An nameless cryptocurrency seller grew to change into a $368 preliminary safe into $2 million of unrealized positive aspects in precisely three days. Commentators on X speculate on a that you just need to well well per chance per chance take into consideration insider procuring and selling direct, even though nothing is confirmed.

In particular, the swap occurred with the meme coin HIPPO on the Sui community towards its native token, SUI. In accordance with a Lookonchain file on October 2, the “man” made roughly $2 million in three days.

First, on September 28, the nameless seller spent $368 value of 198 SUI to safe 253.5 million of HIPPO. The “man” then supplied 119.6 million HIPPO for $325,000 value of 175,000 SUI, in part realizing his positive aspects.

By the point of the contemporary post, the meme coin used to be procuring and selling at $0.012, with 133.9 million HIPPO on the abet of, value roughly $1.7 million. On the different hand, the HIPPO/SUI pair on Cetus’s decentralized alternate is already up, touching the impress resistance at just about $0.014.

Concerns about Sui’s tokenomics

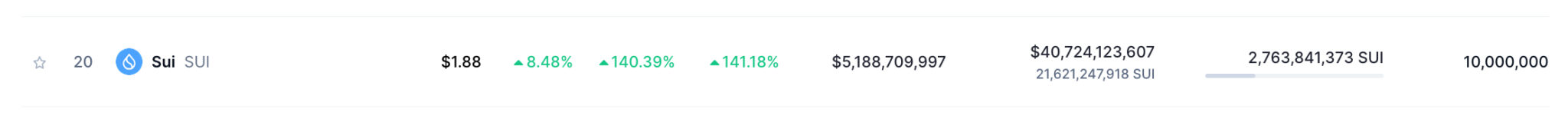

Sui has recently grown to the Twentieth space when it involves market cap with a $5 billion capitalization. But, its fully diluted value (FDV) is a ways increased than that, pondering simplest 27.6% of all SUI’s supply is circulating.

Thus, the cryptocurrency has an impending 72.4% inflation that can inevitably reach the market, creating foremost promoting strain.

Curiously, each and every body among these but-to-scuttle into tokens are locked in vesting contracts within the help an eye on of Mysten Labs or non-public investors. In October, SUI unlocked over $100 million, as Finbold reported, elevating considerations and criticisms.

Justin Bons labeled SUI’s tokenomics because the final result of “sheer greed,” as we published in May per chance.

“SUI has a good create, excluding for its token economics: SUI claims to hold a capped supply of 10B, with 52% being “unallocated” until 2030. The mission is that over 8B SUI is being staked staunch now! Over 84% of the staked supply is held by founders. To divulge here’s unpleasant is an irony The sheer greed of SUI’s distribution is mindblowing”

– Justin Bons

Some market people pointed out that the upcoming free up defined why influencers and the crypto media without warning started “pushing” SUI.

Right here’s explore opening. Now I understand why $SUI has been pushed laborious since 2 weeks by KOLs and a lot of media.

Every single time. https://t.co/Eqa7kkebUI

— Gourmet (@cardano_gourmet) September 29, 2024

Furthermore, cryptocurrency seller and investor Wazz warned of Sui’s model the attach these whales with locked tokens can amassed stake, and income from the but-now now not-circulating tokens pledged to them.

Need to you need to well well per chance per chance also very successfully be keeping any coin that allows for staking of locked tokens, you need to well well per chance per chance also very successfully be getting scammed.

You suspect you need to well well per chance per chance also very successfully be being clear procuring for sooner than the unlocks vest, but in point of fact seed investors are dumping staking rewards non quit at 100x valuationshttps://t.co/hR9eegJZCZ

— Wazz (@WazzCrypto) October 2, 2024

Meme coin traders and the ‘Greater Fool Notion’

Cryptocurrencies are inherently volatile and present appreciable risks for traders, investors, and customers, even with proper and usable initiatives. On the different hand, procuring and selling meme coins provides one other layer of risks, especially liquidity-connected.

Furthermore, this asset class has traits that resemble financial bubbles, which is able to result in liquidity loss of life spirals. The “Greater Fool Notion” explains the dynamics viewed on meme coins. They’re speculative tokens moved essentially by social hype and buzz without any natural question.

Merchants buy the token with the expectation that a “increased fool” pays a increased impress in the end. On the other hand, the procedure fades away once there are no “increased fools” to continue fueling the impress up, most regularly facing liquidity points and loss of life spirals.