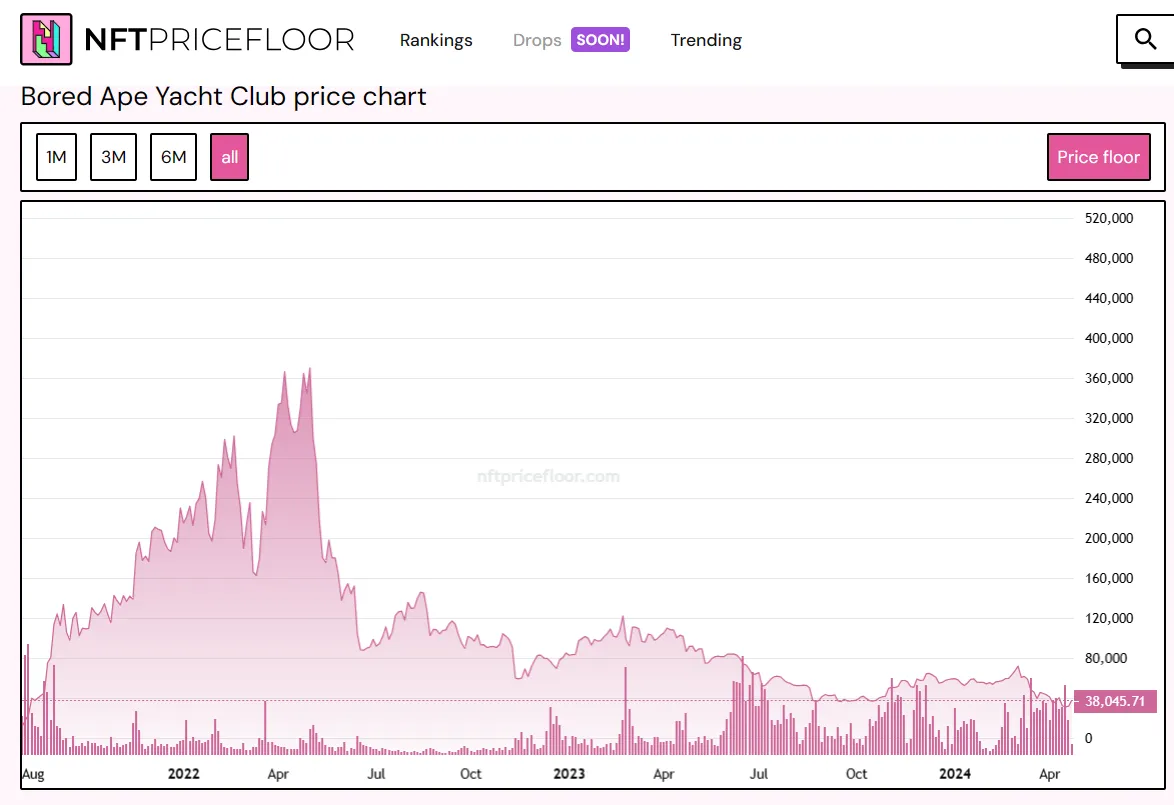

Compounding this, the price floor of BAYC NFTs has been on a downward spiral since closing April, falling from a high of $369K to its fresh $38K per token, in step with NFT Mark Flooring.

There now looks to be a glimmer of hope for Apecoin, on the opposite hand. After hitting an all-time low of $0.989 on April 13, the coin has experienced a 35% restoration, reaching its fresh designate of $1.334. Within the closing 24 hours, Apecoin has surged by 4.82% and is up 12.5% in the closing 7 days—even though it’s peaceable down by 27.93% in the closing 30 days, with a entire lot of the crash occurring in early April.

Phase of Apecoin’s restoration will be attributed to the fresh efforts of the Apecoin DAO to search out unique ways to raise engagement and raise expend conditions for their tokens.

One such initiative is AIP-397, a proposal to birth out an “NFT Launchpad” powered by Apecoin. This platform would serve the creation and procuring and selling of NFTs the utilization of Apecoin. The platform would introduce Puffles, “a user-friendly, no-code instrument” for folk to mint NFTs on tons of blockchain networks, the utilization of Apecoin as a replacement of different cryptocurrencies.

The proposal doesn’t seem like gaining a lot traction, on the opposite hand, with completely 30% of Apecoin holders supporting it as of this writing. Balloting is reside till May perchance presumably well 1, 2024 with many participants criticizing the proposal for a lack of microscopic print that will fabricate implementation complicated.

A separate proposal became once enthusiastically licensed, on the opposite hand: AIP-405, which may possibly perchance birth ApeSwap, a native ApeChain DEX in which 50% of all costs are returned to the ApeCoin DAO treasury. This initiative has better than 80% approval with an allocation of spherical 750,000 Apecoin —valid over $1M in on the present time’s costs.

From a technical analysis perspective, Apecoin’s designate action doesn’t look promising. The coin has hit a most predominant volume zone at its lowest level, and the fresh 35% spike may possibly moreover serve swing traders to grunt their positive aspects. The coin is in the interim for the time being checking out the EMA10 zone, which is below the EMA55, indicating that the price of the closing 10 days is decelerating faster as time progresses.

The Squeeze Momentum Indicator means that a rebound will be starting up, nevertheless the Common Directional Indez (ADX) at 36 displays that the bearish pattern is peaceable solid. The Relative Strenght Indicator (RSI) displays that the coin is oversold, with bears dominating 60% of the trades.

If Apecoin stays bearish, it will moreover lose its fresh 35% positive aspects and retest its all-time low in the $1 to $1.10 zone. On the opposite hand, if it maintains its momentum, it will moreover spike an additional 35% till it exams the resistance location by the EMA55 at spherical $1.66.