Amid the highlight on Bitcoin’s (BTC) march in direction of $100,000 and the rising recognition of meme cash, Solana (SOL) has quietly solidified its arrangement as one in every of the slay-performing digital assets in 2024.

True during the final week, SOL has surged to $256, reflecting a ambitious forty five% weekly enhance and reaching a file excessive of $264.50. This excellent climb is never any longer lawful using on the broader market momentum but is moreover pushed by Solana’s rising ecosystem.

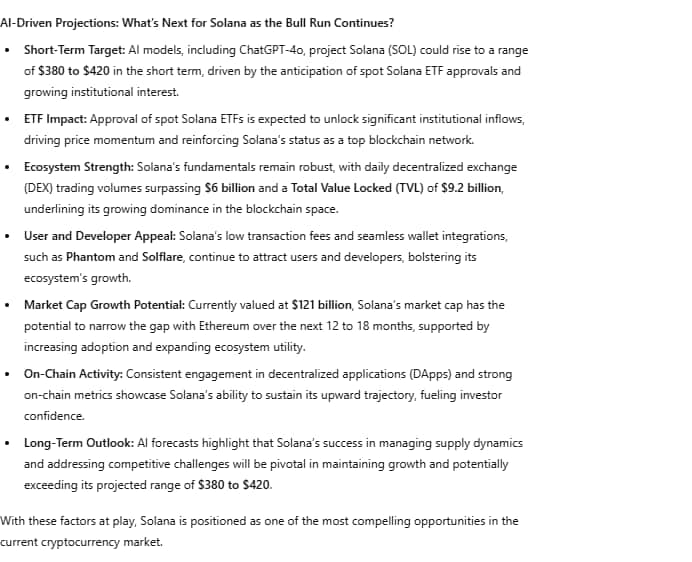

Adding to the momentum is the anticipation of region Solana ETFs, which has ignited a wave of investor optimism, with AI-pushed insights signaling the doable for even bigger beneficial properties forward.

For an intensive evaluation of the establish Solana would possibly head next, Finbold tapped into market info and sought insights from ChatGPT-4o to mediate Solana’s prospects because it hits these unique highs. The findings provide a deeper peep into the major drivers on the assist of SOL’s surge and its future trajectory within the evolving crypto landscape.

ETF optimism ignites Solana’s rally

One of many principle drivers on the assist of Solana’s fresh performance has been the rising anticipation of region Solana ETFs. Predominant gamers adore VanEck, 21Shares, and Bitwise receive filed to list these ETFs on the Cboe BZX Swap, coinciding with the resignation of SEC Chair Gary Gensler.

Alternatively, obvious challenges would possibly have an effect on its trajectory. By mid-2025, Solana’s total offer is predicted to raise, introducing doable capital swings and affecting imprint dynamics consistent with market request.

Big-scale sell-offs would possibly slay downward stress on prices, whereas strategic reinvestments into the ecosystem would possibly enhance long-time length enhance, bettering Solana’s total market strength.

In summary, Solana’s fresh momentum positions it for unique highs, with an ETF approval potentially accelerating its enhance. Alternatively, the flexibility to withhold $250 enhance degree shall be famous to search out out the next trajectory.

Featured image by technique of Shutterstock