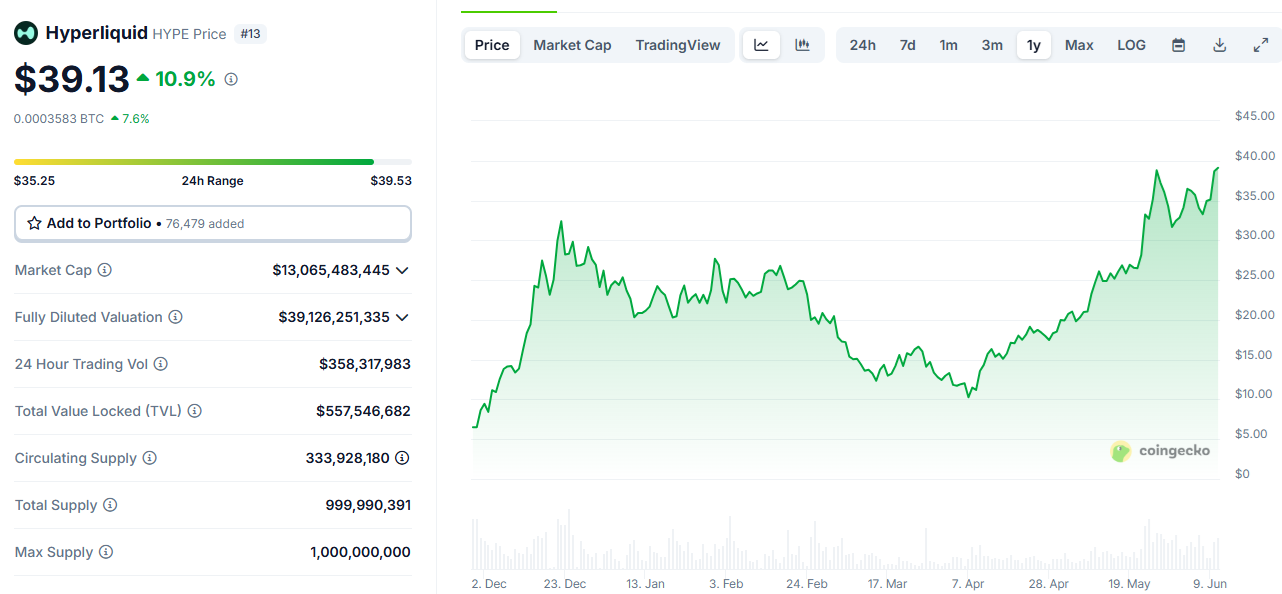

Hyperliquid (HYPE) fulfilled the expectations of rallying, as it reached a brand new peak for 2025. Crypto influencer Arthur Hayes predicts an even bigger breakout for the DEX token.

Hyperliquid (HYPE) is trending again, as its native token rallied to a brand new peak for 2025. The breakout occurs honest a day after whales accumulation became seen, as Hyperliquid continues to scheme attention and new merchants.

Arthur Hayes, crypto influencer and the co-founder of BitMex, expects a rally above $40 with the unpredictability of mark discovery.

HYPE reached $39.18, including over 10% for yesterday, after a interval of nearly non-discontinue recovery since the lows of $12 in April.

Traders are already placing better targets on HYPE, as a result of the long interval of preparation and accumulation. HYPE broke out as shopping and selling volumes increased over 137% in yesterday, up to $1.7B. The HYPE rally liquidated $1.44M briefly positions.

Presently, HYPE long and immediate positions are close to equally balanced, with some plod alongside with the plod alongside with the circulation in opposition to more shorting, as HYPE may perhaps backpedal to a decrease differ in the immediate time-frame. HYPE stays unpredictable as it shifts in opposition to a brand new mark differ. Traders are sever up between an irrational rally corresponding to meme tokens, and a risk to immediate an over-valued asset.

HYPE is soundless shopping and selling honest, no longer showing indicators of being overbought. The asset is no longer even amongst basically the most stylish trending crypto, leading to predictions for a more unhurried and extended rally. Makes an strive at immediate liquidation may perhaps furthermore consequence in additional come-vertical positive aspects in a immediate time span.

Hyperliquid brought out HYPE whales

HYPE stays unsafe as 71.91% of trades are on-chain, locked in the native Hyperliquid ecosystem. The concentrated liquidity has brought out aggressive whales, who like engaged with token at some level of outdated rallies.

A whale deposited $9.975M $USDC into #HyperLiquid and acquired 259,367 $HYPE at a mark of $38.46.

Previously, the whale has revamped $10M in $HYPE trades.https://t.co/iKAuQmwO0d pic.twitter.com/VkKsVWaQgg

— Onchain Lens (@OnchainLens) June 10, 2025

Whales are furthermore coming from exterior ecosystems, even the spend of Solana’s Kamino Lend to borrow USDC and deposit it to Hyperliquid. HYPE became bought come its peak mark in the previous 24 hours, and some of the whales staked the tokens, easing the doable selling stress.

The scorching Hyperliquid disclose may perhaps repeat the peak statistics of May per chance, with file volumes and over $70M in generated charges. On the opposite hand, in the previous weeks, liquidations slowed down as merchants grew to turn into more strategic. Hyperliquid stays one in all the few exchanges to offer up to 40X leverage for BTC.

Many of the delivery curiosity on Hyperliquid is soundless for BTC and ETH. On the opposite hand, shopping and selling other tokens is accelerating, including the native token. The DEX at level to holds $558M in liquidity locked, ready for more foremost growth to compete with older DEXs and even centralized markets.

One of the foremost engagement with HYPE would be natural, as a result of the power to tap into the new BTC bullish style. On the opposite hand, there are furthermore rumors of an eventual 2d airdrop, that would also force extra disclose and social media posting.

An extra offer of curiosity came from the commerce strikes of James Wynn with excessive-cost positions which had been publicly liquidated. No longer too long ago, Wynn acknowledged he’s abet on Hyperliquid with an unknown yarn, continuing his approach to longing BTC with excessive leverage.