BitMEX co-founder Arthur Hayes adjusted his Hyperliquid (HYPE) portfolio on Sunday, September 21.

His most up-to-date movement prompts questions about his skill to alternate with conviction while affirming dauntless lengthy-term forecasts.

Arthur Hayes Dumps $5.1 Million HYPE Weeks After Predicting 126x Surge

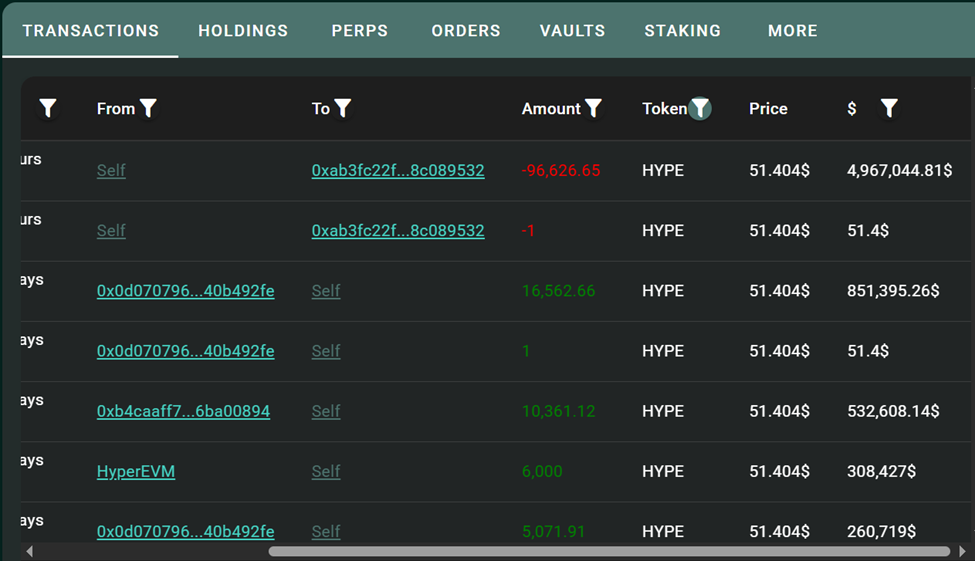

On September 21, Hayes sold 96,600 Hyperliquid (HYPE) tokens valued at around $5.1 million. Notably, he held this command for ultimate a month.

Per on-chain details from Arkham Intelligence, the exit netted him roughly $823,000 in income, or about 19%.

Nonetheless, the sale turned heads because Hayes ultimate no longer too lengthy ago predicted that HYPE could per chance additionally rally as primary as 126x over the approaching years.

Talking at the WebX Summit in Tokyo on August 25, he argued that the token could per chance additionally in a roundabout scheme attain $5,000. The crypto executive cited an explosive enlargement in stablecoin provide and retail appetite for leveraged trading.

Arthur Hayes(@CryptoHayes) merely sold all 96,628 $HYPE($5.1M) he sold a month ago, making ~$823K(+19.2%).

All the scheme in which thru his speech at the WebX Summit on Aug 25, he predicted a 126x upside for $HYPE, nonetheless is now out with decrease than a 20% web.https://t.co/B6z5x7dOsv pic.twitter.com/69s0ZzIIii

— Lookonchain (@lookonchain) September 21, 2025

Hyperliquid, a decentralized perpetuals alternate that has processed billions in quantity, sits at the coronary heart of Hayes’ thesis.

He has described it as a “casino” designed for retail merchants chasing speculative features in a probability-on ambiance.

“Right here’s the system that those accountable maintain chosen to derive and the inhabitants is going alongside with it. I’m going to maintain the casino the place the plebs are going to gamble,” Hayes acknowledged in a podcast interview earlier this year,” Hayes acknowledged in a contemporary podcast interview.

For some, his resolution to exit HYPE so snappy looks to contradict his moonshot projections.

Never keep in mind what of us direct in crypto, ultimate what their actions show conceal on chain

— Cal (@nftpho) September 21, 2025

Alternatively, others belief it in step with Hayes’ trader mentality to grasp short-term earnings while peaceable championing the mission’s lengthy-term doable.

Did CZ and Aster Burst the Bubble for Hyperliquid Traders?

Within the period in-between, others ascribe the movement to Binance founder Changpeng Zhao (CZ), who no longer too lengthy ago promoted Aster. As BeInCrypto reported, the mission has presented as an inadvertent market rival for Hyperliquid.

“Well, he would had been pretty if CZ hadn’t launched Aster. That turned into no longer in the contemporary thesis. When stipulations commerce, merchants adapt,” one person remarked.

Previous the Binance alternate executive, the OKX alternate’s CEO Giant title Xu additionally expressed cognizance of Aster as an inadvertent market rival in the perpetuals DEX command. Notably, Xu has since taken down the submit.

OKX CEO Giant title acknowledged Hyperliquid has shown that onchain perps can be successful even with little groups, with competitors admire Aster now coming into the command. OKX Web3 has examined a identical product since 2023 nonetheless held help mainnet open over regulatory concerns. Giant title cautioned that while…

— Wu Blockchain (@WuBlockchain) September 21, 2025

However, the sale coincided with a dip of practically 5% in HYPE’s mark, exhibiting how closely the market tracks his strikes.

The drop seemingly comes as different merchants soar ship as successfully, with Lookonchain flagging a whale withdrawing $122 million worth of HYPE, presumably in readiness to guide earnings.

“A whale (seemingly Techno_Revenant) withdrew all 2.39 million HYPE ($122 million) 4 hours ago and could per chance be promoting for income at any time. On-chain details shows these HYPE had been sold 9 months ago by the predominant pockets 0x316f…e678, which is tagged as Techno_Revenant. His estimated mark foundation is seemingly roughly $12 and is now sitting on over $90 million in unrealized features,” Lookonchain reported.

Within the period in-between, Hayes has no longer entirely stepped a long way from DeFi probability. Data from Arkham shows that he accrued virtually $1 million worth of Ethena’s ENA token in barely two days, forward of Hyperliquid’s crucial vote on USDH integration.

Ethena Labs, backed by BlackRock, has processed over $23 billion in redemptions and pledged 95% of USDH income help to Hyperliquid.

DeFi researcher Sherif suggests Hayes’ ENA purchases signal a broader strategic bet on the ecosystem’s boost as a replace of a easy exit from HYPE.

Arthur Hayes scooped up practically $1M worth of $ENA in two days.

This came about pretty sooner than Hyperliquid’s giant USDH vote.

Data from Arkham shows he added discontinuance to 1.2M tokens staunch thru several tranches.

What makes this involving is @ethena_labs’ proposal itself: backed by… pic.twitter.com/47mYHjnzZT

— Sherif | DeFi (@SherifDefi) September 21, 2025

By some means, Hayes’ trading project reflects the duality of a market operator, banking features at the unusual time while peaceable promoting the vision of day after right this moment. It additionally highlights the affect tale has on the market.

Whereas HYPE could per chance additionally in a roundabout scheme fulfill Hayes’ 126x prediction, the affect of CZ and Aster can no longer be uncared for. Peaceable, Hayes’ movement demonstrates a willingness to play either side of the alternate.

The submit Arthur Hayes Capitulates on HYPE as CZ’s Aster Jolts Hyperliquid seemed first on BeInCrypto.