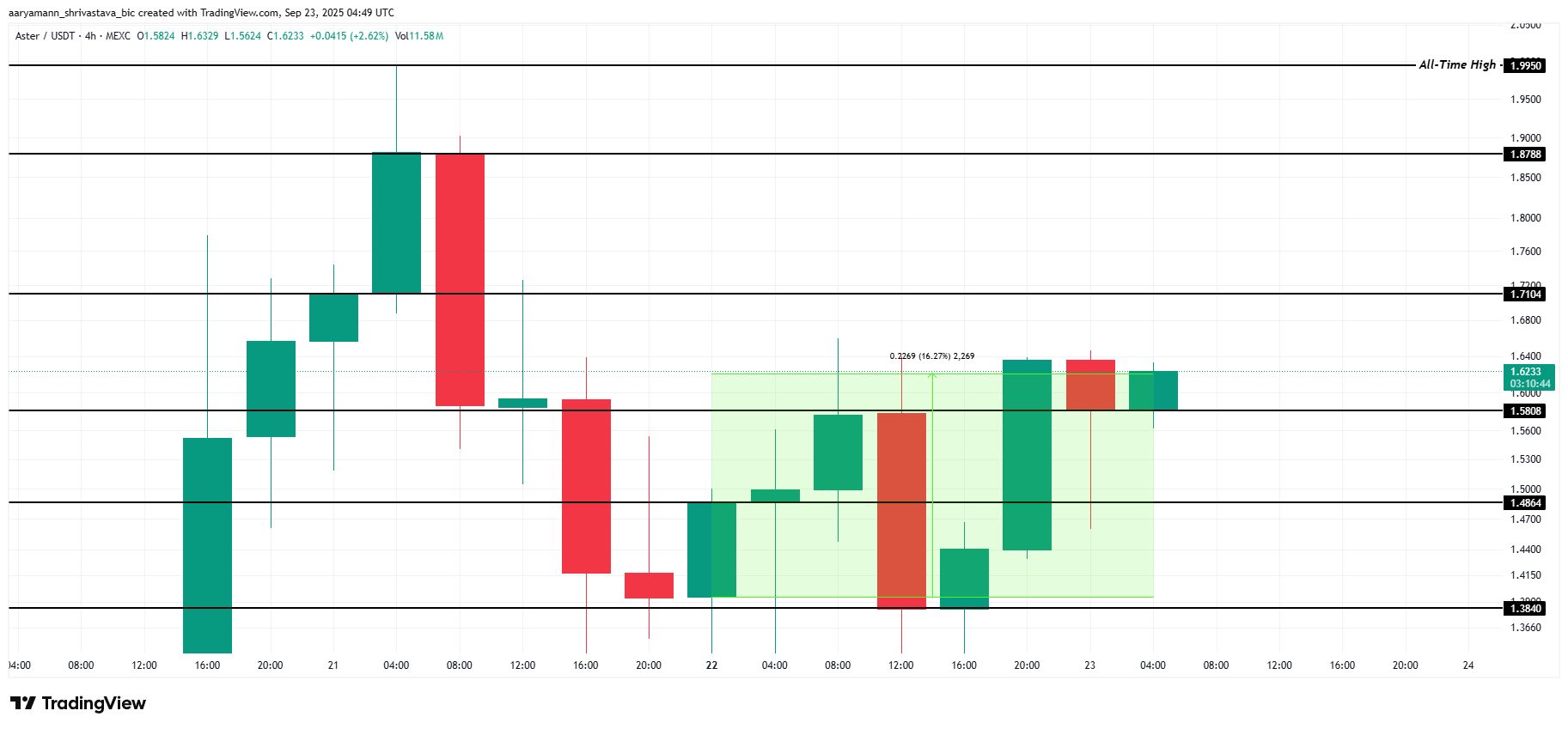

Aster has drawn investor consideration with a though-provoking 16% upward thrust in the closing 24 hours, placing the altcoin at $1.62.

The surprising surge comes despite a directionless broader market, signaling that supportive investors are stepping in to preserve momentum and potentially drive further be conscious good points.

Aster Traders Look Opportunity

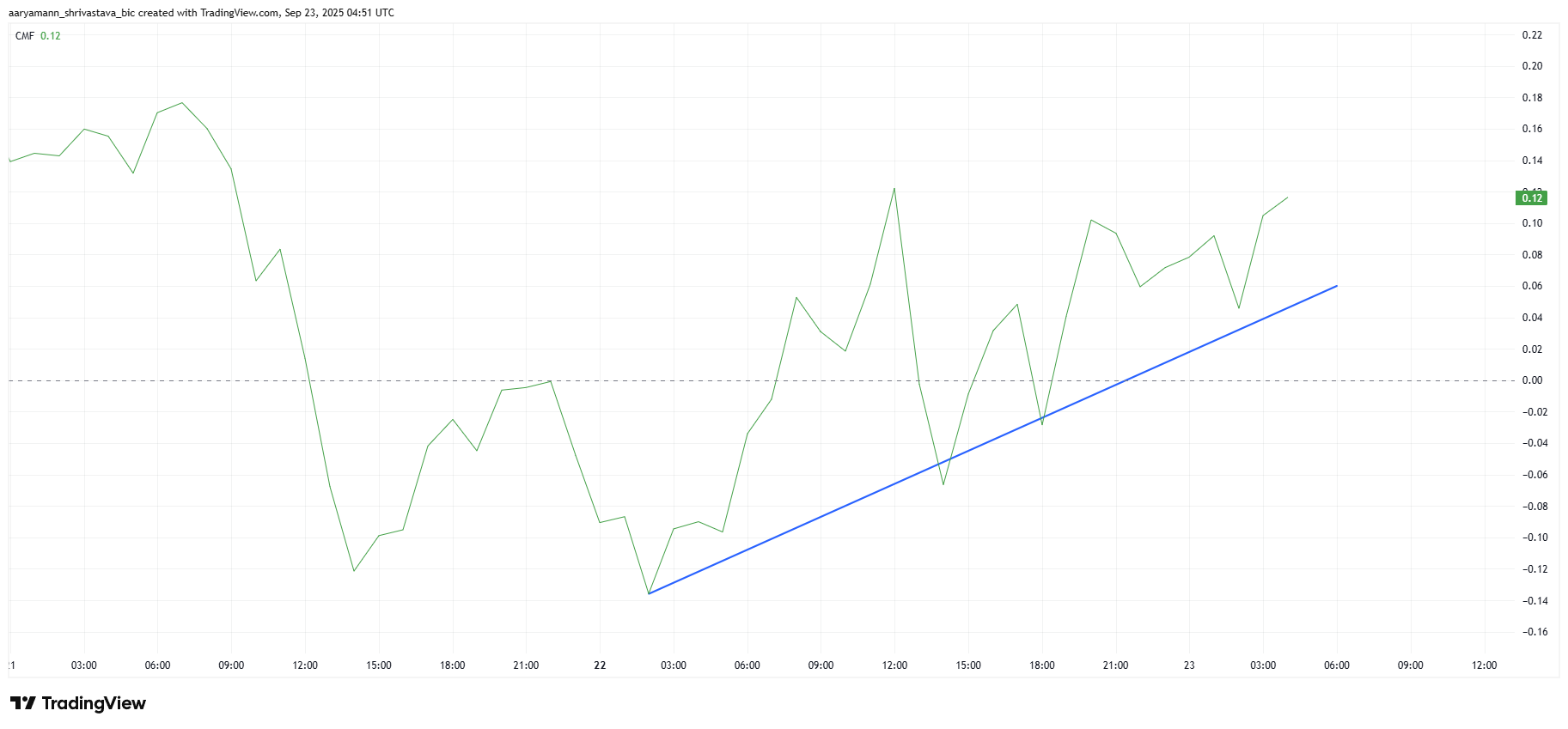

The Chaikin Money Drift (CMF) indicator highlights that Aster continues to file stable inflows at the same time as most cryptocurrencies show declines. Sustained request suggests that merchants stay confident in the token’s ability, regardless of non permanent volatility across the broader crypto market.

This investor conviction might perhaps indicate pivotal for Aster. Constant inflows regularly translate into be conscious balance, and in this case, resilience against wider bearish pressures. If request persists, the altcoin might perhaps preserve upward momentum.

Need extra token insights love this? Be a a part of Editor Harsh Notariya’s Each day Crypto Newsletter right here.

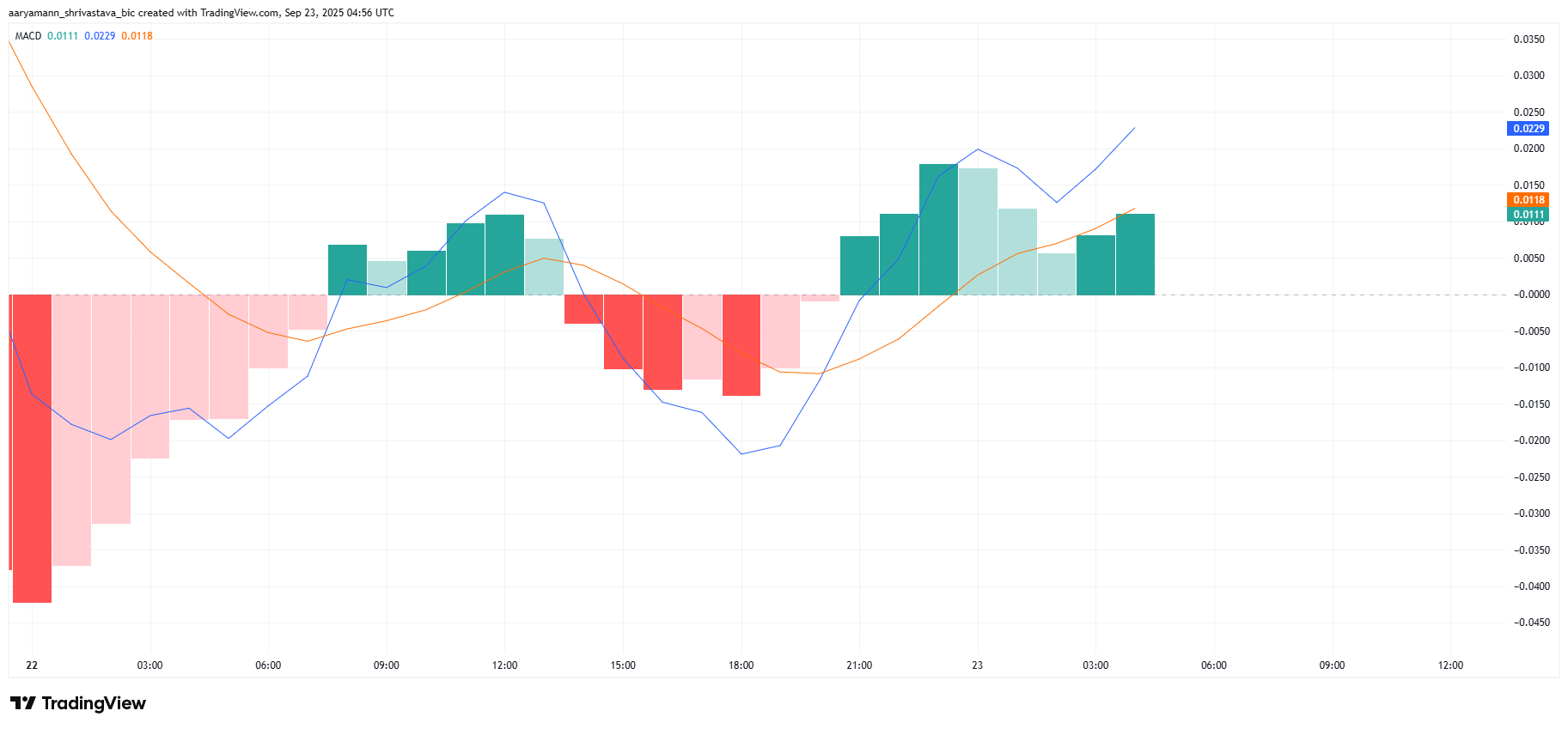

While inflows provide optimism, technical indicators love the Transferring Moderate Convergence Divergence (MACD) paint a extra cautious describe. The MACD reveals restricted strengthen for a bullish continuation, with rapid shifts on the hourly chart highlighting market uncertainty.

This directionless habits suggests that while Aster advantages from stable backing, it is miles light prone to exterior conditions. Any sustained bearish market cues might perhaps offset inflows, leaving the altcoin uncovered to declines.

ASTER Brand Would perhaps well Soar Support

At the time of writing, Aster is priced at $1.62, keeping firm above its $1.58 strengthen. For now, the altcoin is more seemingly to stay rangebound between $1.58 and $1.71 as it consolidates most traditional good points.

If the broader market turns favorable, Aster might perhaps breach $1.71 and skedaddle toward $1.87. Such momentum would elevate the altcoin closer to retesting its all-time high of $1.Ninety 9, a milestone closing considered at some level of high bullish phases.

Alternatively, procedure back risks stay. A spoil below $1.58 would signal weakening request, potentially using Aster appropriate down to $1.forty eight. This danger would invalidate essentially the most traditional bullish outlook, highlighting the importance of stable market strengthen

The post Aster Brand Jumps 16% in 24 Hours As Traders Look Opportunity seemed first on BeInCrypto.