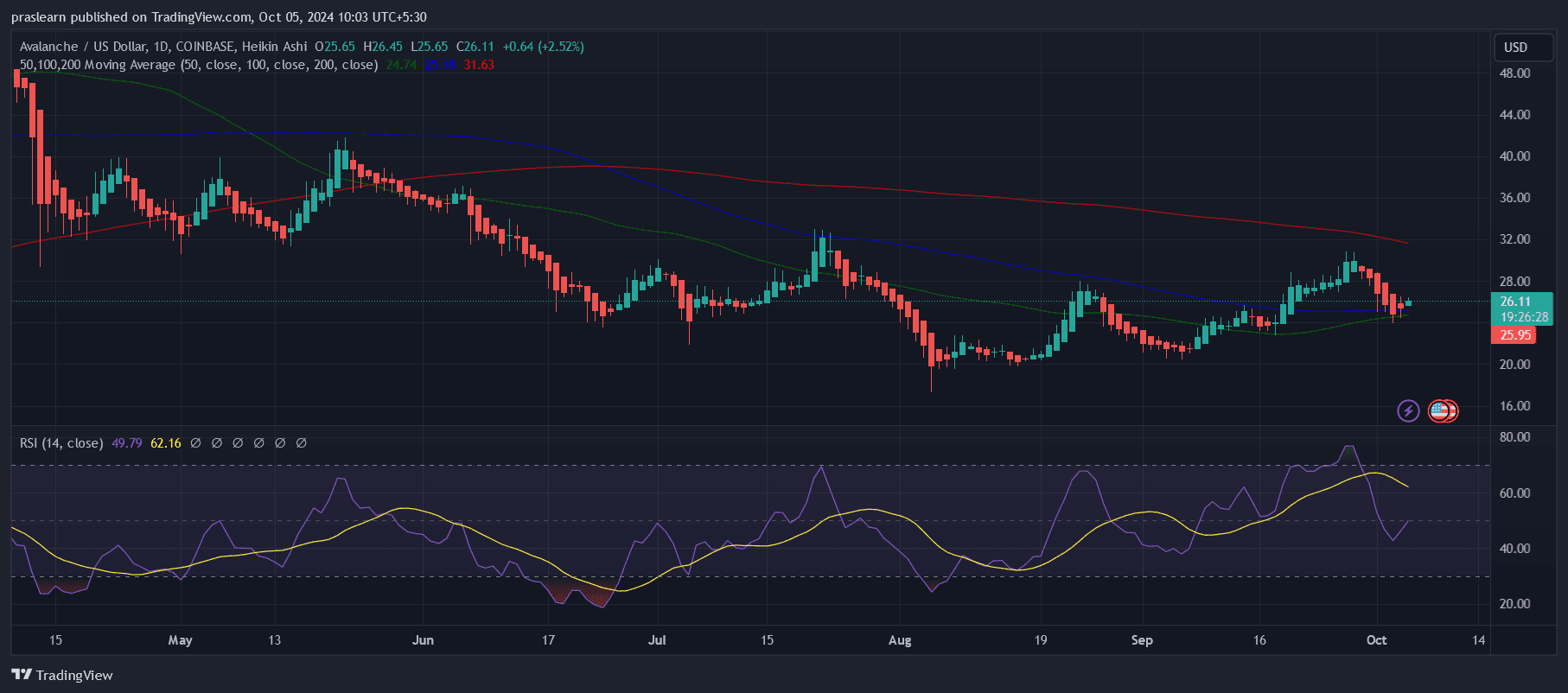

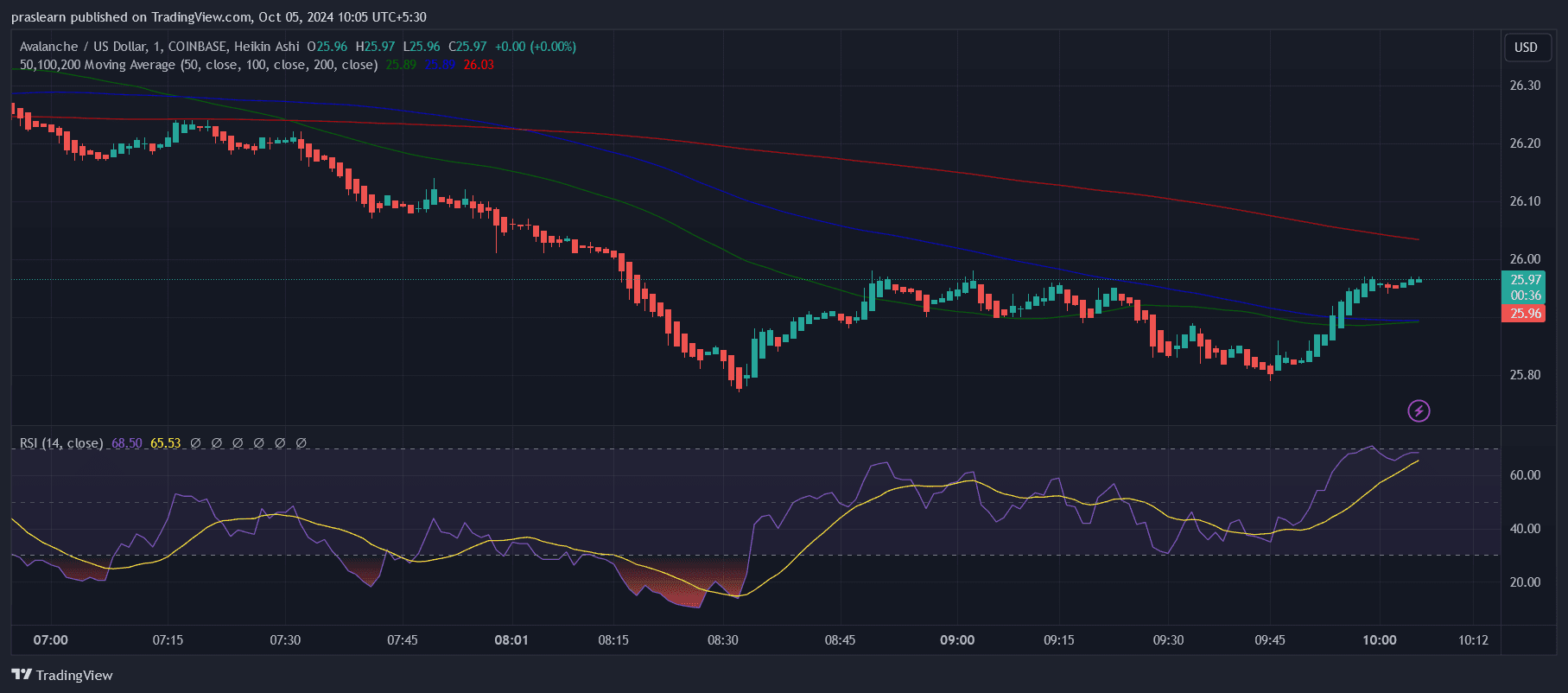

Avalanche (AVAX) is experiencing a obvious tag hunch, driven largely by key give a boost to ranges and heightened notify from big traders, identified as “whales.” No longer too long ago, AVAX has reached its 50-day Straight forward Transferring Common (SMA) of $24.66, which acts as a shut to-term give a boost to, indicating doable bullish momentum.

May perhaps perhaps perhaps silent the charge ruin above the 20-day Exponential Transferring Common (EMA) at $26.42, it might possibly in point of fact well succor as a catalyst for further upward hunch, possibly pushing AVAX into the $32 to $33 differ. If bulls location as a lot as retain this momentum, a surge towards the $35 level can also very successfully be on the horizon, as traders capitalize on this rally.

The increased interest from big traders is clear, as whale transactions private surged by approximately 98%, amounting to $226.19 million in AVAX interior a 24-hour interval. This heightened notify amongst big holders suggests self belief in the token’s doable, at the same time as retail traders place a cautious stance.

The discrepancy between whale notify and the sequence of stuffed with life addresses means that whereas big traders are positioning for a tag shift, smaller participants are waiting for extra definitive market signals earlier than becoming a member of the construction. This cautious capacity from retail traders can also very successfully be a reflection of present market volatility, the place they can also merely desire to see stronger confirmation earlier than committing to AVAX.

On the technical facet, a failure to place give a boost to above the 50-day SMA might possibly well shift momentum encourage to the bears, doubtlessly driving the charge down to around $19.50, the place staunch buying for interest is anticipated.

On the numerous hand, info from Coinglass highlights a bullish standpoint, with virtually $23 million charge of AVAX uncovered to liquidation dangers if the charge reaches $31. This signifies a essential wager on temporary upward tag hunch, reinforcing obvious sentiment amongst traders who request AVAX to perform successfully in the shut to future.

Overall, AVAX is in a pivotal say. The convergence of whale notify, market sentiment, and technical indicators suggests a likely for a rally if the charge breaks key resistance ranges.

On the numerous hand, the market’s response in the arriving days, particularly from retail traders and the skill to place key give a boost to, shall be wanted in figuring out whether or no longer AVAX can retain its upward construction or face downward force.

How excessive can Avalanche (AVAX) Ticket bound?

Avalanche (AVAX) has demonstrated staunch performance at some level of the last 365 days, with a tag magnify of 151%, outperforming 71% of the top 100 crypto assets, as well to major gamers adore Bitcoin and Ethereum. This staunch performance is indicative of rising market self belief in AVAX, because it consistently outpaces mighty of the market.

The token is currently trading above its 200-day Straight forward Transferring Common (SMA), which is a key bullish indicator usually pointing to sustained upward momentum. With 17 green days in the closing 30 days, AVAX’s tag hunch has been predominantly obvious, further bolstered by its excessive liquidity, which presents stability against outrageous market fluctuations.

On the numerous hand, AVAX remains 82% beneath its all-time excessive of $146.18, suggesting there might possibly be very considerable room for advise if the market continues its upward construction. The recent whale notify and increased trading volume hint at rising investor interest, and if this construction continues, AVAX might possibly well goal to interrupt its $35 goal in the shut to term.

A ruin above this level would likely entice extra traders and doubtlessly originate up the path to higher targets around $50 or extra in the medium to future, equipped market prerequisites stay favorable.

Despite these bullish signs, there are doable limiting components to retain in strategies. The once a 365 days inflation rate of 14.63% contrivance a staunch magnify in AVAX offer, which would possibly well exert downward force if question doesn’t retain tempo.

Furthermore, AVAX appears to be overbought for the time being, suggesting a correction can also very successfully be on the horizon. Whereas this doesn’t essentially advise the overall bullish outlook, it might possibly in point of fact well mean that earlier than any essential upward hunch, AVAX might possibly well ride a pullback, allowing the market to stabilize.

In essence, AVAX is successfully-positioned to climb higher, particularly if present trends of whale accumulation, obvious sentiment, and technical indicators place staunch. Breaking past the $35 resistance is wanted for any great rally, and can merely the market align in settle on of AVAX, targets around $50 and even higher are achievable.

On the numerous hand, market participants have to peer for doable overbought signals and be ready for lessons of correction as AVAX navigates its route towards these higher tag ranges.