Avalanche label is at the cusp of breaching a truly extra special resistance degree, which could perhaps well largely affect the total earnings of AVAX holders.

Nonetheless, historical occurrences waste this probability a bit thinner, evoking the quiz of whether or no longer investors will endure earnings rapidly or in the occasion that they’re going to contain to wait longer.

Avalanche Mark End to Noting Half of-Century

Avalanche label, shopping and selling at $47 at the time of writing, has risen by over 10.6% in the final 24 hours, crossing the $44 resistance earlier in the day. The following barrier for the altcoin is determined at $50, which isn’t finest a extraordinarily necessary psychological resistance but furthermore a extraordinarily necessary technical degree.

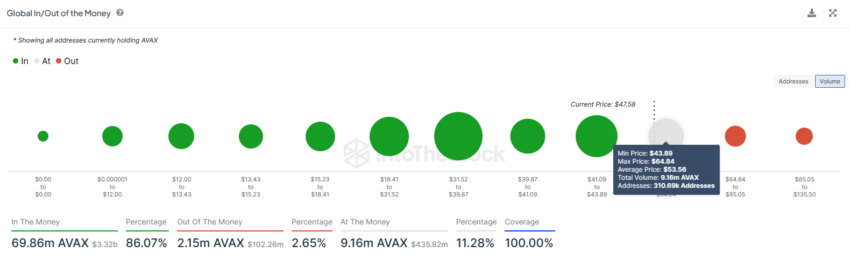

Over 300,000 AVAX holders were ready for this 2d since December 2023. About 9.16 million AVAX rate better than $436 million sits at this label level. Sold at an average of $fifty three, this provide would make cash as soon as the $50 resistance is flipped into increase.

This anticipation will show to be priceless to Avalanche’s label as nicely since investors will probably care for off on selling for now. Furthermore, technical indicators signal a bullish course for the altcoin.

Avalanche Mark Prediction – the First in a While

Merchants and market prerequisites increase Avalanche label breaching $50. The Relative Strength Index (RSI) is for the time being in the bullish zone below the overbought threshold, painting a sure waste consequence for AVAX.

RSI assesses contemporary label fluctuations to settle whether or no longer a market is overbought or oversold. Similar to here is MACD (Transferring Common Convergence Divergence). This pattern-following momentum indicator shows the relationship between two engaging averages of an asset’s label.

MACD, for the key time in four months, is noticing a bullish crossover. Here, the signal line is crossing over the indicator line.

In longer timeframes, a lot like 3-day intervals, these cases basically signal a bull flee, especially in active markets.

Thus, AVAX is more probably to interrupt thru $50, a degree it failed to breach aid in December final year. Flipping it into increase would enable Avalanche’s label to rally further and inferior $fifty three.

Nonetheless, the altcoin could perhaps gaze some correction if the $50 breach fails again. This is able to bring AVAX down to $44, invalidating the bullish thesis.