In response to a document by Messari, Layer 1 (L1) blockchain Aptos experienced colossal features in key metrics all the plot during the first quarter (Q1) of the year. The growth became as soon as pushed by the surge in Bitcoin costs to new document highs and increased capital inflow within the market.

Nonetheless, Aptos’ native token, APT, has struggled with designate efficiency, recording modest features when put next to other high cryptocurrencies.

Aptos Network Allege Surges

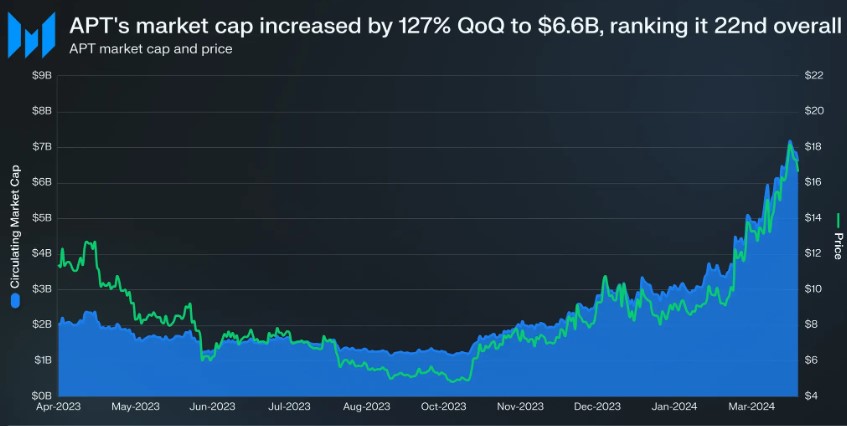

The document highlighted that Aptos’ circulating market cap increased 127% quarter-on-quarter (QoQ) to $6.6 billion.

This boost outpaced other tasks with same market caps, bettering market cap foul from 33 to 22. Regardless of this boost, APT’s designate experienced a more modest make bigger of 76% QoQ.

Aptos revenue, which encompasses all costs gathered by the protocol, grew by 37% to $475,000. Nonetheless, when denominated in APT, the revenue diminished by 10%. All revenue generated by Aptos is burned, however these burned tokens possess no longer vastly diminished inflation.

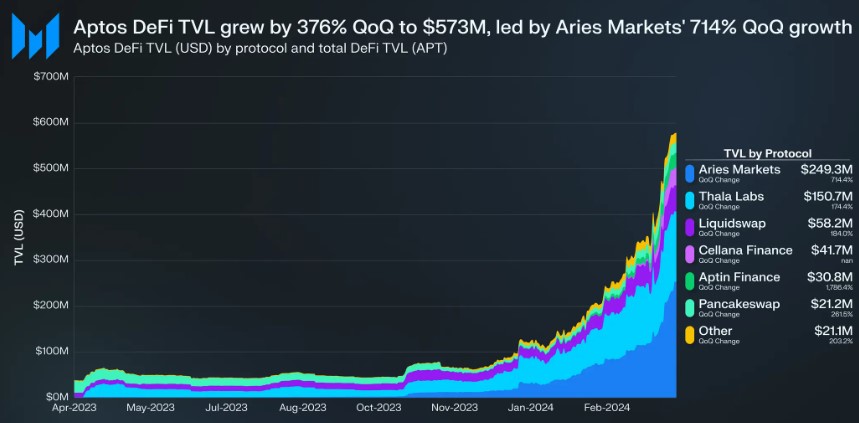

As seen within the chart above, Aptos also experienced boost in its decentralized finance (DeFi) entire fee locked (TVL), which increased by 376% QoQ to $573 million.

In response to Messari, this make bigger became as soon as no longer fully attributable to APT designate appreciation; TVL also grew by 170% QoQ in APT phrases. Furthermore, Aptos’s stablecoin market cap nearly doubled QoQ, reaching $97 million.

APT Struggles To Break $8.80 Resistance

Regardless of these obvious traits, APT’s designate efficiency has faced challenges. The native token has declined over 16% within the previous month, ensuing in a modest 2.7% surge year-to-date. This contrasts with the double or triple-digit features seen by other high cryptocurrencies.

Presently trading at $8.46, APT has struggled to surpass its nearest resistance wall at $8.80, ensuing in a consolidation fragment between $8.20 and $8.70 over the last month.