Arbitrum has emerged as Ethereum’s most worthwhile Layer 2 scaling solution, commanding 35.3% of the L2 market through its optimistic rollup abilities that reduces transaction costs while declaring Ethereum’s security guarantees. Developed by Offchain Labs, this scaling infrastructure has processed over 2.06 billion transactions, secured $17.80 billion in Total Price Locked (TVL) as of August 7, 2025, and saved customers 4.01 million ETH in fuel costs.

The numbers paint a compelling image of sustained development and true-world utility that extends some distance previous frequent blockchain metrics.

What Makes Arbitrum Assorted from Other Layer 2 Solutions?

Arbitrum’s structure facilities on optimistic rollups, a abilities that assumes transaction validity unless challenged within a seven-day dispute window. This differs from zero-knowledge rollups aged by competitors fancy Polygon zkEVM or StarkNet, which indicate correctness upfront through complex mathematical proofs.

The machine works by processing transactions through sequencers that bundle more than one operations into single batches prior to posting compressed knowledge to the Ethereum mainnet. Customers in discovering attain-fast confirmations while keeping Ethereum’s unsuitable layer security during the dispute resolution mechanism.

Core Technical Structure

Arbitrum’s technical foundation depends on plenty of interconnected parts that work together to route of transactions efficiently while declaring security.

Customers put up transactions to Arbitrum sequencers, which elaborate and blueprint them in an Ethereum Digital Machine (EVM) like minded surroundings. Judge of these sequencers because the first point of contact—they offer instantaneous transaction confirmations while staying like minded with present Ethereum tooling and functions.

The machine then compresses transaction batches and posts them to Ethereum as calldata. This creates an immutable yarn on the unsuitable layer while dramatically reducing the tips footprint through clean compression tactics that retain all needed knowledge for transaction verification.

Security comes through a fraud proof machine with a seven-day allege length where any validator can dispute invalid convey transitions. When disputes arise, the machine uses interactive fraud proofs that spoil down contested computations into smaller steps. This continues till reaching a single instruction that Ethereum can test straight, guaranteeing even complex disputes in discovering resolved efficiently without overwhelming the unsuitable layer.

Bounded Liquidity Extend Protocol

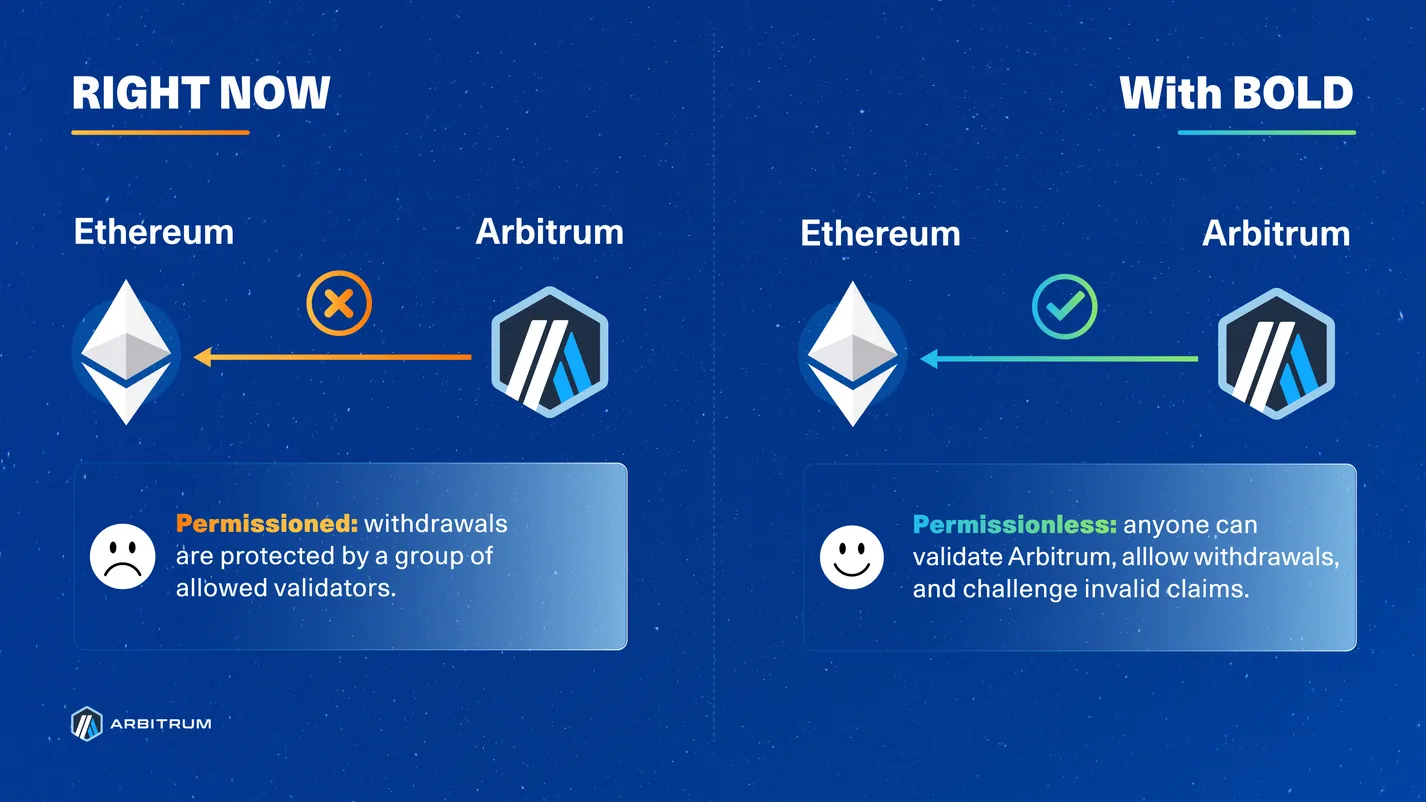

The no longer too prolonged within the past utilized BoLD protocol is a vital step forward in decentralized validation. This methodology enables permissionless validation through an “all-vs-all” dispute mechanism where more than one validators can simultaneously allege the the same assertion.

Mature dispute methods address challenges one at a time, organising doable bottlenecks. BoLD takes a decided diagram by resolving conflicts through a match-trend elimination route of. This prevents corrupt actors from delaying finality through repeated frivolous challenges while guaranteeing legit disputes in discovering lawful consideration.

The protocol maintains security by requiring validators to put up bonds when making challenges. This creates true financial incentives for right habits—worthwhile challengers in discovering better their bonds plus rewards, while unsuccessful challengers forfeit their stakes to the protocol treasury.

Further Technical Elements

Arbitrum supports Stylus for writing clean contracts in Rust or C++, increasing pattern previous Solidity’s obstacles. This opens the door for developers from diverse programming backgrounds while potentially making improvements to contract performance and security.

Transaction costs split into L1 (Ethereum posting) and L2 (execution) parts, most steadily costing 10-100x lower than Ethereum mainnet. Block cases are optimized at 250ms as of 2025, with essentially expert chains fancy Converge pushing it all the trend down to 50ms (planned Q4 2025) for functions that need extremely-low latency.

Historic previous and Background

Arbitrum’s roots impress support to 2018 when Offchain Labs was once based by Ed Felten, Steven Goldfeder, and Harry Kalodner—archaic Princeton researchers who saw blockchain scalability because the important thing allege going through mass adoption. Their venture aimed to solve Ethereum’s excessive fuel costs and congestion through optimistic rollups, a abilities that assumes transactions are real unless somebody challenges them.

Foundation and Early Pattern

2021 Foundation: Arbitrum One launched as Ethereum’s first production-ready optimistic rollup. DeFi protocols within the hunt for decrease transaction costs flocked to the platform immediately, with early adopters fancy Uniswap and SushiSwap providing the liquidity foundation that would perchance well well fuel ecosystem development.

2022 Growth: The body of workers launched Arbitrum Nova for knowledge availability optimization and Arbitrum Orbit for custom chain deployment. These weren’t right incremental updates—they remodeled Arbitrum from a single scaling solution real into a comprehensive infrastructure platform that others would perchance well well include on.

Decentralization and Governance

2023 Decentralization: The ARB token airdrop distributed governance rights to over 625,000 addresses, organising the Arbitrum DAO. This marked the protocol’s evolution from centralized pattern to neighborhood governance, though no longer without some early coordination challenges.

2024-2025 Maturation: Contemporary traits embody permissionless validation through BoLD, multi-language clean contract support via Stylus, and fundamental institutional partnerships with companies fancy Robinhood and PayPal. The platform has clearly moved previous the experimental phase into aged infrastructure territory.

What Are Arbitrum’s Key Technical Advantages?

Arbitrum’s technical implementation delivers measurable improvements over each and each the Ethereum mainnet and competing L2 solutions. The platform’s structure provides tempo, rate savings, and functionality while keeping the safety guarantees that originate Ethereum important for severe functions.

Efficiency Metrics and Capabilities

Contemporary performance specs elaborate vital improvements over Ethereum’s unsuitable layer in some unspecified time in the future of more than one metrics. Transaction throughput benefits from block cases optimized to 250 milliseconds, with some Arbitrum Orbit chains hitting 50-millisecond finality for functions that would perchance well no longer give you the money for to wait.

Gasoline costs are continuously 10-100x less dear than Ethereum mainnet. The rollup spreads Ethereum’s security costs in some unspecified time in the future of many transactions in every batch.

The platform maintains beefy EVM compatibility, which diagram present Ethereum tooling and clean contracts work without modification. This extends to pattern frameworks fancy Hardhat and Foundry, pockets integrations, and block explorers, reducing friction for developers who’re attempting to transfer from mainnet.

Storage optimization entails enhanced fuel limits and improved effectivity for complex functions. These improvements critically encourage>Evolved Elements and Contemporary Upgrades

Arbitrum’s commitment to innovation extends previous basic scaling to embody reducing-edge good points that address evolving market demands.

Stylus Runtime Integration

This toughen enables a vital growth of clean contract capabilities previous the usual EVM surroundings. Builders can now write contracts in Rust and C++, giving them in discovering entry to to aged programming ecosystems with intensive libraries and optimization instruments. The WebAssembly (WASM) execution surroundings—a moveable binary instruction structure—delivers measurable performance improvements for computation-heavy functions while declaring security through deterministic execution and formal verification capabilities.

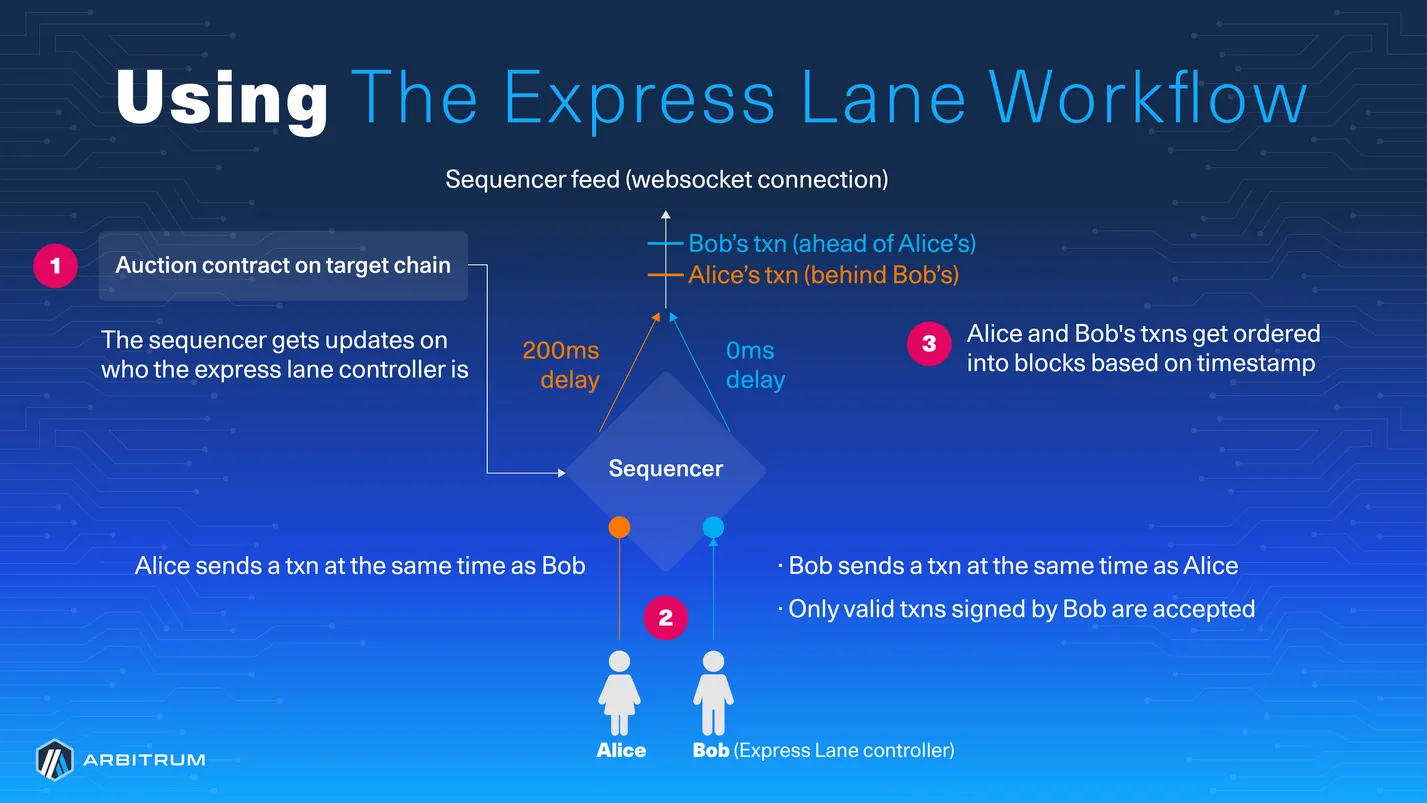

Timeboost MEV Protection

This characteristic introduces a clear diagram to transaction ordering through competitive auctions. Customers can elaborate for priority placement in blocks, organising an very excellent and predictable ordering mechanism that eliminates hidden MEV (Maximal Extractable Price) extraction—the earnings alternatives that arise from reordering transactions. The machine generated $2,491 in earnings for the Arbitrum DAO all through its first day of operation, displaying each and each body adoption and the functionality for sustainable protocol funding through clear rate mechanisms.

Privacy Enhancements

Fhenix’s Fully Homomorphic Encryption (FHE) integration enables confidential computations straight on the blockchain. This abilities addresses privacy considerations in DeFi functions by allowing mathematical operations on encrypted knowledge without revealing underlying values. The implementation opens chances for private trading, confidential governance, and institutional functions that require knowledge privacy while declaring blockchain transparency for auditability.

How Does Arbitrum’s Governance Construction Feature?

The Arbitrum DAO operates through a structured governance route of that balances neighborhood participation with technical abilities. This decentralized diagram ensures protocol decisions replicate stakeholder pursuits while declaring the technical rigor needed for serious infrastructure.

Resolution-Making Process and Community Involvement

The governance lifecycle starts with casual discussions on neighborhood boards where tips in discovering refined through collaborative enter. Proposals that procure traction transfer to temperature assessments, which gauge neighborhood sentiment prior to formal submission. This preliminary route of helps filter tips and ensures supreme neatly-developed proposals proceed to authentic voting.

A success temperature assessments advance to formal on-chain voting through platforms fancy Tally and Snapshot. ARB token holders can imply protocol upgrades, allocate treasury funds, and knowledge ecosystem pattern through this clear mechanism. The voting route of entails more than one phases to originate decided enough consideration time and pause rushed decisions that would perchance well well damage the network.

The DAO controls vital sources, in conjunction with wide ARB token reserves and ETH holdings for strategic ecosystem investments. Contemporary governance decisions elaborate each and each the machine’s functionality and its challenges. The controversial 7,500 ETH funding proposal in non-native initiatives sparked intensive debate about resource allocation priorities, while the 35 million ARB allocation for true-world asset initiatives confirmed consensus around strategic development areas.

Technical Governance and Protocol Updates

Protocol upgrades require cautious consideration of security implications and backward compatibility. The neighborhood has efficiently utilized fundamental updates fancy BoLD and Timeboost through this structured governance route of, proving the machine’s capacity to conform while declaring balance.

Technical proposals endure rigorous review by each and each neighborhood people and core developers. This multi-layered diagram ensures changes meet each and each body needs and technical requirements while protecting the safety properties that originate the network important.

Which Initiatives Power Arbitrum’s Ecosystem Sing?

Arbitrum hosts over 900 decentralized functions spanning more than one sectors, with particular strength in DeFi, gaming, and true-world sources. This diverse ecosystem displays the platform’s versatility and its capacity to support diversified employ cases while declaring performance and security requirements.

DeFi Protocol Panorama

The DeFi sector represents Arbitrum’s most aged and worthwhile application class, with plenty of protocols reaching vital scale and innovation.

Perpetual Trading Dominance

GMX has became the leading decentralized perpetual futures platform, that good points a decided liquidity provision model through its GLP token. This creates a diversified basket of sources that presents liquidity for merchants while producing yield for token holders. The in discovering eliminates the need for passe market makers while guaranteeing deep liquidity in some unspecified time in the future of more than one trading pairs.

Decentralized Alternate Innovation

Camelot is Arbitrum’s premier native DEX, incorporating developed good points fancy concentrated liquidity and sophisticated yield farming mechanisms. The platform’s integration with the broader Arbitrum ecosystem creates synergies that encourage each and each merchants and liquidity suppliers. Uniswap V3’s presence provides liquidity depth and established trading infrastructure for fundamental token pairs.

Yield Strategy Evolution

Pendle’s yield trading platform no longer too prolonged within the past launched Boros to enable onchain funding rate markets. This innovation lets merchants in discovering entry to funding rate exposure the same to centralized exchanges while declaring the transparency and composability benefits of DeFi protocols.

Gaming and NFT Integration

The gaming sector showcases Arbitrum’s capacity to address excessive-frequency transactions while keeping costs low ample to originate blockchain gaming economically viable.

Blockchain Gaming Success

Pirate Nation is a real instance of how neatly designed blockchain games can impact mainstream allure through accessible gameplay and sustainable tokenomics. The game’s success validates Arbitrum’s functionality to address gaming transaction volumes without compromising person abilities or organising prohibitive costs.

NFT Infrastructure Pattern

Magic Eden’s comprehensive marketplace integration provides authentic-grade trading functionality for digital collectibles. A range of native collections, in conjunction with Smol Brains, showcase the ingenious doable of neighborhood-pushed initiatives built specifically for the Arbitrum ecosystem.

Institutional and Mature Finance Integration

The growth into passe finance represents one amongst Arbitrum’s most important development vectors, bridging used monetary products and services with decentralized solutions.

Robinhood Pockets’s support for Arbitrum brings passe finance customers into DeFi through familiar interfaces and simplified onboarding processes. OKX Pockets provides similar functionality for worldwide customers, increasing Arbitrum’s world attain without requiring customers to learn entirely contemporary methods.

PayPal’s growth of PYUSD to Arbitrum demonstrates institutional self belief within the platform’s balance and regulatory compliance capabilities. The integration enables efficient multi-chain rate processing while leveraging Arbitrum’s rate advantages for day to day transactions.

Partnerships with established institutions fancy Franklin Templeton, Spiko, and WisdomTree enable tokenization of passe monetary instruments. These collaborations invent bridges between used finance and DeFi protocols, potentially unlocking trillions of bucks in passe sources for blockchain-basically basically based functions. The platform currently (August 7, 2025) hosts $4.20 billion in stablecoin market cap, demonstrating increasing institutional self belief.

What Contemporary Tendencies Form Arbitrum’s Contemporary Location?

The length from February to August 2025 saw accelerated pattern in some unspecified time in the future of more than one fronts, displaying Arbitrum’s commitment to true innovation and ecosystem growth. The traits span technical upgrades, strategic partnerships, and neighborhood initiatives that collectively beef up the platform’s role within the L2 panorama.

Fundamental Technical Infrastructure Upgrades

The necessary half of 2025 introduced vital technical advancements that strengthened Arbitrum’s infrastructure and expanded its capabilities.

February 2025

This month marked a pivotal 2d with the deployment of the BoLD protocol, representing a vital milestone in decentralization. The toughen enabled permissionless validation on each and each Arbitrum One and Nova, letting any validator steal part within the network’s security without requiring approval from centralized entities. The implementation displays Arbitrum’s commitment to innovative decentralization while declaring security and performance requirements.

On the the same time, Offchain Labs launched a popular intent engine designed to toughen defective-chain interoperability, to electrify sub-3-2d defective-chain swaps in some unspecified time in the future of EVM chains. This abilities addresses one amongst potentially the most pressing challenges within the multi-chain ecosystem by enabling seamless interactions between diversified blockchain networks. Customers now no longer want to esteem complex bridging mechanisms to transfer sources in some unspecified time in the future of chains.

April 2025

This length introduced the combination of Converge as a essentially expert Arbitrum chain, showcasing the flexibleness of the Orbit framework for custom implementations. The month additionally saw Timeboost’s commence, introducing MEV public sale functionality that creates sustainable earnings streams for the DAO while giving customers predictable transaction ordering solutions.

Would perchance perchance additionally 2025

Pattern expanded through node client fluctuate with Nethermind and Erigon support, reducing single-point-of-failure dangers and making improvements to network resilience. The Fhenix integration for confidential computing capabilities enabled privacy-protecting functions all during the broader DeFi ecosystem. Moreover, the DAO well-liked 35 million ARB for true-world asset acceleration partnerships with Franklin Templeton, Spiko, and WisdomTree.

Ecosystem Sing and Strategic Partnerships

The summer months of 2025 targeted on person abilities improvements and excessive-profile collaborations that expanded Arbitrum’s attain.

June 2025

June delivered vital person abilities improvements during the Pectra toughen, enabling developed good points fancy one-click on token swaps and fuel sponsorship mechanisms. These enhancements prick friction for contemporary customers while providing developers with instruments to invent more intuitive functions. The month additionally featured the commence of Trailblazer 2.0, which secured $1 million in funding for agentic DeFi pattern, as neatly as a deepened collaboration between Robinhood.

July 2025

High-profile partnerships dominated this period, in conjunction with PayPal’s PYUSD stablecoin growth and the excellent Birth Condominium builder program announcement with devoted tracks for studying, constructing, and hacking. These initiatives elaborate Arbitrum’s allure to each and each institutional partners within the hunt for authentic infrastructure and grassroots developers constructing innovative functions.

August 2025

Early August has already showcased ecosystem maturity through more than one vital launches. Boros by Pendle launched subtle onchain funding rate markets that compete with centralized substitute mechanisms, demonstrating spectacular early traction with over $800,000 in collateral secured within three hours of commence. The $10 millionaudit program commence bolstered the platform’s commitment to security because it scales, while the Yap AI neighborhood engagement mission and Birth Condominium application opening demonstrated a spotlight on sustainable development through developer and person engagement.

The Birth Condominium program continues with ongoing workshops, in conjunction with essentially expert lessons fancy “Stylus for Solidity developers” that encourage present Ethereum developers transition to Arbitrum’s expanded programming capabilities. Arbitrum has additionally been featured prominently in Ethereum’s present ecosystem updates, highlighting integrations fancy Robinhood and rising AI functions as key indicators of broader blockchain adoption.

What Challenges Does Arbitrum Face Appealing Forward?

Despite its market leadership, Arbitrum confronts remark challenges that would perchance well well impact its competitive role.

Sequencer Centralization remains the necessary technical distress. Whereas BoLD enables permissionless validation, transaction ordering mute is reckoning on Offchain Labs’ sequencers. This creates doable censorship dangers and represents a single point of failure that would perchance well well impact network availability. Customers need to have confidence sequencers to embody transactions somewhat and promptly.

Competitive Stress intensifies from more than one fronts. Zero-knowledge rollups fancy Polygon’s zkEVM offer superior finality without fraud proof delays, potentially attracting functions requiring speedily withdrawals. Meanwhile, Heinous and diversified OP Stack chains fragment the optimistic rollup market, splitting developer attention and liquidity.

Ethereum’s Scaling Roadmap poses a longer-timeframe allege. Planned improvements through sharding and proto-danksharding would perchance well well greatly toughen mainnet performance. If worthwhile, these upgrades would perchance well well prick inquire for Layer 2 solutions by making Ethereum itself more scalable and rate-efficient.

The platform need to proceed innovating in some unspecified time in the future of these fronts to take care of its present advantages because the competitive panorama evolves.

What Does Arbitrum’s Future Pattern Roadmap Embody?

Arbitrum’s trajectory specializes in increasing previous passe DeFi into synthetic intelligence, true-world sources, and improved defective-chain functionality. These strategic instructions role the platform to capitalize on rising alternatives while addressing present obstacles.

Rising Expertise Integration

Arbitrum’s future pattern specializes in three key areas:

- AI Integration: Trailblazer 2.0 provides $1 million in funding for AI-powered DeFi functions, focused on computerized trading ideas, yield optimization, and threat administration methods that would perchance well well attract institutional customers.

- Privacy Elements: Constructing on Fhenix FHE integration, future traits would perchance well well embody zero-knowledge proofs for confidential transactions, addressing regulatory and competitive considerations that restrict institutional DeFi participation.

- Spoiled-Chain Interoperability: The current intent engine targets for seamless, low-latency interactions in some unspecified time in the future of EVM chains, potentially positioning Arbitrum as a central hub within the multi-chain ecosystem.

Strategic Sing and Security Initiatives

Arbitrum’s development strategy specializes in three core areas:

- Accurate-World Resources: The 35 million ARB allocation supports partnerships with institutions fancy Franklin Templeton to tokenize passe sources, bridging used finance with DeFi infrastructure.

- Developer Strengthen: Purposes fancy Birth Condominium present tutorial sources and funding to take care of a solid builder ecosystem, organising sustainable competitive advantages through network outcomes.

- Security Investment: The $10 million audit program ensures sturdy security requirements because the ecosystem scales and turns real into a more enticing diagram for doable threats.

Commonly Requested Questions

How does Arbitrum take care of security while processing transactions off-chain?

Arbitrum inherits Ethereum’s security through its optimistic rollup in discovering, which posts all transaction knowledge to Ethereum mainnet and permits a seven-day allege length for dispute resolution. The fraud proof machine ensures that any invalid convey transitions would perchance well well additionally be contested and reversed, making the machine as true as Ethereum itself.

What are the fundamental differences between Arbitrum and diversified Layer 2 solutions?

Arbitrum uses optimistic rollups that assume transaction validity unless challenged, while solutions fancy Polygon zkEVM employ zero-knowledge proofs that mathematically indicate transaction correctness upfront. This makes Arbitrum more EVM-like minded but ends in longer withdrawal cases when compared to zk-rollups.

Can developers without allege migrate present Ethereum functions to Arbitrum?

Sure, Arbitrum provides beefy EVM compatibility, which diagram present Ethereum clean contracts can deploy without modification. The platform supports all usual pattern instruments fancy MetaMask, Hardhat, and Foundry, making migration seamless for most functions.

Conclusion

Arbitrum has established itself as Ethereum’s premier scaling solution through methodical technical pattern, strategic partnerships, and sustained ecosystem development. With over 2.06 billion transactions processed, $17.80 billion in TVL as of August 7, 2025, and day to day active customers within the a complete bunch of thousands, the platform demonstrates true-world utility that extends previous speculative trading.

The combination of optimistic rollup abilities, comprehensive DeFi ecosystem, and lengthening institutional partnerships positions Arbitrum as a vital infrastructure layer for blockchain adoption. Contemporary traits in AI integration, true-world sources, and privacy enhancements elaborate endured innovation that addresses rising market demands.

The platform’s success in saving customers over 4 million ETH in fuel costs while declaring security requirements validates the optimistic rollup diagram for mainstream blockchain functions.

For more knowledge on Arbitrum’s most modern traits, focus on about witharbitrum.io and apply@arbitrum on X for potentially the most modern updates.

Sources:

- L2BEAT – Arbitrum TVL

- Arbitrum Foundation – Authentic documentation

- Arbitrum doctors – technical specification

- Offchain Labs – Technical specifications and pattern updates

- Arbitrum research – Technical knowledge

- DefiLlama – DeFi protocol analytics and TVL monitoring

- Arbitrum DAO – Community governance discussions and voting info

- CoinMarketCap – Market knowledge